[ad_1]

Jin Lee | Bloomberg | Getty Images

Wall Street was hit by lashes throughout August, as trade headlines and the crisis of the recession triggered a sharp fall in equities in the last month of the summer.

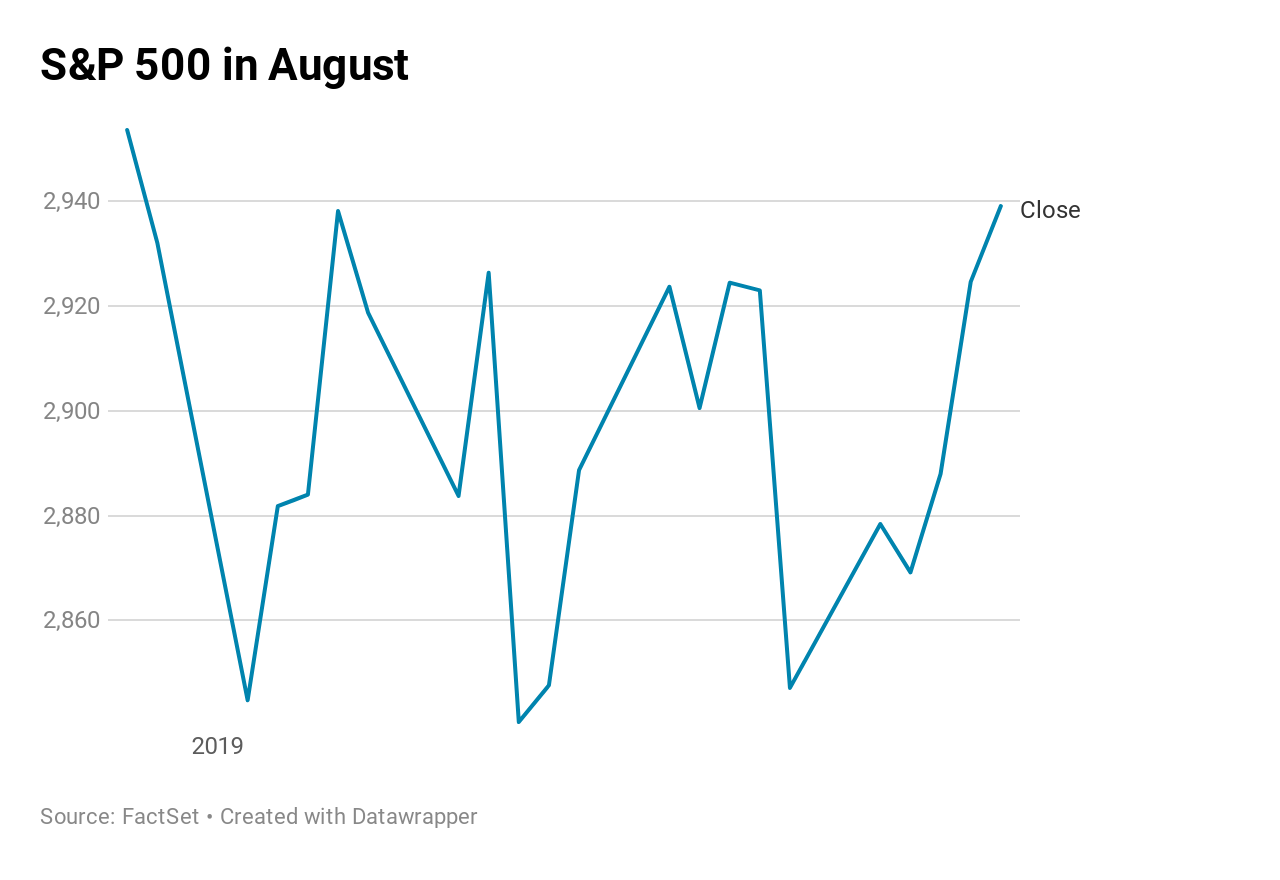

The S & P 500 recorded 11 moves of over 1% in 22 trading days in August. These movements include three declines of at least 2.6% as well as the worst day of the year on August 5th. The Cboe Volatility Index (VIX), widely regarded as the best indicator of fear on Wall Street, reached 24.81 in August before returning around 18 years ago.

The turbulent trade action this month was mainly driven by two factors: an escalation in US-China trade relations and a recession triggered by the bond market. While trade tensions are expected to persist and bonds continue to signal a recession, continued market volatility is expected to continue.

"It's not just normal volatility – you've had this tip these days of all-or-nothing trading," said Willie Delwiche, investment strategist at Baird. "Whether it continues or not, from the point of view of titles, I do not see why that would not be the case."

Here is what happened in August

The month of August began with the announcement by President Donald Trump, in a tweet, that an additional 10% tariff will be applied to Chinese imports, amounting to $ 300 billion dollars, starting September 1st. The index ended the August 1st session down 0.9%.

On August 5, Trump accused China of manipulating its currency after the fall of the yuan to levels not seen for more than 10 years. The S & P 500 fell nearly 3% that day.

"Trump loves to be a tough guy," said Maris Ogg, president of Tower Bridge Advisors. "If history is a guide, it will go from the front and become a tough guy."

"I would be surprised if we make progress," said Ogg, referring to trade negotiations. "I guess the Chinese do not want him as president, so they will make it difficult for him."

Inventories have been trying to stabilize after the sharp drop that followed the announcement by the United States to delay some tariffs on certain goods from China. However, the upbeat sentiment in the market was short-lived as the 10-year Treasury yield fell below its 2-year counterpart.

This is known as a reversal of the yield curve and is feared by the experts because it preceded periods of recession in the past. The 2-10 yield curve reversed for the first time in intraday on August 14, prompting investors to get rid of their stock in favor of US long-term debt and other traditional safe havens such as gold and silver. Dow Jones Industrial Average fell

"The yield curve will have to start to stiffen again, driven by higher yields in the longer run, to send a more positive long-term signal to the economy and equities," said Tom Essaye, founder of The Sevens Report, in a statement. Note.

Trade tensions intensified again last week after China unveiled new tariffs on US $ 75 billion worth of products. Trump responded by ordering US companies to outsource their operations outside China and announced tariff increases on many Chinese products.

Equities rallied sharply in the last week of the month as both countries softened their trade discourse. Chinese Foreign Ministry reportedly said Friday that negotiators from both countries maintain "effective communication," while Trump said some trade talks .

Overall, however, the S & P 500 lost nearly 2% in August and posted its worst monthly performance since May, down 6.6%.

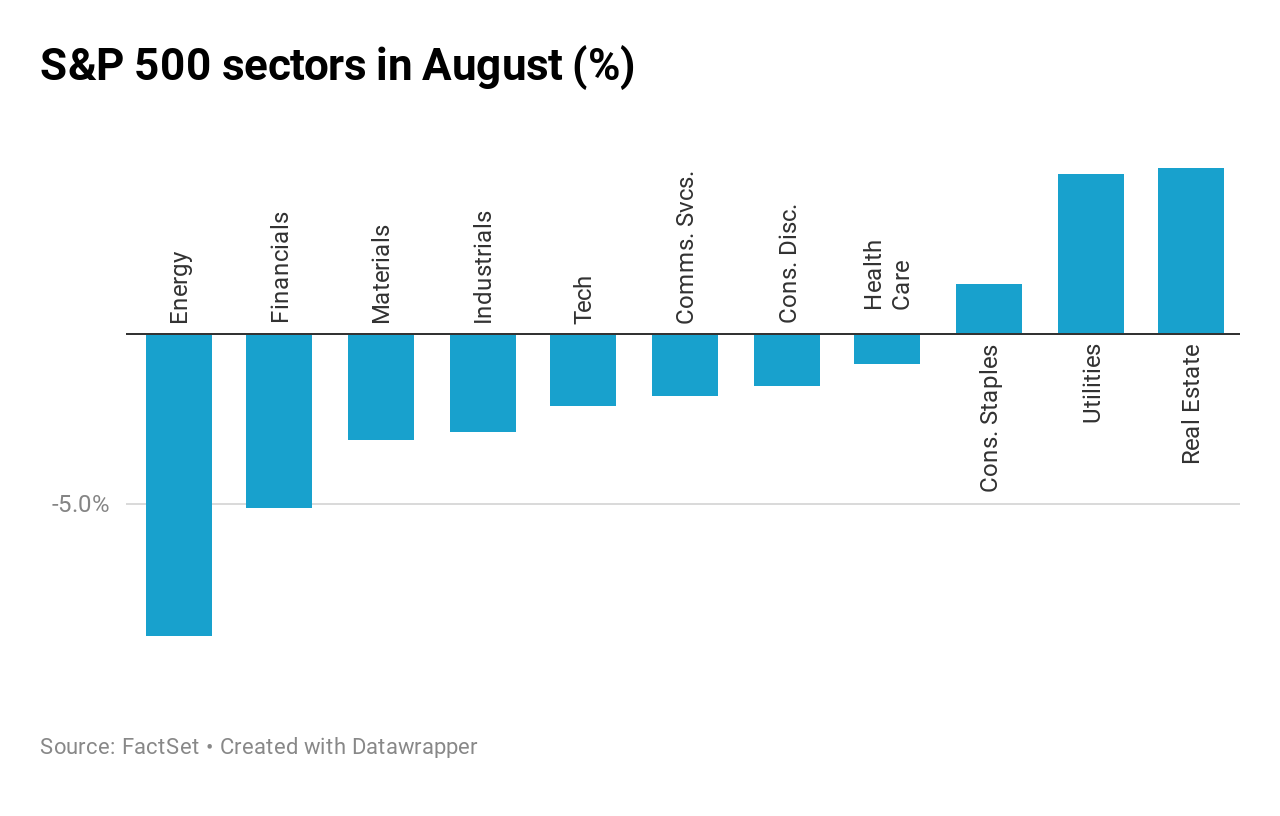

Many losers, but some winners too

The energy and financial services sectors were the worst performers in the S & P 500 in August. For the month, they fell by 8.7% and 5.1%, respectively, the trade war and the reversal of the yield curve having lowered expectations of global growth.

Concho Resources, which lost a quarter of its value in August, recorded the largest drop in energy values. Schlumberger and Devon Energy sold about 20%.

Among the big banks, Bank of America was the biggest loser, with a fall of about 10%. Citigroup, JP Morgan Chase and Wells Fargo also lost at least 3.8% for the month.

Technology stocks also suffered from the sector's 1.7% loss as stocks such as Skyworks Solutions lost more than 11% for the month. Overall, eight of the 11 S & P 500 sectors fell for the month.

The big winners of the month of August were traditional safe havens such as gold, money and long – term bonds. The SPDR Gold Trust (GLD) gained more than 7% during this period, while the iShares Silver Trust (SLV) jumped more than 12%. The iShares Treasury Bill ETF at 20+ (TLT) also rose 10.8% in August.

No rest for stocks in September

Investors who hope that the turn of the calendar will bring some calm to the market could be wrong, if history gives an indication.

Since 1950, the month of September is the worst month on average for the S & P 500. Data from the Stock Market Almanac shows that the S & P 500 shows an average loss of 0.5% in September.

"It will be more of an" attachment "than an" expiration and expect something to change, "said Baird's Delwiche.

Subscribe to CNBC on YouTube.

[ad_2]

Source link