[ad_1]

Just about every day, AT & T (T) reminds investors how much the company was wasting shareholders' money during mega acquisitions. The latest news about DirecTV Now reminds us once again that the company needs to focus on repaying its debt well beyond the stated goals, as any other management decision will affect the stock. For now, AT & T is stuck at $ 30, offering at least a 6.7% dividend yield to shareholders to offset the suffering.

Source of the image: DirecTV Now website

More DirecTV now weakness

One of the main reasons for the purchase of DirecTV was its ability to offer a competitive streaming service. After the purchase, AT & T launched DirecTV Now with initial success, but the company is now crushing a major reason to pay $ 48.5 billion in the mega merger.

AT & T announced plans to bring DirecTV Now's lowest price to $ 50 while removing cable channels Viacom (VIAB) and AMC networks (AMCX) to make the service profitable. The problem with AT & T's OTT concept was that this service was too much like traditional media services with a wide range of channels.

The company now offers two packages of $ 50 and $ 70, HBO included in base packages costing $ 10 more, despite the removal of dozens of channels. According to Edge, AT & T now has the highest base cost of the five major streaming services currently run by Sling TV (DISH) and Hulu, with Live TV being owned via a future majority Disney (DIS).

The problem is that AT & T management again claimed to understand the company's business in December to make it clear that it had no idea how it had bought DirecTV. CEO Randall Stephenson said at the UBS Global Media conference:

We are talking about $ 50 to $ 60. We learned this product, we think we know this market really, really well. We built 2 million subscribers. But we were asking this DirecTV Now product to do too much work. So we reduce the content and get the right price; to reach it where it is profitable.

The end result is a service that already cuts customers after reaching 2 million subscribers. DirecTV Now lost 267,000 customers in the fourth quarter when Hulu replaced the base service of 2 million customers. In addition, AT & T lost 403,000 satellite customers, suggesting that the company is rapidly losing an edge in pay-TV services. The only good news is that the purpose of this change is to make the business profitable and the profits to keep the dividend high.

The wireless entertainment and entertainment company is at the heart of a video-streaming war in which the purchase of Time Warner (NYSE: TWX) opposes DirecTV. Offering DirecTV Now at-loss packages has just let AT & T support content providers to compete with Time Warner properties. The company is now moving quickly to most WarnerMedia products with the following video streaming services.

The planned entry of Apple (AAPL) in the wars that unfold on March 25 adds to the upheavals of the area. The technology giant would have a budget of one billion dollars for content and could give the service for free to attract subscribers for other video subscription services such as HBO, where Apple takes a cut.

Hulu runs a business that loses money and can afford to wait for competition. DirecTV Now should be expected to lose a significant portion of its subscribers while traditional pay-TV services continue to show a significant downward trend.

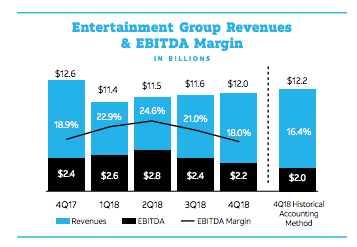

Fortunately, the entertainment sector is the smallest profit generator of the new AT & T company. Fourth quarter EBITDA and the segment's $ 826 million operating profit were only $ 2.2 billion. Reducing DirecTV Now should help stabilize the profit levels of the entertainment group.

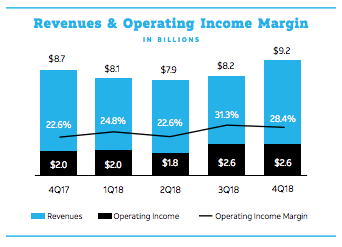

Source: Briefing for AT & T Investors Q4 & # 39; 18

The biggest risk for the bullish investment thesis concerns the media sector of the new WarnerMedia. Most content providers have a strong incentive to generate profits, but many of the new content services offered by technology players like Apple are as interested in subscribers as in initial profits. The media division reported operating income of $ 2.6 billion in the fourth quarter, which is now threatened by a competitive environment.

Source: Briefing for AT & T Investors Q4 & # 39; 18

Hang on to the dividend

Chief Financial Officer John Stephens did not comment warmly at the recent Deutsche Bank press conference. In the first quarter, the financial manager realized that wireless equipment revenues could reach $ 100 million and at least an additional $ 200 million through the amortization of wireless commissions.

The biggest problem is that the CFO does not even attack the success of DirecTV following the price increase. The company will lose customers even though, once again, the DirecTV Now service may not touch EPS.

Not addressing this issue only reinforces my belief that AT & T 's management team does not direct the market, but rather follows the instructions given by other players in the market. industry, whether in wireless, entertainment or the media. The mega-mergers of DirecTV and Time Warner are proving to be examples of skaters stepping into the entertainment and media sectors without heading to the markets. The company does not dominate the market, which is the traditional weakness of a conglomerate far too slow to act.

For this reason, and until AT & T gets a new leadership, the company must follow a strict debt repayment regime. No more transformational acquisitions where the old leaders of the industry are bought at a great price.

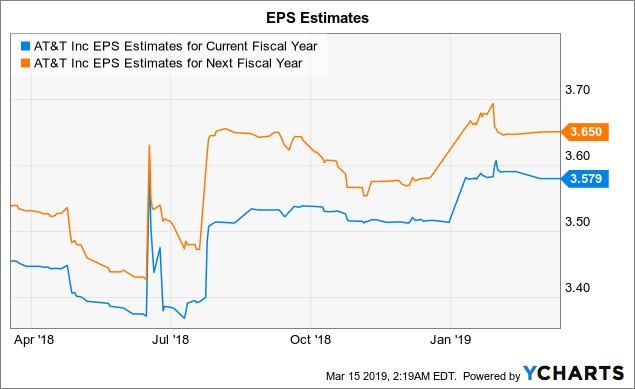

My previous thoughts on stock prices down to $ 40 are starting to fade. The wireless giant is not generating the expected earnings per share growth with the Time Warner acquisition, or even in the hopes of achieving a target of $ 4 a year. Analysts see the company earn a maximum of $ 3.65 per share in 2020.

Data by YCharts

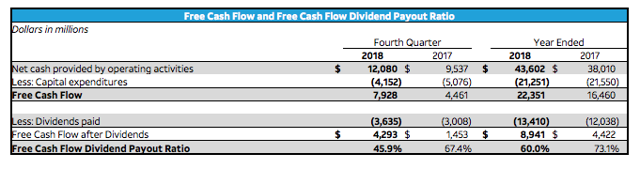

For this reason, AT & T is likely to realize minimal capital gains due to a lack of confidence on the part of the management team regarding the risks presented by these estimates on behalf of AT & T. competitive entertainment and media sector. The best hope is to collect the annual dividend of 6.7% with an average payout ratio of 50%. The company achieved a payout ratio of 60% last year.

Source: Briefing for AT & T Investors Q4 & # 39; 18

To take away

What investors should remember is that the market has already lost confidence in the wireless giant. Despite the purchase of both DirecTV and Time Warner, AT & T is already a big laggard in the field of video streaming. The only hope, while this management team is in charge, is to reduce costs, reduce indebtedness and pay the high dividend yield.

Disclosure: I am / we are long T, AAPL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: Disclaimer: The information in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link