[ad_1]

My constant message on AT & T (T) think the stock is going to have a hard time getting together until the current management team can prove that the big conglomerate of wireless and multimedia media is manageable. The first quarter of 19 only reinforces these fears as the company struggles to generate solid results from the assets acquired. Limited information is provided on debt projects beyond 2019. The security is expected to trade at $ 40, but AT & T is expected to fall to $ 30. these results until there is more confidence in how the company will manage all of these assets.

Source of the image: AT & T website

Merger assets in difficulty

Shareholders do not like this, but my message will continue to mark AT & T's lack of success with the assets of DirecTV and Time Warner. All that the company has done is turn the old DirecTV business into a margin story, instead of the revenue package promised with the wireless.

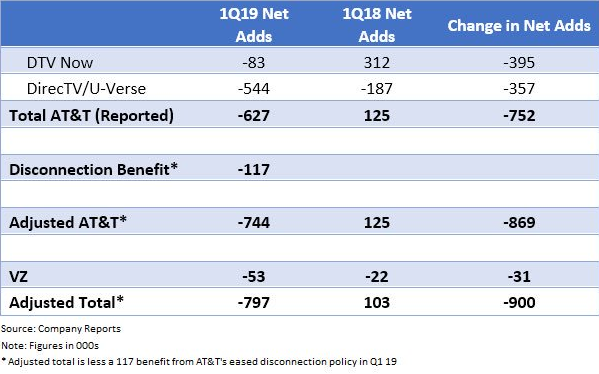

For video subscriptions, AT & T has stopped displaying statistics as charts because quarterly losses have become so severe. In the first quarter, the DirecTV division lost 627,000 subscribers and the change in net additions was an astounding 752,000 compared to last quarter.

Again, Verizon Communications (VZ) has greatly benefited from the refocusing on wireless. The market is not so focused on their video business, nor have they made a major acquisition that now bleeds submarines.

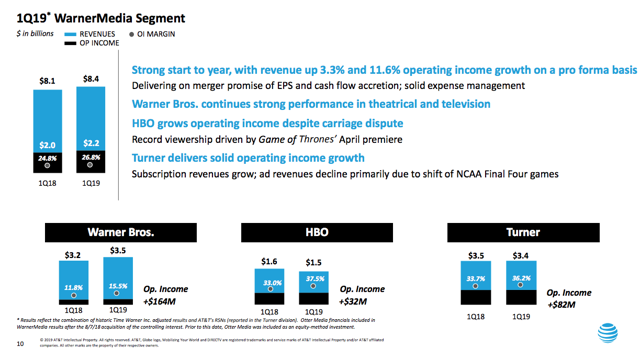

In addition, the activity of Time Warner would already be an absolute failure, without the powerful theatrical outputs of Warner Bros. The HBO and Turner segments are already experiencing a decline in their revenues while a streaming service such as HBO is expected to increase its revenues closer to the 20% + rate. Netflix (NFLX).

Source: AT & T presentation Q1 & # 39; 19

Again, the combination with a wireless giant was supposed to generate grouping opportunities to generate revenue. The goal was not to prune customers who were losing money.

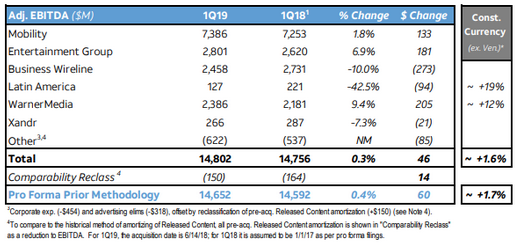

Both Entertainment and WarnerMedia posted the largest absolute EBITDA variations in the quarter. The opportunity to reduce the costs of these operations has generated net results, despite weak results and major questions about the future.

Source: AT & T presentation Q1 & # 39; 19

Significant debt reductions, but …

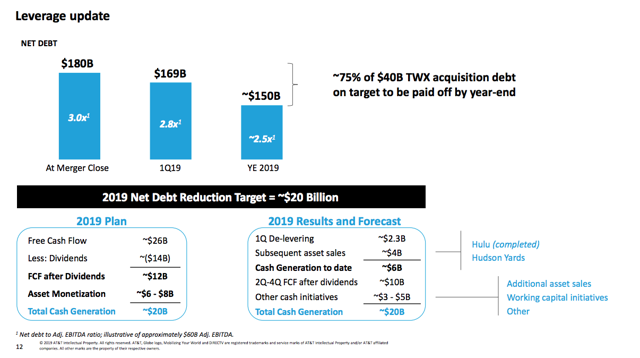

The management team clearly understood that debt reduction was essential to keeping their job, but it failed to make definitive statements about projects beyond 2019.

AT & T has given a lot of trouble to submit debt reduction plans in 2019, but the company has not provided any details for the beginning of 2020, which is only in eight months to sentence. The wireless and media giant is making great strides to reduce the debt accumulated when buying Time Warner, but significant control of debt reduction comes from the sale of assets such as Hulu and Hudson Yards . Once again, AT & T did not ask Time Warner to divest itself of this activity in order to improve its debt.

Source: AT & T presentation Q1 & # 39; 19

The end result is that AT & T is still on the verge of reducing debt to around $ 150 billion by the end of 2019. The question is what the company is doing at this point, even if the leverage ratios are reasonable at 2.5x.

Shareholders are faced with a long risk of slowing business activity, which is taken with a mountain of debt. As mentioned by the company, AT & T has free cash flow available to repay the debt and cover the significant dividend of 6.4% for the time being.

The fear remains that AT & T will return to the state of mind based on debt consolidation and empire building in recent years. Another line on the chart placing a debt target in the range of $ 140 billion by 2020 would be very promising for the stock.

To take away

What investors should remember is that this analysis of the first quarter results of 19 is a summary of the problem as a whole. The discussion is too focused on the weaknesses of DirecTV and HBO and not enough on the potential of 5G wireless. Unfortunately, this analysis is very necessary because of the actions of the current management team.

HBO could have great success in Game of thronesbut the stock game continues to not be fun for shareholders. Equities exchange about 8.5x earnings per share estimates, but unfortunately for shareholders, AT & T should not bounce back before management makes it clear that 2020 will be a year of the 5G and other debt reductions. Let's hope that the weak share forces management to reward shareholders with the huge dividend and positive returns on capital.

Disclosure: I am / we are long T. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The information contained in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link