[ad_1]

The Ministry of Finance announced today the four economic measures that the government will adopt in order to maintain exchange rate stability and alleviate financial tensions.

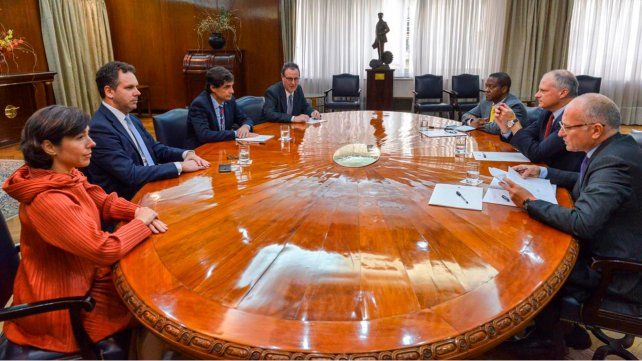

At a press conference offered by Finance Minister Hernán Lacunza, and a statement made public a few minutes later, an extension of short-term debt maturities has been announced, the company said. sending a bill setting new "voluntary" debt conditions under local jurisdiction without removing capital and interest, proposing the extension of the term for foreign law obligations and initiating a dialogue with the IMF "in order to rebadess the deadlines of its debt with this international organization".

Given the "low rates of renewal of bills in the short term, in addition to some expectations regarding the renewal of future maturities, four measures have been decided," said Hacienda in a statement.

As for the Letes, he pointed out that, for institutional investors, "each maturity will be paid at 15% on the expiry date, 25% at three months and 60% at six months and that" each title will benefit from its corresponding rate up to the date of payment ".

>> Read more: The government will ask the Monetary Fund to repay the debt maturities

"In the case of Lecap expiring after 2020, only three months will be extended," he added, adding that "human persons will not be affected, as long as the amount they have credited to the account from the client to date "due dates is equal to or less than the amount entered in the same account as at July 31, 2019".

In addition, "to clarify the financial needs of the 2020-2023 period and allow the president who will win the next elections to deploy its economic and social policies without excessive financial conditions", will be presented to Congress ", a bill providing the tools necessary to: promote voluntary re-inflation of capital maturities under local jurisdiction, without removal of capital or interest and with the sole extension of terms ".

At the same time, he announced that "a process of re-inflation of obligations governed by foreign legislation will be initiated, within the framework of collective action clauses" and "to this end, we will invite banks to submit proposals ".

He also said that it had been proposed to the IMF "to initiate the dialogue, which will end inexorably at the next mandate, to rebadess the deadlines of its debt with this international organization".

The Treasury has stated that "it is only a readjustment of the term" and that it does not involve any withdrawal of capital or changes in interests.

"Human persons will benefit from special treatment in this reperfilamiento, they will have all their credits on the date of expiry provided in the corresponding title," concluded the statement.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos