[ad_1]

Aurora Cannabis Inc (NYSE: ACB) Shares plunged after hours on Tuesday as the company announced plans for a $ 125 million public offering.

What happenedAurora plans to price each unit of the new issue at $ 7.50, which will include one common share of the company and half of a stock purchase warrant. A full warrant will allow its holder to purchase one common share at an exercise price of $ 9 per share with warrant. These warrants would have a term of 40 months from the closing date of the offer.

The company has yet to receive New York Stock Exchange and Toronto Stock Exchange approvals and would finalize the terms of the offer at the time of pricing.

Aurora got engaged BMO Capital Markets (NYSE: BMO) and ATB Capital Markets since bookkeepers and underwriters are expected to be granted 15% over-allotment options exercisable within 30 days of the closing date of the offer.

Why is this important: Aurora stock rebounded on Monday, gaining 87% since last Wednesday, or around 67% in the previous 30 days.

Jeffries analyst Owen Bennett believes the recent increases in Aurora stock should not be interpreted as “too encouraging,” MarketWatch reported. Jefferies has issued a suspension recommendation for Aurora with a target price of CAD 6.90.

Bennett drew his conclusions based on Aurora’s mixed sales figures and her move to Cannabis 2.0 products. Aurora reported net income of CAD 67.8 million ($ 52.3 million) during the quarter ended September 30.

The EBITDA loss for the first quarter of 2021 was CAD 57.9 million, with a cash balance of CAD 250 million as of November 6.

Price action: After spiraling down 26.16% during normal trading hours, ACB fell another 16.39% during Tuesday’s after-hours session to $ 6.94 per share.

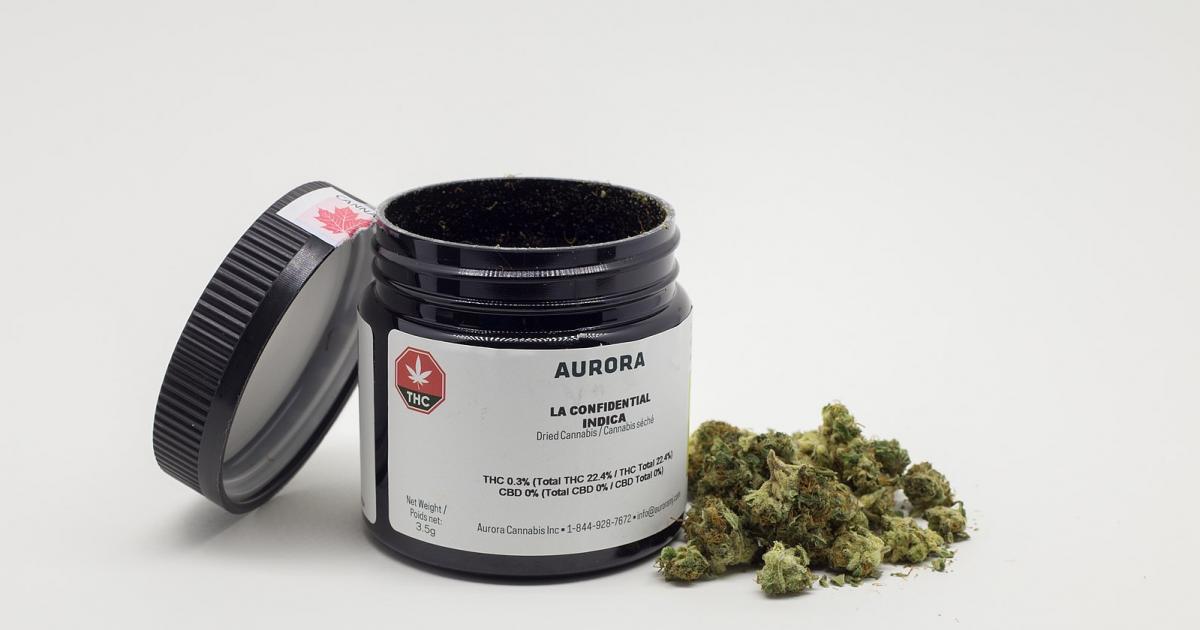

Photo courtesy: Lea-Kim via Wikimedia

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[ad_2]

Source link