[ad_1]

The Board of the International Monetary Fund (IMF) approved the third review of the local economy and approved the shipment of $ 10.8 billion. With this amount, the lender of last resort completes an expenditure of $ 38.9 billion and is preparing his next visit for the month of May.

After the meeting, the Managing Director of the IMF, Christine Lagarde He pointed out that a gradual recovery is expected over the next few quarters, but warned that inflation remained high. "Inflationary expectations are rising and inflationary inertia is hard to break," he added.

Technicians estimate that the economy will fall less than expected: -1.2% instead of -1.7% compared to the previous revision. In the first quarter, construction and industry improved in January, as well as in agriculture, but the question is whether there is a sustainable trend . "The recovery will begin in the second quarter," they repeated.

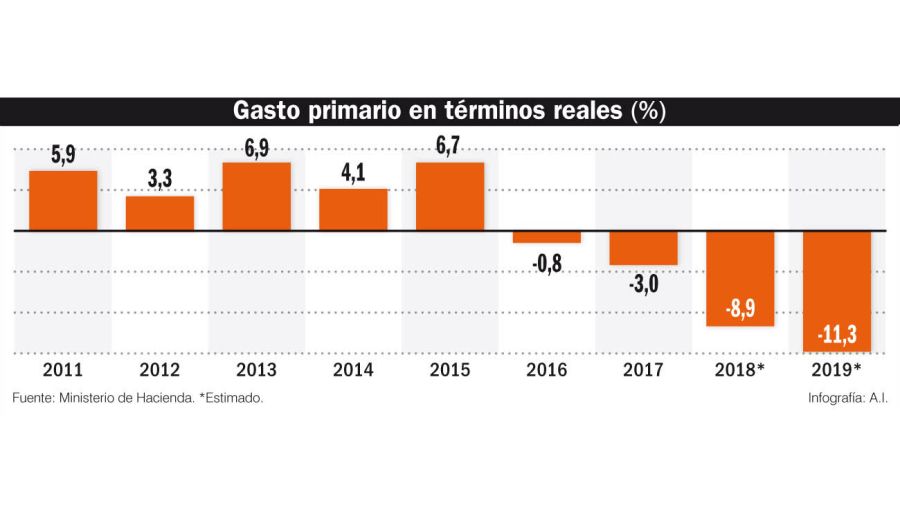

Reducing tax collection is, however, a factor that may lead to a greater reduction in spending to meet the fiscal objective. The team led by Roberto Cardarelli, recommended reduction of capital expenditure – public works – or increase of VAT on certain products or services.

According to the IMF account, the government said it could not opt for the second option during an election year, where the changes should go through Congress. On spending cuts, the Department of Finance said that "there could be reductions in spending margins, including rationalization of spending on goods and services and non-priority capital spending." They also told the government that non-tax revenue could be generated (through the sale of badets, for example).

Among the risks, the Fund lists elections, political uncertainty and pressures on the dollar and the capital account. And he advocates a clear plan and communication with financial officers and the general public.

votes The description of the election year is clear: "The October elections represent the most visible risk in the short term.Presidents in the presidential election are announced in June, the coup de send the electoral race. generating anxiety in the market and fueling dollarisation and larger than expected capital outflows, which would weaken the peso and raise new concerns about the dynamics of debt. Inability to reduce inflation can reduce support for the adjustment program. "

Until March, fiscal and monetary targets were met. And despite the financial volatility, in Washington they think that the government will be able to deal with dollarization or the flight of capital with the existing tools: calls for daily Treasury offers up to 60 million dollars and possibility that the Central Bank intervenes with sales of up to $ 150 million if the dollar is located outside the no-intervention zone. "If there are shocks of a magnitude greater than we imagine, we can look at" the agreement relating to the intervention of the Central Bank, explained the sources of the I & # 39; 39; agency.

The Fund sees no problem raising interest rates as they accompany inflation. In this context, they stressed that the entity presided over by Guido Sandleris "should not be judged by the volatility of the interest rate".

Salaries Inflation for 2019 will be 30% in December according to the IMF, according to government forecasts. According to agency sources, to contain inflation and prices "it is important that the parities come closer to a moderate rise", which corresponds to inflation.

Staff highlights the rise in poverty and the loss of 200,000 jobs in 2018, with a focus on protecting the most vulnerable. For this, it was possible to increase social spending from 0.2% to 0.3%. The staff report says that if AUH's income had doubled – with a budget cost of 0.5% of GDP, according to the World Bank -, the increase in extreme poverty could have been avoided last year.

"The authorities plan to increase spending on some health plans, the provision of medicines in public centers and access to the carafe and food," says the Fund in its dialogues with the authorities.

Debt The target of the 0% primary deficit "has been chosen by the government to signal a need for less funding," they explain to the IMF. And they think I should control those needs. The report already predicts that the maturity profile of the debt will need to be improved after 2021/23.

The ability to repay the debt "remains adequate although subject to risks". In meetings with the opposition, the IMF said all agreed to continue the program and were willing to renegotiate.

On the other hand, this year, the current account deficit is expected to be reduced by 3 percentage points of GDP due to the improvement of agriculture, a real exchange rate more devalued , increased growth in Brazil and continued decline in imports. The next revision of the directory is scheduled for mid-June, for a disbursement of $ 5,400 million.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos