[ad_1]

Written by Bob Ciura for Sure Dividend

The tobacco industry is a potential gold mine for dividends. Investors can find high returns in the tobacco industry, especially the two major tobacco stocks, Altria Group (MO) and Philip Morris International (PM). At the time of writing these lines, Altria and PM have dividend yields of 4.8% and 5.4%, respectively. The yield of 5% + PM is particularly attractive.

The high return on their dividends is attributable to the fall in share prices. Both stocks have lost about 20% this year, while the S & P 500 index is up 5% since the beginning of the year. Although Altria and PM have disappointed investors up to now in 2018, their high dividend yields are attractive to income investors.

In addition, the two stocks are now more attractive in terms of valuation. As a result, investors in search of value and income may have reasons to take a closer look at these two stocks of high-yielding tobacco

Overview of Current Events and Events

Altria and Philip Morris International manufacture and distribute tobacco products. They share the Marlboro cigarette brand – Altria sells Marlboro in the United States, while Philip Morris owns the international distribution rights. Altria dominates tobacco in the United States, Marlboro controlling nearly half of the domestic market share. Other Altria products include Skoal, Copenhagen, Black & Mild and Ste. Michelle. Anheuser Busch Inbev (BUD).

PM owns the Marlboro trademark rights in international markets. Outside of Marlboro, it is less diversified than Altria. There is no investment in wine or beer, but there are important brands of tobacco. His other brands include L & M, Chesterfield and Parliament. According to the Prime Minister, he has six of the world's largest international brands. 15.

Tobacco is an excellent company. Major tobacco producers like Altria and PM benefit from high margins and high cash flow generation. Cigarettes are addictive, and also benefit from a huge brand loyalty, which gives Altria and the PM a pricing power over the consumer. In addition, investment needs are low, thanks to the economies of scale achieved in manufacturing and distribution. This has led to the strong growth of Altria's earnings and shareholder returns over the past five years.

Source: Altria Shareholder Meeting, page 10

In the first quarter of 2018, Altria increased its revenue by 1.7%. -part has gone up 30% from one year to the next. Both revenue and earnings per share exceeded badysts' expectations of $ 40 million and $ 0.03 per share, respectively. The smokable sales revenue declined 0.8% for the quarter, but was offset by growth elsewhere. For example, incomes from smokeless products increased by 13% in the last quarter, while wine revenues increased by 1.4%

. The $ 7.73 billion business figure rose 11.7% year-on-year and exceeded badysts' expectations by $ 200 million. Earnings per share of $ 1.41 were up $ 0.18 per share and up 24% from the same quarter last year.

However, PM has reduced its forecast for the year, which explains the negative sentiment of the market. The PM expects EPS of $ 5.02 to $ 5.12 for 2018, compared with the previous forecast of $ 5.15 to $ 5.30. The reduction in forecasts is due to higher than expected marketing and development costs, as the company continues to roll out its next-generation products.

Growth Prospects

The biggest risk for Altria and PM is the decline in smoking rates. Altria said in the first quarter that the volume of domestic cigarette shipments in the industry as a whole fell by 5.5%. Altria 's shipping volumes decreased 4.2%. MPs reported a 1.5% drop in the volume of cigarette shipments in the last quarter.

To prepare for continued declines, Altria and PM are working on a range of "reduced risk" products such as electronic vapors and electronic cigarettes. These reduced risk products heat up the tobacco rather than burning it, which, according to the companies, would have less harmful effects on health.

Source: General Assembly, page 15

In the first quarter, Altria's Nu Mark subsidiary of approximately 30% and extended the MarkTen Elite to more than 6,000 retail stores

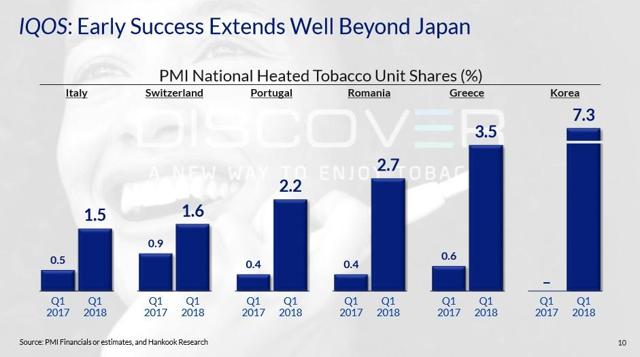

In addition, both companies are working on IQOS, their main bet on next-generation tobacco. The reduced risk portfolio of PM generated a business turnover of $ 3.6 billion in 2017. It has already deployed IQOS in some international regions, with good results. Shipments of heated tobacco units jumped 73% in the last quarter. IQOS HeatSticks of PM reported a 15.8% market share in Japan in the first quarter of 2018, compared to 10.8% in 2017. It is already the # 2 brand in Japan, according to the company, and continues to gain share several non-Japan markets.

Source: PM Annual Meeting of Shareholders, page 10

By 2025, the PM expects its reduced-risk product line to generate revenue $ 17 billion to $ 19 billion annually. PM plans to bring IQOS to India, the second largest tobacco market behind China. Altria's IQOS product is ready for deployment as soon as it receives FDA clearance.

Valuation & Expected Returns

Valuations and expected returns are more attractive to Altria and PM. We consider both stocks as undervalued. Altria shares are trading at a price / earnings ratio of 14.7, based on 2018 earnings forecasts. Over the past 10 years, equities traded for an average price / earnings ratio of 16.2, which that we consider a reasonable estimate of the fair value of Altria. Therefore, if the stock returned to a price / earnings ratio of 16.2, the expanding valuation would add about 1.9% to Altria's annual performance over the next five years. In addition, we expect annual earnings growth of 7% for Altria. If we take into account the current dividend yield of 4.8%, the annual return of Altria shares could reach 13 to 14%.

Similarly, the shares of Philip Morris could generate strong returns for shareholders. The company is expected to earn $ 5.07 per share in 2018, halfway through the forecast. The stock is currently trading for a price / earnings ratio of 16.5. This corresponds exactly to our estimate of fair value. Although the stock does not seem undervalued, it can still generate positive returns. We expect earnings per share will increase by approximately 6% per year over the next five years, thanks to the continued expansion of IQOS, to price increases and a rate of return. lower taxation. Combined with a dividend yield of 5.4%, the total return of PM could exceed 11% per annum over the next five years

Final Thoughts

Altria's and PM's shares did not not behaved well this year. rate. But companies continue to increase their earnings per share, thanks to rising prices and the benefits of lower tax rates. And in the case of Altria, share buybacks are an important incentive for earnings growth.

The reduction of their products at risk could help to offset the decline in smoking rates, led by IQOS. We still expect both companies to increase their profits in the long run. In the meantime, high dividend yields mean that investors are well paid to be patient. As a result, we expect a total annual return of 10% for Altria and PM over the next five years.

Disclaimer: I have no position in the actions mentioned and we do not expect any positions in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link