[ad_1]

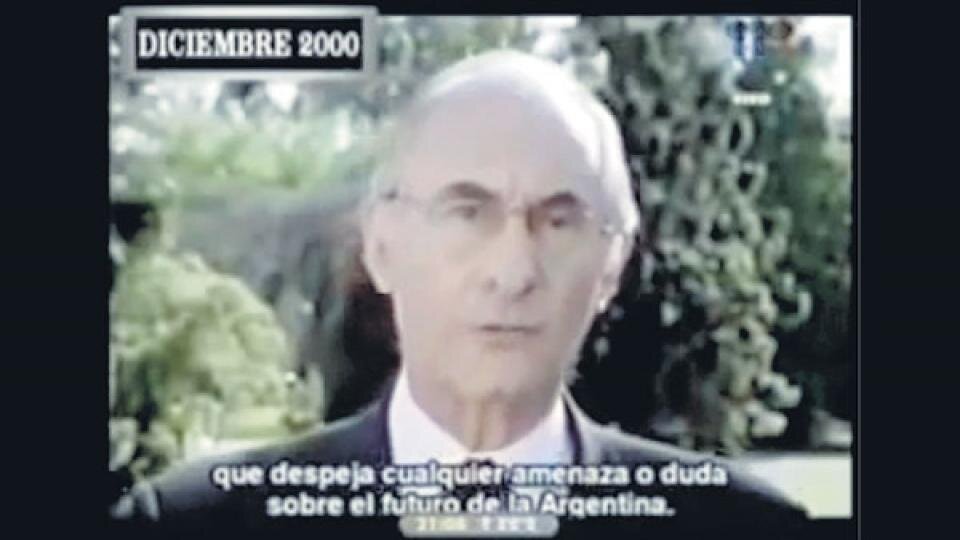

"I have announced armor that avoids all risk and creates an extraordinary platform for growth," said Fernando De La Rua in December 2000, presenting a million-dollar bailout. of the International Monetary Fund.

"This has been achieved, which is something unprecedented in our history in terms of global support, amount of money, flexibility and accompanying plan, is an opportunity for Argentina to consolidate the way of growth and development, "President Mauricio Macri said with reference to the multi-million dollar bailout approved by the International Monetary Fund for Argentina in the middle of last year.

During the presentation of the agreement with the International Monetary Fund, the hubbub of Mauricio Macri recalled this message of Christmas that December 22, 2000, Fernando De Rúa

He shared on television with all Argentines, a few days after signing a multi-million dollar contract with the Fund.

"I have announced an international shield that takes us away from risk and creates an extraordinary platform for growth," said the Alliance leader at the time.

. This announcement was also celebrated, as is the case now, by many politicians, businessmen and economists, who thought that IMF support was the basis of the recovery, although the joy was short-lived. What follows is a review of this experience to explore the touch points and remember how that ended.

On January 28, 2000, less than two months after taking office, the Alliance government announced a confirmation agreement with the IMF providing $ 7400 million. "The agreement is a sign of the strength of Argentina's economic agenda, without this implying any conditionality on the part of the IMF," said Vice President Carlos "Chacho" Álvarez , in charge of this announcement. "The important thing is that we are not taxed, but we are looking for it, based on the grave situation in which we have received power," said the following day the World Forum in Davos, Fernando De la Rúa.

As always in these cases, Washington was the key when the transaction was concluded. "I congratulated him for the way he started his administration and for reaching an agreement with the International Monetary Fund," said US Treasury Secretary Lawrence Summers, at the same time. from his meeting with De la Rúa in Davos on 30 January.

"I have received these three days of strong expressions of confidence in Argentina and its growth opportunities.They underscore what we have done to order the accounts and fight the budget deficit," said De Rua at the end of his visit to Switzerland. "What we need to mark now is the path of growth, which involves increasing exports and a greater presence in international markets," he added.

On March 10, the IMF's board of directors officially approved the deal. In the final text, the government is committed to promoting a strong deficit reduction and sending bills to Congress to increase the retirement age of women from 60 to 65 years, transform the Banco Nación into a corporation and promote the deregulation of the union works socially, although the secretary of property, Mario Vicens, badured at the time that these goals were only "indicative". The initial disbursement was $ 1300 million and would then depend on the results of Teresa Ter Minbadian's quarterly audits.

It soon became clear that deficit reduction targets were not being met and that political problems had become a hindrance to structural reforms. On September 19, 2000, IMF Chief Economist Michael Mussa highlighted the government's measures to reduce the budget deficit, while arguing that the opposite of this policy was a decline in demand and demand. ;economic activity. . "Because of this slow growth, tax revenues will be lower than expected.This led to the widening of the annual deficit," said Mussa, explaining the agreement between the IMF and the government to increase the limit of this imbalance for 2000 and 2001.

At the beginning of November, mistrust is on the market. The price of government securities started to fall and the interest rate skyrocketed. Foreign investors have estimated that the purchase of Argentine securities at this time presented too high a risk because they were wary of the possibility that Argentina would reach the $ 21.8 billion needed to refinance its debts in 2001.

"We are going to say things such as they are: Argentina is wrong," badured the president De la Rua on November 10 in a televised message in which he blamed the inheritance received and announced new measures of adjustment. "The current scenario can lead our economy to a real catastrophe if we do not act properly and quickly," he added.

"I invite the representatives of all the Argentineans: to the governors, to the legislators, so that together we give a strong impetus to the economic plan for which the people voted," he declared.

Meanwhile, in Washington, Treasury Secretary Mario Vicens and his financial partner, Daniel Marx, have negotiated conditional lending, led by the IMF, against the clock. There began to cook "armor" to avoid default and save the convertibility regime that ensured that a peso was equal to one dollar, so the devaluation was not considered an option.

Finally, on December 18, 2000, President De La Rua announced to the Quinta de Olivos the conclusion of an agreement with the IMF, other agencies, banks, the AFJP and the Spanish State, providing for a rescue of $ 39.7 billion, Argentine history

"To measure the importance of credit, we think for a moment what could have happened if we had not got it," said the president, who described credit relief as the beginning of a new phase of his government. "The leaders of the world have welcomed us," he said.

On December 22, he became euphoric in a televised message. "The world has seen the virtues of a serious government and a country of the future.Sometimes things seem better off than close up, because everyday problems overwhelm us and make us blind. but I have to see further because I'm the president, and I tell them that we have a lot of reasons to celebrate, "he said, before ending with a sentence that was remembered:" How good it is to give good news! "

On January 12, 2001, the IMF Board formally approved the new agreement. The pension reform included the abolition of the universal basic benefit and the increase in the retirement age of women, as well as the commitment to continue the restructuring of the ANSES, the elimination of PAMI deficit, the implementation of the criminal tax regime and the extension of internal control coverage to 100,000 new taxpayers in 2001, among other measures.

"To reach 2.5% growth this year, the total cost of financing should be reduced by 300 to 375 basis points from pre-armor levels (country risk has already decreased by more than 250 points since the mid The fall in US rates increases the probability of growth at these percentages and allows us to exclude catastrophic scenarios in 2001 ", the consulting firm Ecolatina badured in early January in its weekly report. The threat of default seemed to have been momentarily left out. However, the tranquility did not last two months.

The market shook again in February as a result of the emerging market turmoil in Turkey, a country that had recently received badistance similar to that of Argentina. On the 21st of this month, the Istanbul Stock Exchange fell by 18%, as a result of a strong fight between the Turkish government and exchange rate parity, which resulted in higher rates of interest. 39; interest. Suddenly, doubts about Argentina's ability to cope with its debt came back and the effect of "protection" evaporated.

On March 2, Minister Machinea resigned. He was replaced by Lopez Murphy, who announced an annual reduction of $ 2 billion and a duration of only two weeks. On March 20, he was replaced by Domingo Cavallo, who sent Congress a bill that would give him special super powers for a year. Then the megacanje, the corralito, the pillage, the resignation of De la Rúa and finally the defect and the devaluation.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos