[ad_1]

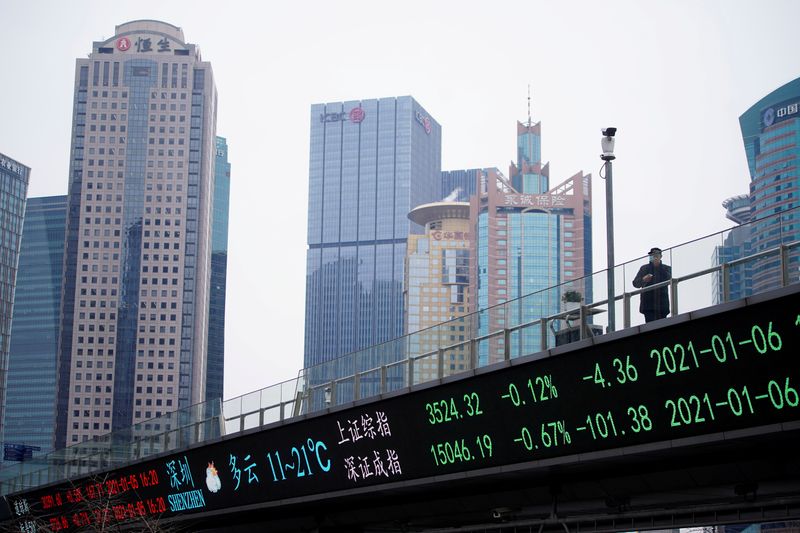

© Reuters. FILE PHOTO: Man stands on an overpass with an electronic map showing the Shanghai and Shenzhen stock indexes in Shanghai

2/2

By Hideyuki Sano and Alwyn Scott

TOKYO / NEW YORK (Reuters) – Asian stocks slipped on Wednesday as investors looked to the Federal Reserve’s guidance on monetary policy, while US tech stock futures surged after strong earnings from Microsoft (NASDAQ :).

The MSCI Asian Ex-Japan Equity Indicator fell 0.3%, dragged lower by profit-taking in natural resources stocks as some investors wary of stretched valuations.

But they rose 0.2%, and the region’s tech-intensive markets, such as South Korea and Taiwan, saw small gains, aided by 0.5% increases in futures on the market. Nasdaq after Microsoft’s good quarterly results.

Microsoft shares rose 4% in extended trade after its Azure cloud computing services rose more than 50%. The results bolstered optimism for other US tech giants, including Apple (NASDAQ 🙂 and Facebook (NASDAQ :), which report quarterly results later today.

“Microsoft’s earnings have been excellent, even when compared to high market expectations,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ (NYSE 🙂 Morgan stanley (NYSE 🙂 Securities.

“These tech stocks have been in a bit of a slump since August, but they are expected to dominate the market again, given their strong outlook,” he said.

At its peak in August, the combined market capitalization of America’s top five tech companies, which also include Amazon (NASDAQ 🙂 and Alphabet (NASDAQ :), hit 24.6% of the blue-chip US index. It stood at 22.7%, still well above 15% two years ago.

S & P500 futures were mostly flat, capped by caution ahead of the Fed policy meeting as well as profit taking on cyclical stocks after stellar gains this month.

The S & P500 is now trading at 22.7 times its expected earnings, near its September peak of 23.1 times, which was its most inflated level since the dot-com bubble in 2000.

The US Federal Reserve is due to announce the results of its two-day political meeting on Wednesday. Analysts expect the Fed to stick to its easygoing tone to help accelerate the economic recovery.

U.S. stimulus talks are also at the center of concern, with U.S. Senate Majority Leader Chuck Schumer saying Democrats will move forward with President Joe Biden’s $ 1.9 trillion rescue plan. dollars against the coronavirus without much needed Republican support.

The 10-year benchmarks were down 1.040%, after hitting a three-week low of 1.028% on Tuesday on rising speculation, Biden may have to cut and possibly delay his ambitious stimulus package.

The US dollar was hardly shaken as investors waited for the Fed’s decision on whether to buy riskier currencies.

Flirting with this week’s low at 90.211, while the euro held steady at $ 1.2162.

The British pound rose 0.1% to $ 1.3735, its highest level since May 2018, while the Japanese yen edged down to 103.71 per dollar after a slight gain the day before.

The Australian dollar was little changed at $ 0.7744, showing a moderate response to stronger than expected local inflation data.

Oil prices were supported by economic optimism, with futures contracts up 0.3% to $ 52.79 per barrel.

The International Monetary Fund has raised its forecast for global growth in 2021, as widely expected, and many investors expect the global economic recovery from the pandemic slowdown to continue.

[ad_2]

Source link