[ad_1]

the T Mobile (TMUS) acquisition of Sprint (S) could potentially reduce price pressure by the domestic wireless market. AT & T (T) was about to take advantage of the fact that several operators had not underpaid their rates, although the new T-Mobile is poised to become a formidable 5G player. In any case, AT & T will likely benefit from either option, but the big problem is the Department of Justice's sudden desire to approve an acquisition only if a viable fourth carrier is created.

Competitor viable

AT & T dropped to nearly $ 30 last week, after announcing that the Justice Department would ask T-Mobile and Sprint to create the conditions for a formidable new wireless network. Essentially, Makan Delrahim, head of antitrust affairs, wants the market to remain viable with four operators.

The biggest stumbling block to the merger has always been the view that markets become anti-competitive when they only address three of their participants. The Justice Department had previously blocked Sprint's and T-Mobile's attempt to merge in 2014, as well as the T-Mobile purchase offer in 2011 by AT & T, which created the fourth Troll carrier in the mastodon that he became.

For AT & T, the real question is whether the approval of the DOJ requires the emission of wireless radio waves or simply that of the Boost Mobile division. Technology companies of Amazon (AMZN) and Alphabet (NASDAQ: GOOG) (GOOGL) to cable companies Comcast (CMCSA) and charter (CHTR) are expected to participate in the creation of a viable national wireless network provider.

The impact on AT & T and even Verizon Communications (VZ) strongly depends on the decision of one of these companies to rely on a national wireless network enriched by the gifts of the new T-Mobile.

The Ministry of Justice would have defined the plan in this case with AT & T's 2011 attempt to buy T-Mobile (via Fierce Wireless):

To replace the competition that would be lost from the removal of T-Mobile by AT & T as an independent competitor, moreover, a new entrant would have to have a national spectrum, a national network, and a 39 economies of scale arising from the presence of tens of millions of customers and strong brand, as well as other valued characteristics.

On the basis of these details, all the supposed buyers of Boost Mobile would naturally provide the strong brand needed to create a viable competitor, but there is no logical situation in which the new entrant would have a national spectrum and a national network. Maybe some kind of combination with the spectrum of DISH Network (DISH) would create a national spectrum that would require billions of investments and years to create a real network.

At present, DISH is the fifth spectrum spectrum and has neither the network nor the customer base to compete in the national wireless market. A combination of T-Mobile and Sprint would reduce a company's incentives to build a fourth competitive network.

The biggest problem would be the lack of an attractive customer base for an Amazon or a Comcast in order to fill the void. Boost Mobile's prepaid subscribers, low value and generating an estimated $ 3 billion in revenue, will simply not cut it for these industry giants.

Both companies seem to have less interest than media speculation. On Friday morning, Comcast withdrew from discussions because the flawless spectrum of the new T-Mobile or pre-paid customers of Boost Mobile is enough to create a fourth competitive wireless service provider.

According to Philip Cusick, analyst at JPMorgan, Amazon is not a logical builder of wireless networks under the proposed scenario. The distribution giant is a logical investor in a new network, but a viable fourth operator must not be built to compete with AT & T and Verizon.

The regulator's logical conclusion is that these industry giants are working with an independent Sprint or T-Mobile to improve the service offerings of these companies. The spectrum of DISH and cash from a tech giant would provide the assets needed to make AT & T highly competitive without eliminating a fourth carrier in order to satisfy the GM.

Unfortunately for the Department of Justice, merging the industry to reduce competition is the only party interested in a merger. The likely result remains that the spectrum of a weakened Sprint is entrusted to another industry player who could very well become T-Mobile.

Dividend no threat

A large number of reports have already discredited the likelihood that Amazon or Comcast will find appealing only the Mobile Boost spectrum or the wireless spectrum. An agreement of this nature seems highly unlikely.

For this reason, AT & T's $ 30 drop is again an additional opportunity to buy shares selling close to 7%. The only real threat to society is a separate Sprint and T-Mobile that reinforce each other through a combination of technology giants investments or cable and DISH spectrum. These options are not even in the cards yet.

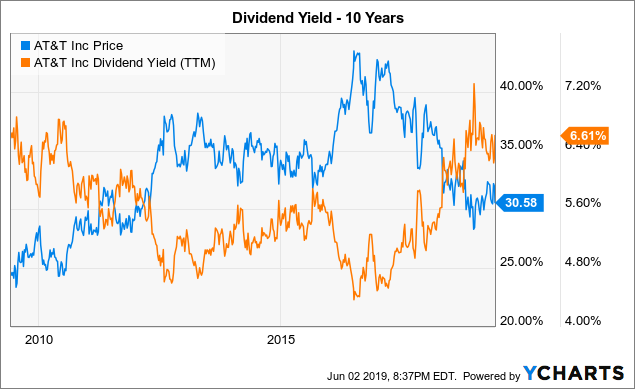

Over the last decade, AT & T has rarely traded with a dividend yield well above the current level of 6.7%. Whenever the yield was so high, the stock represented a solid buy because of strong capital returns and a large dividend for a high total return.

Data by YCharts

Do not forget that the media and wireless giant is forecasting free cash flow of $ 26 billion this year and about $ 12 billion in cash after paying the dividend obligations. The dividend is strong as long as competition in the wireless sector does not worsen.

To take away

The main advantage of investors is that the market has no apparent interest in responding to the GM's demands. In the absence of such a scenario in which a fourth viable mobile operator is created, AT & T remains a good deal at $ 30 with a dividend yield close to 7%.

Disclosure: I am / we are long T. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: The information contained in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link