[ad_1]

Asian stocks rose on Friday after US stocks hit a record high of optimism about a stimulus-fueled economic recovery. Stock trading volumes were below average due to vacations in the region.

Chipmakers backed South Korean stocks report that the United States plans to meet with semiconductor and auto companies to discuss the global shortage of microprocessors. The Japanese and Chinese markets posted modest gains.

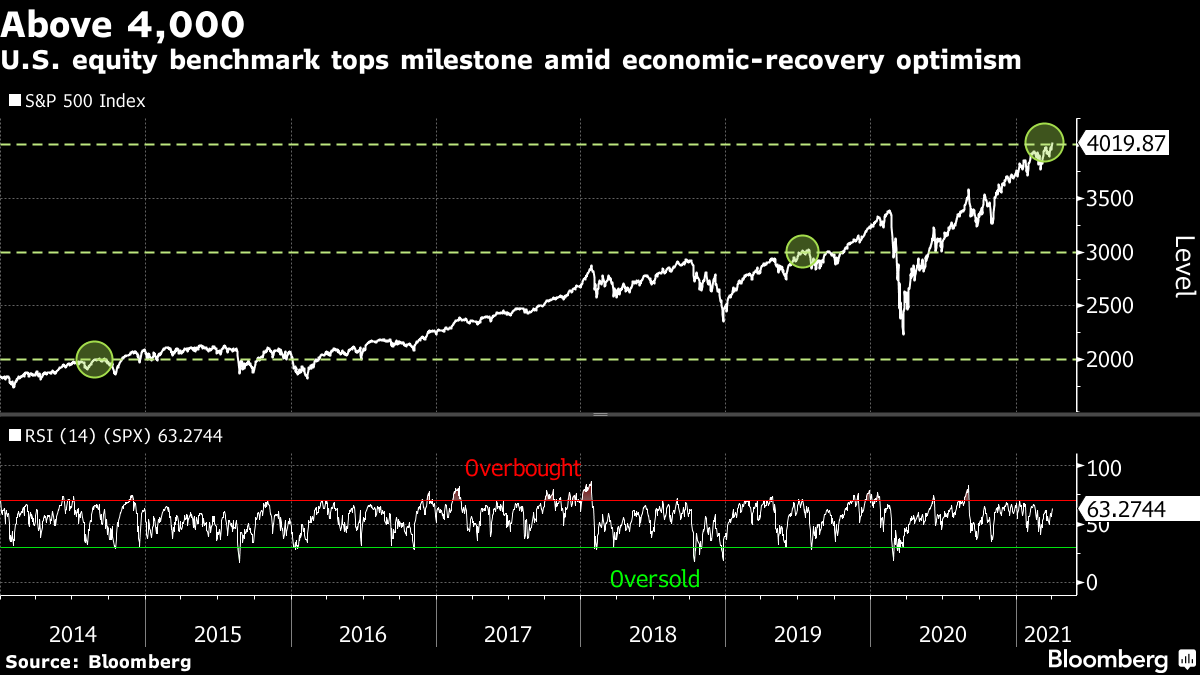

US equity futures edged higher after the S&P 500 closed above 4000 for the first time. Tech stocks outperformed and value stocks rallied as traders weighed President Joe Biden’s $ 2.25 trillion spending plan and signs of faster growth.

Treasuries rebounded from the worst quarter in decades, with 10-year yields falling below 1.7%. The dollar fell. Oil soared after the OPEC + alliance agreed to gradually increase production. In Asia, markets like Australia, Hong Kong, Singapore and India are closed for holidays, like many around the world.

Investors are increasingly applauding signs of strength in the US economy. Growth in manufacturing picked up in March, and government labor market data due Friday is expected to show the first in a series of outsized monthly increases. By Biden the infrastructure reconstruction plan strengthens prospects, although questions remain as to how much of it can actually be delivered.

For now, investors are looking beyond deteriorating viral trends, like Chile’s decision to close its borders for April and a lockdown in France. They remain focused on the risk of inflation in a context of an economic rebound.

“Before you worry about inflation, there is reflation and I think that’s the main theme of the market,” said Ed Campbell, AMQ fund manager and CEO.

Traders are bracing for the US jobs report, which could shake the bond market in a cut short trading session over the holidays. Very strong data could push benchmark returns back to a recent one-year high of 1.77%.

Read more: Navigating the trade-in trade becomes much more complicated

Some key events to watch this week:

- US Employment Report for March Friday.

- Good Friday begins Easter weekend in countries like the US, UK, France, Germany, Australia, and Canada.

Here are some of the main developments in the financial markets:

Stocks

- Futures on S&P 500 were up 0.2% at 12:45 p.m. in Tokyo. The S&P 500 Index rose 1.2% on Thursday.

- The Japanese Topix index climbed 0.5%.

- South Korea’s Kospi index rose 0.8%.

- China’s Shanghai Composite added 0.4%.

Currencies

- The yen was little changed at 110.62 to the dollar.

- The offshore yuan added 0.1% to 6.5692 to the dollar.

- The Bloomberg Dollar Spot Index fell 0.3% on Thursday.

- The euro was little changed at $ 1.1780.

Obligations

- The yield on 10-year Treasuries fell seven basis points to 1.67% on Thursday.

Basic products

- West Texas Intermediate crude rose 3.9% to $ 61.45 per barrel on Thursday.

- Gold added 0.1% to $ 1,731.72 an ounce.

[ad_2]

Source link