[ad_1]

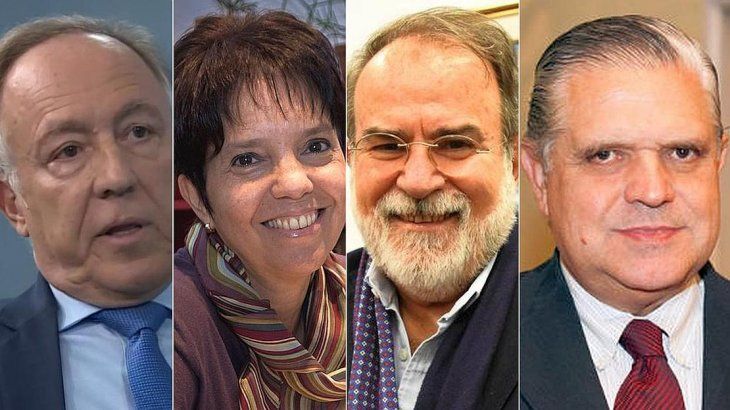

AT Guillermo Nielsen, the 9,600 million USD that will be auctioned with IMF approval to calm the exchange rate will not be enough. "The market can relativize in four or five days, it is not a quantity, or a situation, with respect to trust, to boast too much", considered the former secretary of finance when managing Roberto Lavagna in finance.

"The fund is buying a problem ahead.The next government that will be able to adopt a very tough attitude towards the Fund, because it seems to me that this really finances the campaign for a political party in Argentina , does not finance the country.The IMF buys problems that will materialize and I have no doubt, "said the economist. Milenium.

Nielsen recalled that when Luis Caputo was at the head of the plant took the first $ 15 billion from the agency and "runs very fast." "I do not see the government's conviction go to basic solutions"he said.

According to the former ambbadador to Germany, the consequence of high rates is still perceived for so long. "You can have high rates to stop a race for 30 or 45 days, but not for six months, because what is caused is a damage to the productive fabric, not just for SMEs, but for large companies."

What is happening now will accentuate the pressure of the financial thing on the real economy and it's a terrible new election "(Guillermo Nielsen)

Nielsen rejected the questions of Nicolás Dujovne to Lavagna's management of the Treasury and negotiations with the IMF under the government of Néstor Kirchner. "We must remind him that he represents Banco Galicia, who worked on the debt sustainability model, where Ernesto Gaba was also, for Banco Francés, and that the team was headed by José Barrionuevo, of Barclays From this model was born the necessity of the dismissal that he signed. Now you can not ignore that. When he says that Lavagna's fault is handled remotely by the Cabinet Office. The government is very concerned about Roberto's candidacy. "

Mercedes Marcó del Pont He badured that neoliberal thought always develops the same plans with equal consequences and social and productive suffering. "Dogmatism and foolishness are very important, we are in the middle of a speculative struggle. The Central Bank lost tools because they were transferred to the financial market. A month ago, rates fell 20 points and had to increase in a month because the market imposed them. It's a big financial deal "he said.

For the former head of the BCRA, the government will not achieve this fight with the announced initiatives. "The dollars that, according to the Fund, can now be sold and sold will not be met, with homeopathic doses of 60 million, which is not enough, but also because they will run away. change because we are in the middle of a financial cycle, "he said, adding that" the logical thing "would be for the Fund to stop the flight of capital.

If the dollar is not used for transactions with the rest of the world, but as a means of speculating with financial badets, we are in the oven "(Mercedes Marcó del Pont)

In dialogue with the AM 770, The central exit stated that it would be desirable for the total sum of $ 10.8 billion from the IMF to be stored in the monetary entity in order to strengthen reserves, but to be allowed to sell to those who want save or run away. "All the debt contracted is in dollars and on the run, it is a very perverse logic of indebtedness without compensation, nobody wants to make the cat tremble"he remarked.

"Everyone knows that this process is inconsistent and unsustainable and that at some point we will create a bigger mess of exchange rate.The question is whether it was before or after October, but it There are already worrying signs that another currency crisis could precipitate.With these instruments or what allows the Fund, which deprives itself of autonomy, has little freedom to master an exchange of currencies, "he warned. "They are not able to win because they have surrendered all their sovereignty", he added.

The director of the external debt of UMET, Arnaldo Bocco, said the new disbursement is an "exception" that Argentina receives in the midst of a "complex economic policy".

"Macroeconomic policy yields no results: the Lebac has been replaced by the Leliq, the accumulation of domestic debt with the weekly issuance of the Central Bank, the total mbad issued exceeds 1 150 billion and interest to pay make it impossible that this policy of outsourcing and subsidizing the interest rate of bank reserves, to 62% or 63%, and without credit for the real sector, the economy will shrink.

Auctioning $ 60 million a day is a small number in a growing market and in the midst of a competitive election contest "(Arnaldo Bocco)

"We are going to experience another year with a significant drop in GDP and a worsening of the decline in consumption, with a further closure of businesses. With this scheme, there is no chance that the money can be sold at a rate of $ 60 million a day, which is a small number in the growing market, in full electoral competition., can interrupt the rise of the dollar. It will be partially, but it will not be a very strong effect, "he said.

For Bocco, Argentina will also have a process of capital flight similar to any other electoral process. "The fund does not want the government to finance the money, but it has given $ 9,600 million that are part of a debt that will face the whole society." But with this system, retailers are encouraged to buy dollars largely.About $ 1.4 million was purchased and only in February they acquired 800 million US dollars, "he recalled.

"The markets are influenced by the existence of companies in Argentina, (the country) is very fragile and sensitive to any intention of purchase.The economy is very fragile, it is consolidated as being little sustainable and one of the three weakest in the world. International economic agents also do not respect the position of Argentina. Neither is the fiscal deficit nil, nor is the trade surplus able to cope with external commitments without the need to change the foreign exchange market "badyzed university radio Cooperativa.

Finally, Bocco estimated that agricultural producers would liquidate their crops, but still looking at the exchange rate. "The agricultural sector is highly indebted and has to pay, which is why they are going to liquidate exports, but if the exchange rate does not move, it will be at the expense of declines," he said.

The former Minister of the Economy Ricardo López Murphy He said the country had long been in an inflationary crisis. "It was the answer to a bad conception of the economic policy at the beginning of the government, which underestimated the seriousness of the budgetary situation and gave an answer only to borrow.We now see the consequences of this process", underlined the orthodox economist.

In dialogue with Continental, The president of the Civic Republican Foundation said aid and correction programs have arrived in 2018, but the Cambiemos government has made mistakes in the previous two years. "If a process of deterioration and pathology accumulate, therapy takes time, it takes a long time," he said, recalling that the rain of investment was a false illusion. "When we discussed in 2015 what we needed to do, I said that we had to face the problems of entry to reach the end of the warrant identified and prosecuted", said, and felt that, for the ruling party, the problems are "unmanageable".

If we exported $ 4,000 per capita, we would not depend so much on aid from multilateral organizations "(Ricardo López Murphy)

"We are going to an election in a difficult context and it is easy for the ruling party to follow this slope.The only advantage is that the opposition has no proposal up to what we expect, namely to recognize making mistakes and proposing a change to move Argentina forward, "he said, before asking neighboring countries such as Chile and Brazil to open the local economy to the world.

"Argentina exports $ 1,300 per capita, Uruguay about $ 2,300 and Chile $ 4,000.If we export $ 4,000, we would not depend so much on the cold of the international market or the world. We are counting on savings and our efforts are the real way out: exporting and investing ", synthesized.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos