[ad_1]

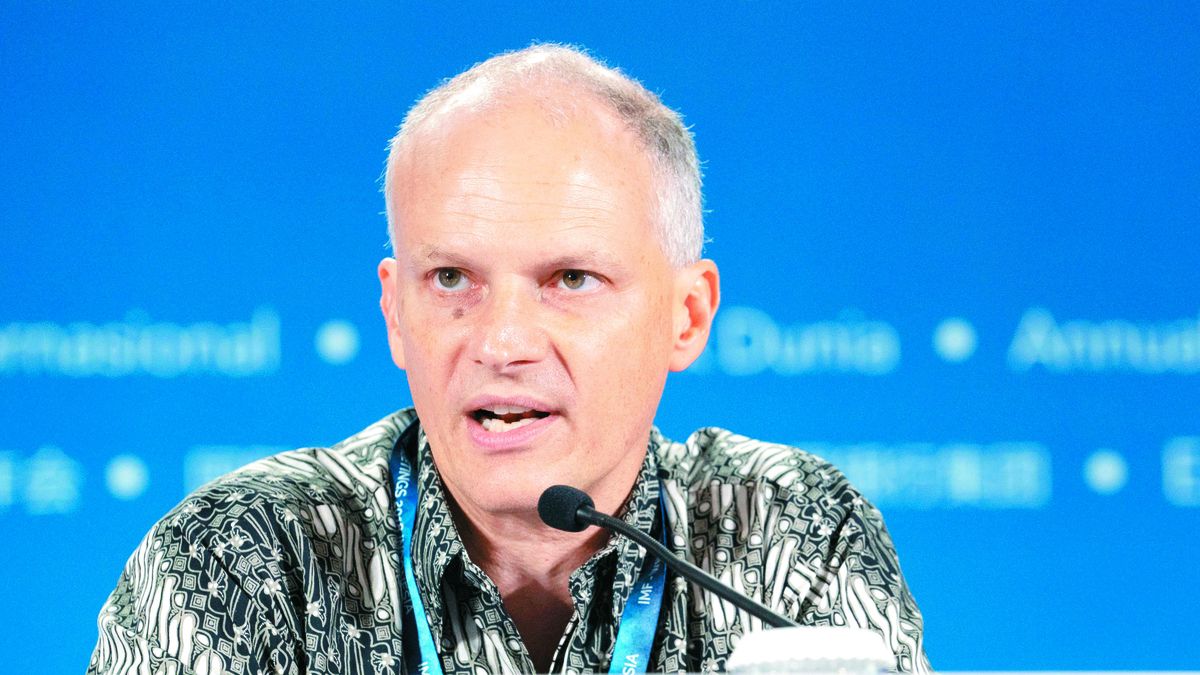

According to the manager – who will leave his post on August 31 – “Latin America has started to recover from the significant drop it suffered in the first quarter of the pandemic in the second half of 2020. And we hope that this recovery will continue into 2021.”

At your discretion, “The delay in vaccination campaigns may have made the first semester a little less dynamic” than estimated.

For Werner, the Monetary Fund expected “the acceleration of vaccination campaigns, the strong economic recovery expected in the US economy, the recovery of the Chinese economy and significant increases in commodity prices, as well. than at low international interest rates, they would allow the recovery in Latin America in the second half of the year to be quite strong and end up being a good year for the region, with growth between 4.5% and 5%. “

“However, given that the decline in 2020 was around 7%, we are still going to be below the level that was before the pandemic. Therefore, the delays are going to accumulate in the social field, in the field of poverty, a situation that was no longer good in Latin America “, he added, in an interview published Tuesday on the IMF website.

The manager also considered that the level of per capita income in 2025 in the region “is probably similar to what we saw in 2015, which also shows a problem of worsening poverty, deterioration of the distribution of income” .

In this context, he indicated that Latin America “Important steps will also have to be taken in the fiscal and financial sphere to strengthen public finances. As the economy normalizes, public finances will also have to be normalized.”

“Latin America is one of the regions of the world where the greatest number of days of face-to-face lessons have been missed”, highlighted.

At the same time, he pointed out that 60% of the financial support given by the IMF during the pandemic was intended for Latin America through emergency lines, contingency lines and the extension of some programs.

On the other hand, Werner pointed out that the Monetary Fund “has moved to view the concept of macroeconomic stabilization as a broader concept, in which it is not enough only to stabilize financial variables, but also to protect and improve certain social indicators, even during macro-financial stability processes “.

“It has also evolved in its financial tools: from having only corrective instruments to preventive instruments such as our flexible credit lines and the preventive credit line” insured.

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos