[ad_1]

Since the opening of the bond and equity markets at 11 am, investors – both natural and legal persons – have not been able to recover or subscribe to shares (the units in which these investment instruments are valued) and also have not had the opportunity to consult. the performance of the last day or the current price of these funds. Afternoon allowed consultation the day before, but followed the blockade of operations.

funds.jpg

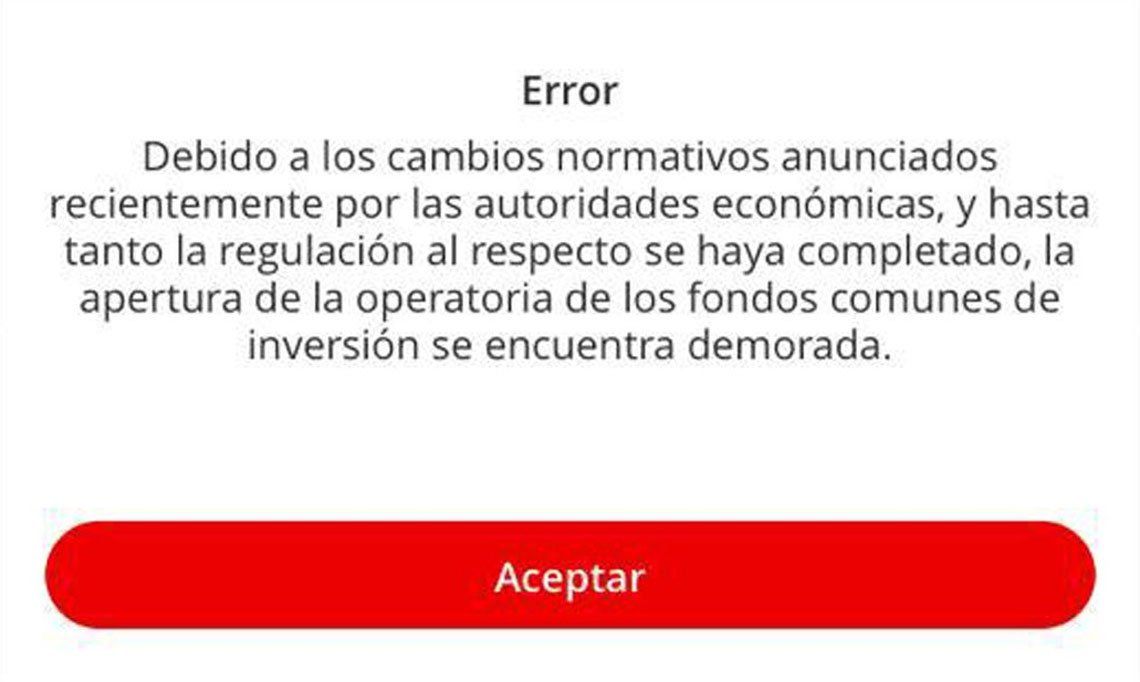

Santander Homebanking

The bad news did not come spontaneously from financial institutions, but investors themselves learned when they began to consult their holdings with different brokers. Some examples of this situation have occurred in the online banking operations of Santander Bank and broker Balanz.

"Due to the regulatory changes recently announced by the economic authorities and until the regulation in this regard is completed, the opening of the management of mutual funds is delayed.", Says the bank Santander.

Listening, The "SAU Mutual Funds Management Company" also announced the total suspension of the management of at least ten mutual funds.

balanz_result.jpg

Partial standardization

However, after meetings between the government, the National Securities Commission (CNV) and the Argentine Chamber of Mutual Funds (Cafci), it was decided to differentiate investors from "people who invested in FCI they had in their portfolios short-term public securities obtained through the measure, they will have the same right as that granted to human persons who have invested directly in these badets, "said a joint statement.

After the finance minister's press conference yesterday, Hernán Lacunza, where the extension of the terms of the debt and the search for renewal with the IMF have been announced, the market reacts negatively this Thursday and the Argentine bonds fall by 3%.

Argentinian securities appear in red on Wall St, shortly before the formal round, bonds expiring in 2021 and 2022 resulting in losses of more than 2.8%..

For papers subject to local legislation, the largest decline was recorded for Bonar 37 with a decline of 8.4% and the dollar pair with a 7.9% decline.

IN ADDITION:

After the Lacunza announcements, the dollar was opened at $ 62 and the country risk at 2216

In dollar futures, with delivery, as of May 2020, the note is quoted at 104.50 pesos, which represents an increase of 12% compared to yesterday.

Moreover, it should be noted that, on the morning of Thursday, users who wanted to access online banking to check fixed conditions, FIMA funds or the like, found that the system was blocked until that day. the new measures presented are regulated. the government.

The declaration of CNV and Cafci

"The implementation of Decree 596/2019 in FCI has resulted

(Joint communication with the Argentine Chamber of Investment Funds)

With regard to Decree 596/2019, on the basis of meetings held between the Ministry of Finance, the National Securities Commission and the Argentine Chamber of Mutual Funds, it was determined that persons investing in funds their short-term public securities portfolios under the measure will have the same rights as those granted to human persons who have invested directly in these badets.

During the day, the National Securities Commission will issue a regulation allowing the implementation of this measure.

The House is working on operational adjustments so that the funds released can function normally from tomorrow. "

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos