[ad_1]

US stocks They rose on Thursday after China said it would not react immediately against the latest US tariff increase. Treasury bonds fell as A reading in dollars indicated a maximum of two years.

The S & P 500 index rose for the second day in a row after a spokesman for the Chinese Ministry of Commerce said the intensification of the trade war would not benefit any of the parties and that It was more important to discuss the elimination of additional customs duties. Asian stocks reduced declines as commented, while the Stoxx Europe 600 index closed higher.

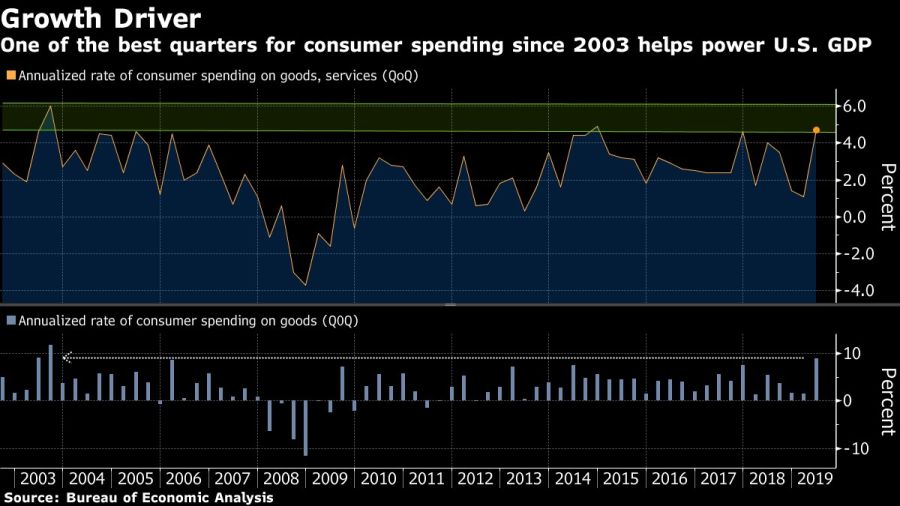

The market remains sensitive after the recent statements by President Donald Trump on trade and pending investor resolution. Trump said Thursday that the United States and China has a scheduled business conversation today. US economic growth In the second quarter, it slowed more than initially announced, due to lower results for the categories including exports and inventories. Despite this, consumer spending remained strong, exceeding expectations.

"Given the positive news on trade, investors are looking to return to some stock markets, with perhaps a little more risk," said Chris Gaffney, President of Global Markets at TIAA.

"The GDP shows that, even if the second quarter estimates have slightly decreased, consumers still look strong.That is the key.The earnings component is very good, corporate earnings look solid," he said. added.

Meanwhile, the bond rally stalled after the US Treasury's 30-year yield collapsed to a record lows at 1.90% on Wednesday. The secretary of the treasury, Steven Mnuchin, he said that "they considered very seriously" the issuance of US bonds very long. This would mark a historic revival of the $ 16 billion US Treasury bond market.

Gold fell, while crude from West Texas remained at around 56 US dollars a barrel.

In Europe, Italy's bonds rebounded and their shares outperformed as the country shifted towards forming a new government. The pound fell due to the growing risk of a Brexit without agreement. The euro has peaked after a European Central Bank policy official said the region's economy was not weak enough to guarantee the resumption of the country's purchases. # 39; obligations. The Chinese Continental Yuan was strengthened for the first time in 11 sessions.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos