[ad_1]

In a country that embodies the spirit of enterprise and has the largest number of billionaires in the world, the problem has been on everyone's lips for the past few weeks.

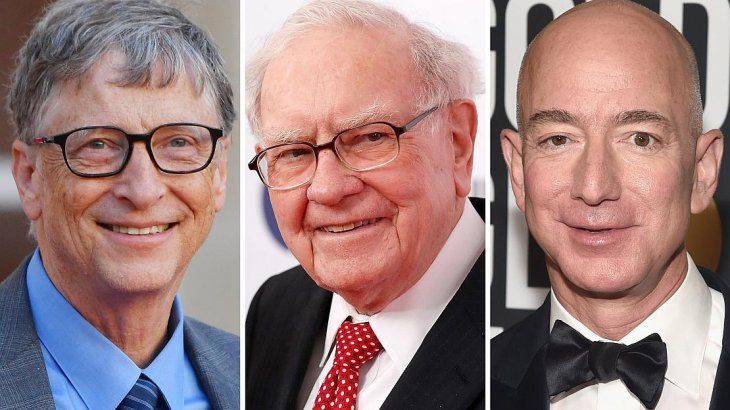

There is not a single Democratic candidate in the presidential election of 2020 who does not talk about the issue, agitated by two extremely wealthy men who worry about growing inequality: Bill Gates and Warren Buffett, second and third worlds in the 2018 Forbes ranking.

The leftist senator of Vermont Bernie Sanders He was the first to launch the issue in the 2016 presidential election, defending federal tax increases to fund free universities and health coverage for all.

Elizabeth Warren defends a 2% tax on any fortune greater than $ 50 million, Kirsten Gillibrand a tax on financial transactions, Sanders an inheritance tax for the rich of up to 77%: every Democratic candidate has his post. Without being a candidate, the new representative of Puerto Rican origin Alexandria Ocasio Cortez, Democratic star, is at the forefront of the debate: she defends a new tax higher than 10 million dollars which would reach 70%, so to fund an ambitious program that combines more renewable energy, medical coverage for all and a guaranteed job for every American.

The highest parcel is currently 37%. A 70% rate would be something never seen since the 1970s.

Another priority for Democrats is to raise taxes on businesses.

The discussion opened with the controversy surrounding the fiscal situation of Amazon, the society with which Jeff Bezos he made his fortune

Amazon does not pay federal taxes thanks to the credits it has earned through its large investments and feeds the debate about companies that do not pay taxes even if they benefit from them.

Several Republicans attack the Democratic proposals, starting with those of Ocasio Cortez, his worst nightmare.

Do you agree with the increase …

Grover Norquist, president of the American Center for Tax Reform (US for tax reform) and close to Republicans, warned since January against the proposals targeting the rich, but always ends up "falling to hit" the middle clbad.

But for Joseph Thorndike, a specialist in the history of US fiscal policy, it is now possible to return to the trend that has resulted in lower taxes since the end of the Second World War.

"I think something is really happening: a discussion has been launched that we have not had since the 1960s or even since the 1950s," he said.

At the end of the war and President Roosevelt's "New Deal," taxes were very high, with a tax rate of up to 94%. They dropped sharply in the '60s, then with Reagan in the' 80s, he explained.

In 2017, billionaire Donald Trump – who has always refused to release his tax return – and the Republican majority in Congress have approved a further federal tax cut, despite Democrats' opposition. How was the speech reversed? Largely due to growing inequality, says Thorndike.

"People can tolerate the rich getting rich, provided the middle clbad benefits as well, but when the middle and working clbad stagnates, it creates politically problematic social tensions," he said.

Trump could also have had a catalytic effect.

While major changes in US taxation have occurred during a period of crisis war or severe recession, Trump's presidency "may be a sufficient break to trigger this type of change," according to Thorndike.

A survey conducted by the Morning Consult Institute for the political site from 22 to 24 February seems to confirm the growing approval of Americans: 74% of voters are generally in favor of the fact that the rich pay more taxes and more. % that companies pay more.

More than 90% of voters believe that these additional taxes should be aimed at improving the health system or infrastructure.

But this apparent consensus, which conceals large disparities between Democrats and Republicans, must be interpreted with caution, as tax issues are sensitive, warn experts.

The most effective measures are often difficult to explain to the public, and the arguments "anti-rich" advanced by some Democrats could scare voters, notes Thorndike.

One thing is certain: "Politicians seek to innovate and react (through inequalities) to non-traditional methods," says Kenneth Scheve, professor of political science at Stanford University.

Taxation of the rich "will be a key topic of the debate in the 2020 Democratic primary," he said.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos