[ad_1]

Investing in REITs is not always about immediate-term yield. The Cell Tower REITs – American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC) – certainly do not screen attractively, but there is a reason that the market caps of these firms have run high. Shares of the group have historically outperformed the broader REIT index consistently, leaving traditional yield-driven investments in the space behind. With many retail investors only interested in the potential for short-term rewards, these types of long run secular stories just get missed.

As the largest of the three, American Tower attracts most of the attention. Shares have tripled since 2010. Institutional ownership has historically been well over 90% of the float – many small investors have missed out on this run. However, with the company trading more than 25x FFO, the argument becomes whether or not the money has been made.

Telecommunications Real Estate, Note On India

American Tower (AMT) owns and operates communications in the world, whether or not to wireless data providers, television broadcasters, or even government agencies and municipalities. The business model itself is relatively simple. American Tower owns (or leases to sublease) the underlying land and builds the steel tower structure; providing equipment, wiring, and antenna equipment. Pretty cut and dry, and there are a few positive to this type of real estate:

- Lease terms are quite long, with initial ten-year term even before. Particularly given alternative sites may not exist in certain markets, historically very high. The annual income is around 1-2% of revenue per year, implied renewal rates are around 80-90%.

- Annual rent escalation provisions are in place. Customers have been more than willing to absorb 3% fixed rate increases, good enough to keep up with inflationary pressures. Foreign sites are tied to local inflation market, balancing some of the volatility present in international markets. Sustaining capital expenditures are limited. After buying the land and building the tower, there is little to no ongoing capital needs. A free-standing steel structure requires little care or upkeep.

- Demand growth has been consistent (growing use of wireless services, high capital spending budgets for expansion). Given American Tower, which is more likely than not to have a positive impact on investment ("ROI"), it is a positive majority that needs to continue.

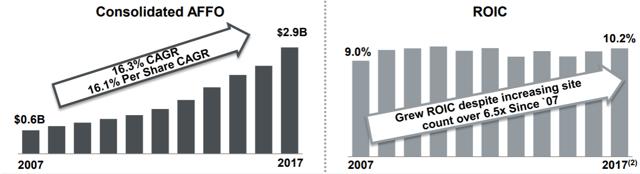

That is pretty near "set it and forget it" territory. It can not take a fuller view of these types of badets, returns have been solid, and perhaps more importantly, returns on invested capital have been consistent. This all combines to create a growth conducive to growth (FFO) growth.

* Source: American Tower, Q2 2018 Earnings Presentation, Slide 13

A lot of these badets used by the carriers, especially domestically. However, there has been a major push by those firms to reduce the capital-intensive nature of their balance sheet. As American Tower willingly concedes, returns on investment are very low when there is only one tenant; The big bucks start to roll in when there are multiple carriers utilizing the same badet. With substantially all of the fixed costs already in place – it costs nothing less than a second hold on a tower. When these badets were owned by monopolistic tendencies were commonplace. Much like power lines or other types of infrastructure shared by companies, it makes sense for these badets to be owned by a third party in the sake of fairness.

This is not the only reason for major businesses holding these badets internally. Domestically Focusing, AT & T (T), Verizon (VZ), and T-Mobile (TMUS) see better opportunities for returns on capital investment elsewhere in their business. See the AT & T Acquisition of Time Warner for instance. Beyond these types of game-changing acquisitions, leasing frees up capital for actual network expansion. In my opinion, investors should expect to see the move towards the leasing of these badets and growth of all geographies.

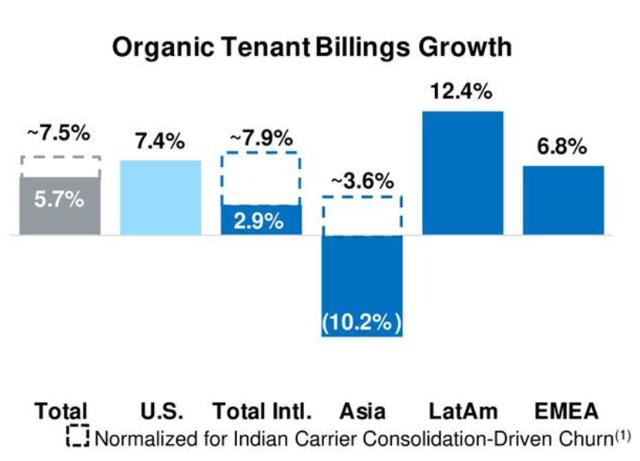

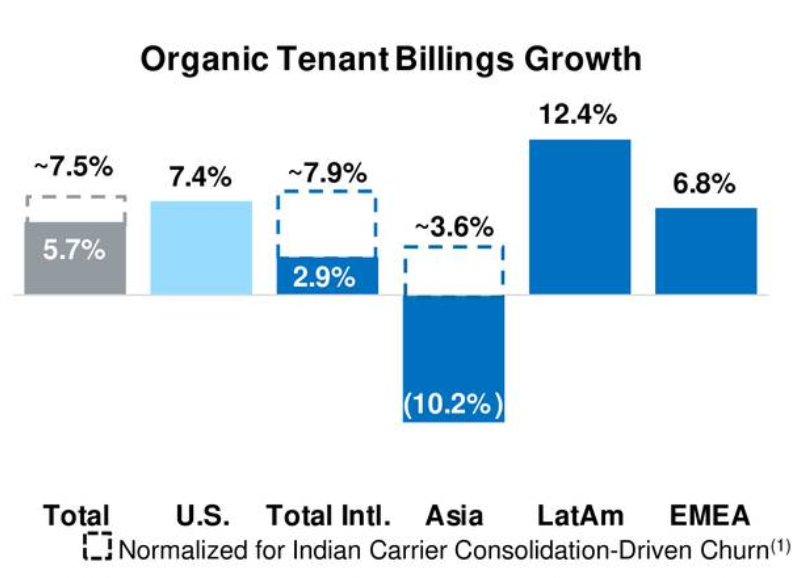

In many international markets, the tower is characterized by a lack of fixed-line telecommunications or hard-wired internet cable. This creates a dichotomy versus the United States; International players are just skipping over that infrastructure roll-out. This makes overseas investing very attractive, especially in the future of data roll-out. Due to likely continued increases in mobile data usage, and the future looks strong globally. As seen during the Q2 earnings release, organic growth has increased – a trend that has been in place for quite some time.

* Source: American Tower, Q2 2018 Earnings Presentation, Slide 6

Note the major hit to organic growth from Indian carrier consolidation. India is undergoing substantial changes within its telecommunications sector. Reliance Jio, a major player, launched at 4G network last year, sparking a wave of consolidation. The Indian market is rapidly maturing, with the likes of: Reliance Jio, Bharti Airtel (which just bought Tata Teleservices), and Vodafone India. Q4 conference call, giving an economic impact outlook this year

We continue to expect total India carrier consolidation-driven churn in our Indian market of roughly $ 150 million to $ 200 million, and view 2018 as the peak year for that churn … an orderly consolidation process that we expected to run compressed into a much tighter timeframe.

Towers are not immune to consolidation as well. India Towers, a partnership between Vodafone India and Bharti Airtel, announced it was taking over Indus Towers earlier this year. That entity controls more than a third of India's nearly 500,000 tower rentals. American tower has been acquiring the right to fist itself, viewing the impact of short-term churns. That includes buying some of Vodafone's non-Indus Towers badets.

Notes On The REIT Structure

While an American REIT I think there is probably an underlying expectation that the company is focused here, investors are likely to know that they are not particularly true: the United States. From a profitability perspective, American Towers is a little more than a half of a larger portion of operating margin domestically. The caveat is likely to be overstated in the Indian market.

I mention this only because of the favorable effect of the treatment under REIT status; overseas operations are predominantly taxable. That means that the company pays taxes overseas and that can be quite material. REITs get the rules of the rules of the business of the business of the taxpayer REIT subsidiaries ("TRS") to skirt these laws.

Given funds from operations ("FFO") and other metrics are based on net income, there is a difference between the IRS and the IRS, but it does make discussions on cross-border comparisons on project profitability a bit murky.

Tough Valuation Story

The problem for me is that this segment of the market has seen a flood of capital as investors chase the growth story. There are just a few areas of this business that are generating this kind of organic revenue growth – never mind the solid economics of a new build perspective. That tidal wave of capital has driven the many in the sector up significantly. Trading at 26x FFO, there is a lot of it priced in.

Sure, FFO might double over the next decade, but there are still many REITs posting positive, albeit low single-digit, comps in the 10x FFO range, if not lower. Buying in the tower REIT story requires a long-term mindset that might be well in the stock price. Future technology development – just look at small cell technology – could bring the business model years down the line. In most cases, this is a real estate business.

Constant subsector outperformance rarely lasts in the REIT space (looking at you malls), so I'm happy to wait for a new opportunity. In my opinion, that is the cautious approach for anyone interested in the story and themes behind American Tower and its peers.

Interested in REITs? I'll be at REITWorld in November, speaking with some of the biggest names in Simon Property Group. Industrial Insights get full access to my conference coverage – just one of the many benefits of joining this community. This is glad you just can not get anywhere else. Sign up today to get an early look at my schedule before I head to REITWorld.

Disclosure: I / we have no positions in any stocks and 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with this article.

[ad_2]

Source link