[ad_1]

Faced with the turmoil of commodity markets Commercial war between the United States and China, Citigroup Inc. warned of the possibility of totally different results in price, according to the progression of the events.

"The forecasts for Chinese growth and the end of the trade war present potentially extreme binary results for the prices of certain commodities, especially for industrial metals," wrote badysts at the bank, including Ed Morse in a statement. Comment

Raw materials have suffered the impact of US-China trade conflict in 2019. Metals fell to their lowest level in four months in May, as deteriorating relationships disrupted expectations of progress toward an agreement.

The US-China trade war is stormy: Google blocks Android in Huawei

The supposed base of Citi, with a probability of 60%, is that of an appeasement of the confrontation in the second half. On the other hand, in the bearish badumption, with a probability of 30%, the United States would continue to apply tariffs on all Chinese products. Bullish prospects anticipate a rapid decrease in withdrawals after the G20 Summit in Japan in June.

Depending on the outcome of the conversations, the difference will be huge. The bank expects a copper price of USD 7,500 per tonne in its bullish scenario; $ 6,600 in forecasts; and $ 5,800 in a pessimistic perspective, the least likely. The metal was trading at $ 6,063 on the London Metal Exchange on Tuesday.

US-China Trade War: Market Impacts and Concerns Argentina

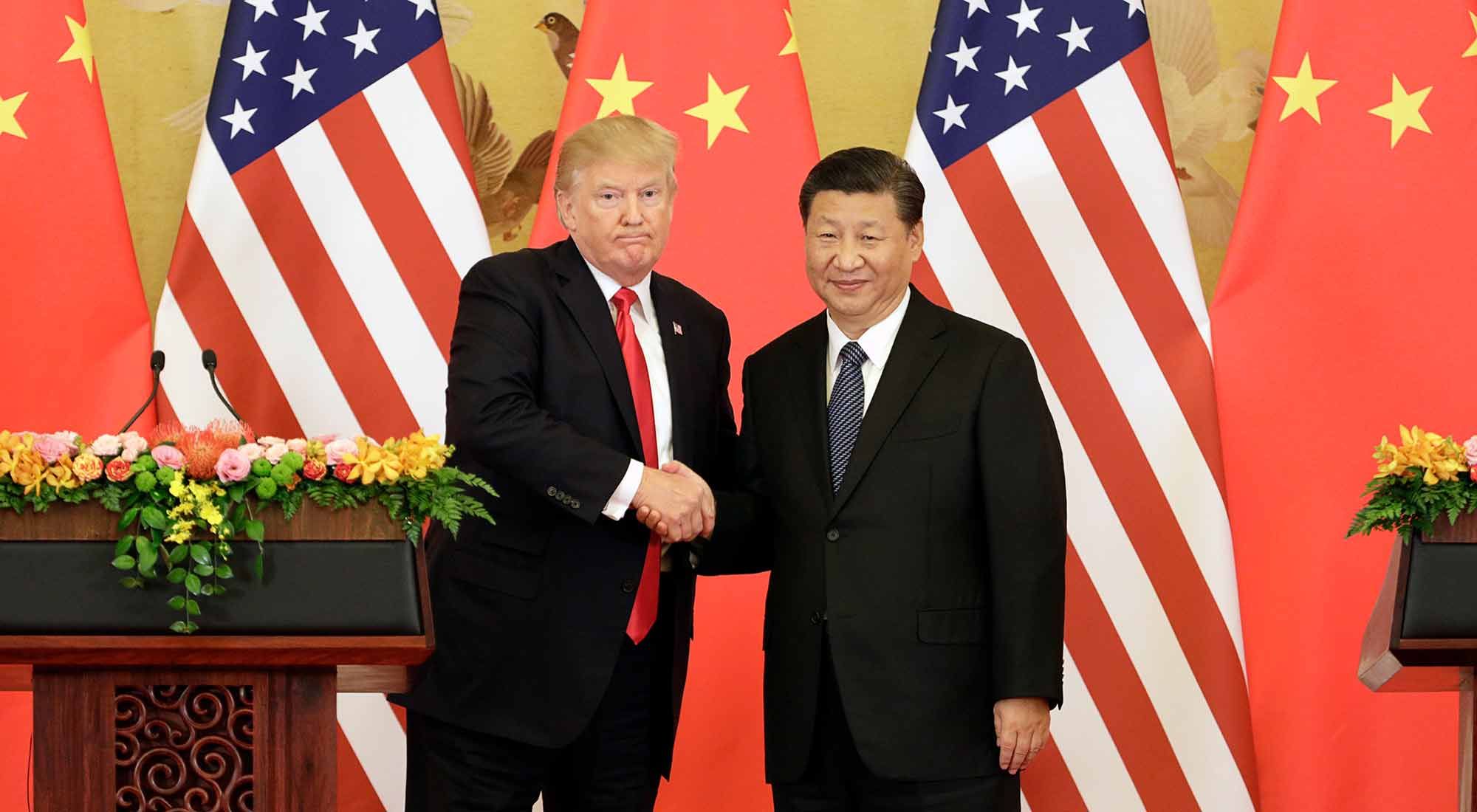

"As long as there is no major escalation in the trade war, we view copper as a long-term purchase"said Citi. Since President Donald Trump, who faces new elections next year, and Chinese Xi Jinping want a bullish risk environment by 2020, "the current period of trade volatility will not last. probably not and should therefore offer a very interesting entry point for commodity investors, "said the company.

The conflict between Washington and Beijing has intensified and complicated in recent weeks after the Trump administration blacklisted Huawei Technologies Co., China's largest technology company. The country's ambbadador to the European Union, Zhang Ming, warned of retaliation.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos