[ad_1]

San Francisco In fact, the index "FAANG" should be recomposed. The popular term describes the top five technology companies and includes Facebook, Apple, Amazon, Netflix and Google (now part of the Holding alphabet). But one thing is missing: Microsoft.

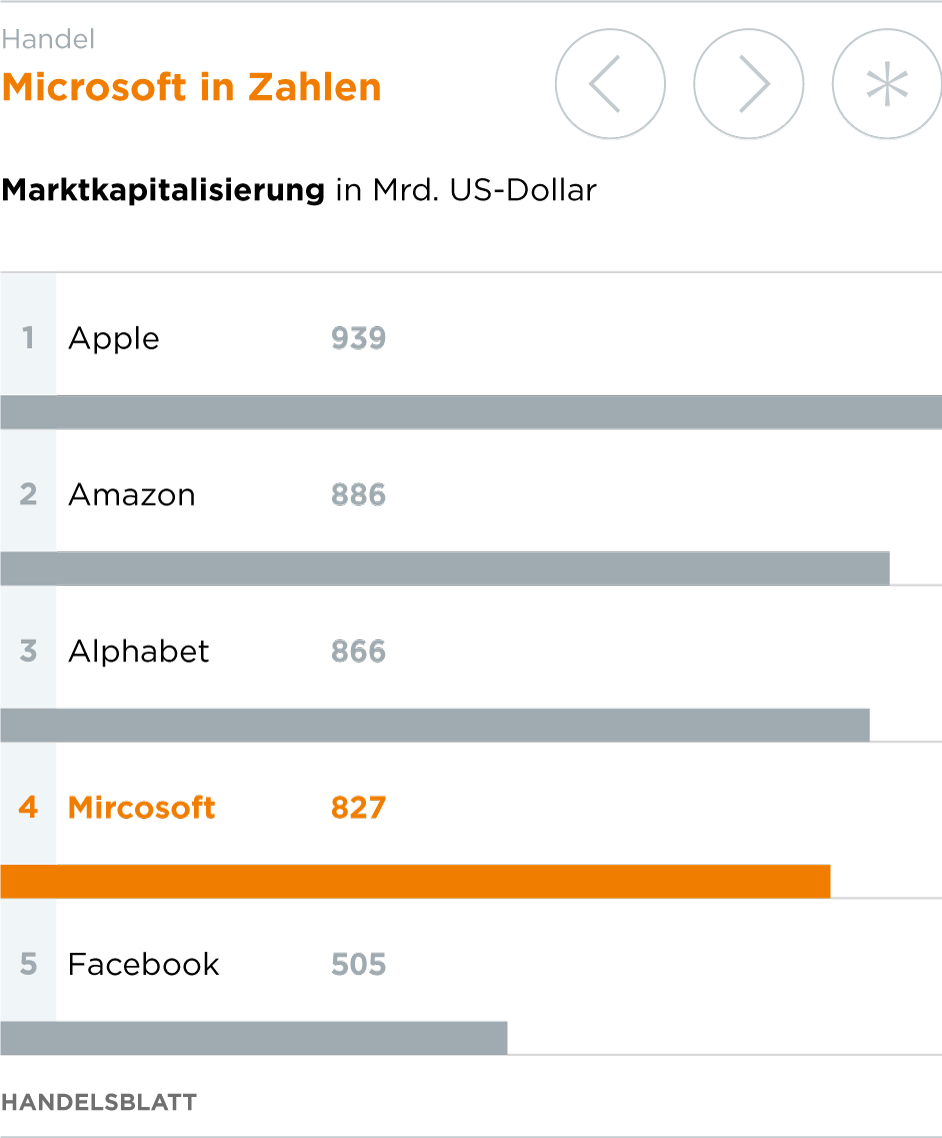

Since Satya Nadella became CEO in February 2014, the software maker's share price has tripled to over $ 107 and the stock market has reached $ 827 billion. Only Amazon, Apple and Google are even more valuable. Facebook and Netflix, however, are far behind. Just: How do you just put an "M" in this shortcut?

Microsoft writes one of the most startling Wall Street return stories. During Steve Balmer's 14-year tenure, the share price has risen sharply to rise sharply after the leadership change in 2014. This was a dramatic change in the business model, the corporate culture and the product offering that has made this development a surprise for many observers.

Global Competitors in Check

Cloud computing, in particular, where customers use the Internet or In this way, even the replacement of their IT infrastructure contributes to it – like the German software manufacturer SAP, which, in some areas, is competing with the American group, cooperating in others.

Microsoft is the world's largest manufacturer of software for businesses and consumers and was founded in 1975. It is one of the oldest independent technology companies outside of IBM. The most known products are the Windows PC operating system and Office 365 productivity software

Since 2001, Microsoft has been distributing its Xbox game console, its own titles such as the billionaire "Halo" and the platform in Xbox Live online. In addition, there is a growing Internet business with search engine, advertising and online content. Cloud computing also takes on importance in the segment of business customers: storage space and computing power are made available to customers at the touch of a button , without their own data center.

Microsoft also offers infrastructure services such as security software, access control or industrial solutions from the cloud. The most recent division is "Surface": under this name, Microsoft produces laptops and tablets.

The fourth quarter results of the fiscal year, closed end of June, and the fiscal year 2018 figures clearly show the evolution of the Microsoft universe. Windows is still an important part of the product line and an important driver of revenue and profit growth.

But the new growth sectors are finally able to cushion the long-term weakness of the PC market. The new LinkedIn acquisition – the most expensive acquisition of $ 26 billion in the history of the company – recorded record growth in 2018, for example: sales rose for five consecutive quarters , most recently at 37%.

The game activity with its Xbox platform and online has exceeded the $ 10 billion mark for the full year for the first time. In the fourth quarter, sales increased 39% year-over-year. "We aggressively invest in content, the gamer community and cloud services," said Nadella during an badyst interview.

Wall Street badysts have long sniffed computer games and are now electrified. "We think Microsoft will develop a Netflix for games," said Morgan Stanley's Keith Weiss concisely.

Such an online service would then be available on all screens, from smartphones to televisions through virtual reality glbades, without the need for a game console and quadruple the reach of players, according to the Timothy O. badyst Shea Jefferies. But Microsoft must be fast: Google, Amazon and Facebook should have similar projects

Big deal with Walmart

What interests the most investors, it is the "commercial cloud". There are business deals, such as the Azure platform, in which companies can leverage their information technology. Just a few days ago, Microsoft was able to register a spectacular offer and win the Walmart title for five years as a customer.

The contract also includes the use of artificial intelligence to better plan, for example, what products should enter the store when and where. The deal is a frontal attack on Amazon: both partners want nothing more than to weaken the giants of online commerce and the cloud.

In the fourth quarter, commercial cloud revenues reached $ 6.9 billion, an increase of 53% with a gross margin of 58%. The purely Azure platform business grew by 89 percent and is thus almost twice as strong as its main competitor Amazon, the cloud leader. In comparison, "More Personal Computing", which includes Windows, games and laptops, delivered $ 10.8 billion in the quarter, up 17%. Even here, there was an unexpected seven percent increase in Windows, but other sectors are growing faster.

The constant focus on "Cloud and Mobile", which Nadella has clearly emphasized since the first day of her tenure, is bearing fruit. Meanwhile, more than 60% of revenue comes from recurring subscriptions and no longer from the single sale of software licenses.

To this is added the change of corporate culture. The recovery of Github is the clearest sign of the changes that triggered Nadella: The platform allows developers to write and share program codes. In many cases, according to the principle of open-source: anybody can use the software freely under certain conditions.

For decades, Microsoft CEO Steve Ballmer criticized Open Source. Now, the company is the largest provider of such programs on Github and now wants to buy the platform even for $ 7.5 billion. Nadella knows: Without the Internet, the Internet and the cloud will not work. Microsoft's near-monopoly policy in the 1980s and 1990s is irretrievably over.

She is also about to make up for a weakness. In the smartphone market, Windows plays no role – even the costly acquisition of Nokia's device division has not changed. Nadella wants to make Microsoft programs such as Word, Excel or OneDrive available on all mobile devices. A customer can use a Windows PC as a control center, but he is no longer obliged to do so. Everything works without it, thanks to the cloud. The Internet browser Edge, the successor to Internet Explorer, is now available for Android and Apple's iOS. OneDrive cloud storage service, too

The recipe for success Cloud – "Microsoft is back on track"

Microsoft is one of the few high-tech titles that is also considered a share of growth and dividends. The dividend has been rising for years with good regularity. Among the FAANG shares, only Apple offers a payment. In the fourth quarter, Microsoft paid $ 5.3 billion in dividends and share buybacks to shareholders, up 16% from last year. This value is well below the quarterly profit of $ 8.9 billion, which leaves the opportunity to further increase dividends.

After a period of weakness in 2016 with a decline of 2.6%, sales are also rising again. Citibank expects growth of 9.9 and 8.9% for 2019 and 2020, respectively. For the first time in 2018, sales exceeded $ 100 billion for the first time

Analysts recommend to buy

Wall Street badysts have rediscovered their love for Microsoft in light of this evolution. According to quarterly figures, at least 19 badysts have raised their price targets, according to Fact-Set. Stifel's Brad Reback about 118 instead of 107 dollars. The Deutsche Bank is one of the biggest optimists with a price target of $ 130.

John DiFucci of Jefferies is one of the few not so convinced experts. He wonders if the good performance of the Windows division compared to the PC market is sustainable and if the profit margins in the cloud should be maintained. Competition with Amazon and Google becomes sharper. According to Fact-Set, however, 34 badysts currently recommend 29 to buy the stock with an average price target of $ 119.9.

Subject: Series – Global competitors fail

Microsoft has a real competitor in all areas not in Germany. Only with the company software is with Walldorf's SAP a German concern tied with the giant of Redmond. And here too, Nadella relies on pragmatic realism.

The two companies announced an extended partnership at the end of 2017: key cloud products such as Azure and S / 4 Hana will be offered via each partner's platform and will also be used internally. Competition and cooperation do not exclude each other.

The goal is clear: Both companies want to attract as many business customers as possible to the cloud – and Microsoft also wants to keep Amazon out

never as hard as today # 39; hui. The Handelsblatt publishes a series of important international actors and badyzes their strengths and weaknesses.

Source link