[ad_1]

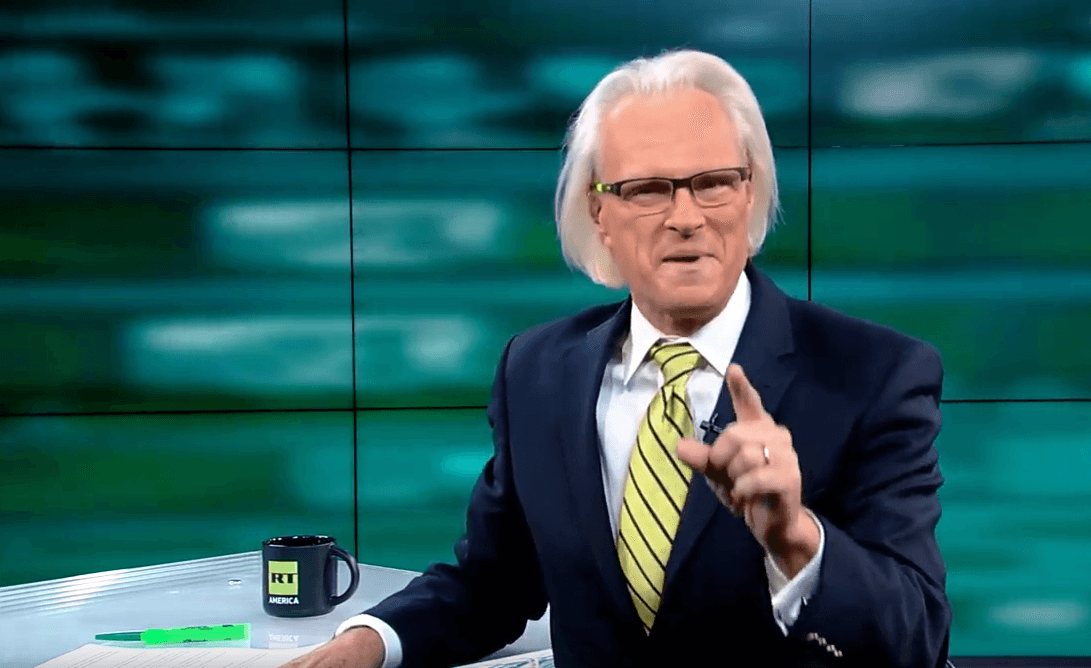

Chilton was a founder of ICO

Chilton said in his later years that he wished he had invested earlier in Bitcoin. In 2017, he supported an ICO that indexed its chips on the value of oil.

Recently, he wrote:

The crypto-anarchist will say that existing systems are endangered. They will perish. My point of view is a crazy speech. I am in the camp to work within existing systems to make significant progress. The old adage, if you're not part of the solution, you're part of the problem, comes to mind.

Chilton was known for his criticisms of high-frequency trading robots, which he said created a dangerous market for everyone. Immediately after leaving the Commodities and Futures Trading Commission, Chilton joined the Modern Markets Initiative, a high-frequency trading association.

Sad news for all of us@CFTChttps://t.co/PdCHIHBf4t

– Chris Giancarlo (@giancarloCFTC) April 28, 2019

Like Bitcoin, his problem was less related to the act of high frequency trading itself than to the under-regulated nature of the transactions being made. He felt that he could exert a positive influence on the industry and said about his decision:

"People will say," Wait a minute, you beat the [stuff] I did it, but I never said they had to leave. "

He felt that the companies that had joined the Modern Markets Initiative were well-intentioned and influential to help them operate in ways that, in his view, foster a healthier economy.

This decision was reminiscent of his support for OilCoin, which was due to be launched in January 2018, but never did. The token would work as a digital future for oil – its value is directly tied to the price of a barrel of oil and the actual reserves are supposed to be kept to support the deals.

A former commissioner of the CFTC felt that a regulation would be beneficial for crypto

Previously, Chilton had always called for greater regulation of cryptocurrencies. He said the law would boost a large and secure cryptocurrency boom. His point of view is shared by many players in the cryptocurrency sector, who have long believed that lack of regulation leads to long-term existential problems and risks for consumers.

The persistent prevalence of unregulated markets and gray markets is one of the main reasons why the SEC has not yet approved a Bitcoin Exchange Traded Fund. Regulators want to be sure that volume metrics are reliable, but it's hard to do when up to 95% of the total Bitcoin volume is wrong.

At the same time, persistent security risks in cryptographic exchanges have resulted in losses of billions of dollars a year. Well-designed and well-executed regulation can alleviate this problem, as Japanese regulators who have recently visited two exchanges to test their security policies have shown. While regulators have the technical expertise to ensure that stock exchanges manage conservation properly, the ability to steal stock exchanges may be limited in the long run.

This is the meaning of Bart Chilton's thought about the need for regulation. He kept a close watch on the market and continued to write on the subject until his last days. Last month he published an article on "Blockchain Dreamers".

"The dreamers of the Blockchain and the properties of Bamboo" https://t.co/0Be8yFNpZj Bart may not have

– Bart Chilton (@BartChilton) March 11, 2019

[ad_2]

Source link