[ad_1]

Investors are still waiting and have a greater aversion to risk. Technology stocks, down 2%, were the main losers. They were impacted by disappointing figures from SAP and Taiwan Semiconductor and weak technology stocks in the United States. SAP lost 5.9%. The group has not been able to meet the expectations of its operating margin. Spanish banks' shares were under pressure. According to a market participant, a decision of the Constitutional Court forced banks, not their customers, to pay certain taxes on home loans. Bankia lost 5.1%, Caixabank 4.5%, Sabadell 6.7% and Santander 2.9%. The Carrefour share rose 9.3% after the announcement of sales figures. Analysts have pointed to signs of a positive trend reversal at the retailer. Nestlé gained 0.7%, as expected. Following the slightly more optimistic growth of Novartis sales from one year to the next, the price rose by 1.9%. For Ericsson, it increased by 6.2%. Liberum estimates that sales, gross margin and profit were higher than estimated. The industry enjoys investment in the new 5G communication standard. the

With the minutes of the recent central bank meeting, concern over rising interest rates helped determine what was happening. New US economic data has fueled fears of a rise in interest rates. Added to this is the unresolved trade dispute that persists between the United States and China as a factor of heaviness, also because the stock market has fallen to its lowest level in four years. Global markets could suffer an "additional shock" if fears of slower growth in China materialize, warned market players. The volatility index, also called "barometer of fear," rose 17%. Due to concerns about the economy, Caterpillar was down 3.9% under the effect of Dow's lag. Alcoa increased by 5.9%. The aluminum company has exceeded market expectations with its business numbers and announced a share buyback. Steel Dynamics has also performed surprisingly well. The price rose by 1.9%. Philip Morris rose 3.6% after good quarterly results. Endocytes increased by more than 50%. Novartis acquires the pharmaceutical company, the bond market benefiting from the flight of the shares. The yield on 10-year US government bonds dropped 2.5 basis points to 3.18%.

The EU accuses Italy of an "unprecedented" derogation from European budgetary rules. This is clear from a letter from the European Commission to the Italian government on Thursday. The deviation from fiscal rules is "unprecedented in the history of the Stability and Growth Pact," says the report. Brussels requests a "clarification" until Monday noon. If Italy does not correct the proposal, the Commission may reject it. This would be a first in the EU. Rome provides for a new level of debt significantly higher than that agreed with Brussels. Austrian Federal Chancellor Sebastian Kurz said he had "no understanding" of the Italian budget. Italy is the second largest total debt in the eurozone after Greece, accounting for 131% of economic output. At the end of trading on Thursday, Italian bond yields rose again sharply.

In the third quarter, the Chinese economy posted the weakest growth since the 2009 global financial crisis, with a 6.5% advantage. The forecast had increased by 6.6%. Even though the economy is still on track to achieve the Chinese government's growth target of about 6.5% for this year, evidence of a weakening has occurred. condensed. Industrial growth slowed to 5.8% in September from 6.1% the previous month. Shortly before the data was released, China's central bank chief Yi Gan, head of banking and insurance Guo Shuqing, and chief financial officer Liu Shiyu made unusual statements. They called on investors to remain calm, given the new numbers. Guo said the "unusual fluctuations" in China's stock markets did not reflect the country's economic fundamentals and "stable financial system".

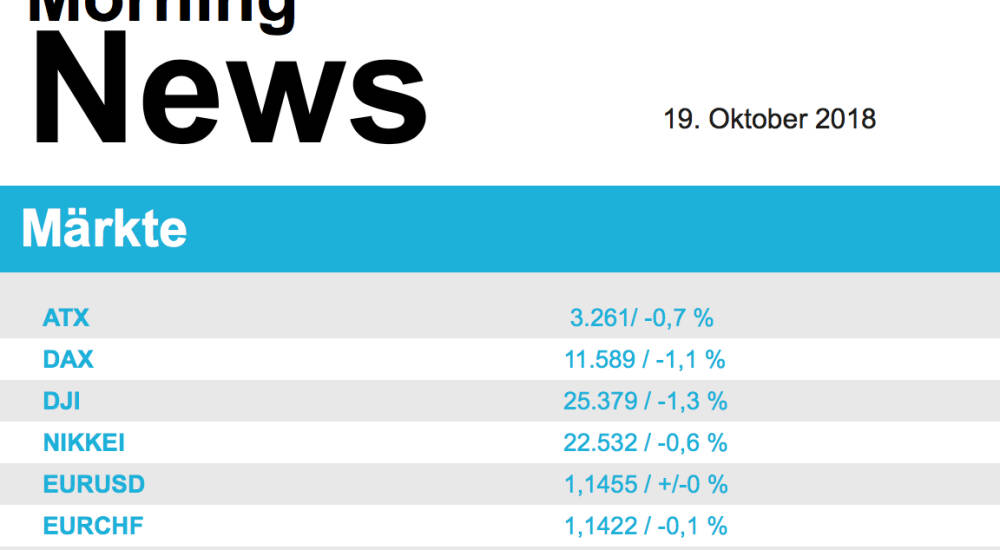

Pre-commerce are the europ. Stock markets are slightly positive. Asian markets are incoherent. On the corporate side, Volvo released results (slightly above expectations). From the macro point of view, it's relatively calm.

SOCIETY NEWS

Mayr-Melnhof Karton AG

Last night, the national cardboard manufacturer Mayr-Melnhof announced that he had reached an agreement with the owners of the TANN group on the complete acquisition of the group of companies whose head office is located in Traun in Austria. The stock purchase price is expected to be around 275 million euros. The TANN Group is a long established company that is the world leader in fine paper for cigarette filter paper. The acquired company currently owns 8 production sites in 7 countries and has recently achieved a turnover of approximately 230 million euros, the objective being to enhance the profitability of Mayr- Melnhof by developing its added value, added the company. In a subsequent step, the takeover must be approved by the antitrust authority. Closing is scheduled for end 2018 or early 2019.

(10.19.2018)

Alcoa

Act, indication: 26.05 / 26.31

time: 10:40:49 p.m.

Skip to the last SK: 00: 49%

Last SK: (0.00%) 5.26

caterpillar

Act, indication: 118.17 / 118.66

time: 9:28:39

Skip to the last SK: 00: 35%

Last SK: (-3.92%) 118.00

Mayr-Melnhof

Act, indication: 110.00 / 110.42

time: 9:30:01

Skip to the last SK: 0.19%

Last SK: (1.66%) 110.00

Nestle

Act, indication: 70.46 / 70.49

time: 9:30:41

Skip to the last SK: 1: 55%

Last SK: (0.66%) 69.40

Novartis

Act, indication: 75.34 / 75.36

time: 9:30:17

Skip to the last SK: 00: 33%

Last SK: (1.90%) 75.10

SAP

Act, indication: 95.46 / 95.50

time: 9:30:20

Skip to the last SK: 16.01%

Last SK: (-5.94%) 94.38

Photo credit

first

Stocks on the radar: composite . DO & CO . UBM . Buwog . Warimpex . Valneva . Immofinanz . Austrian Post . Mayr-Melnhof . KTM Industries . SBO . Petro World Technologies . Oberbank AG VZ . Bawag Group . Strabag . Souche Oberbank AG . Amag . Merck KGaA . LINDE Z.UMT. . Deutsche Telekom . Munich Re . Beiersdorf . Fresenius . HeidelbergCement . Infineon . SAP . Wirecard . O2 . Fresenius Medical Care . BASF . Daimler,

Random partner

HSBC

HSBC Germany is part of the HSBC Group and therefore has access to one of the largest international networks. HSBC Trinkaus & Burkhardt AG employs more than 2,700 people at 12 locations in Germany. The financial institution has more than 25 years of experience in issuing investment certificates and leveraged products.

>> Visit 64 other partners on boerse-social.com/partner

Latest blogs

»ATX Trends: Mayr-Melnhof

Netflix is preparing for the next explosion (Christian-Hendrik Knappe)

Volkswagen: speculation or wishful thinking? Porsche fantasy on the stock market …

Training on a Thursday (Philipp Pflieger via Facebook)

Klondike Gold: Interview and live questions / answers with Tallmann CEO Stefan Müller

"Inbox: This is the choice: who will be the athlete / athlete of the year?

"Running in the center of Vienna. (Monika Kalbacher via Facebook)

»Always there – the role of fascination (Beatrice Drach via Facebook)

Georg Wailand announces opening of 28 Years Profit Fair

Deutsche Post is launching a consolidation phase – how can you describe it?

<! –

Posted in:

Blog CD,

finanznachrichten.de

–

Marked with:

->

Source link