[ad_1]

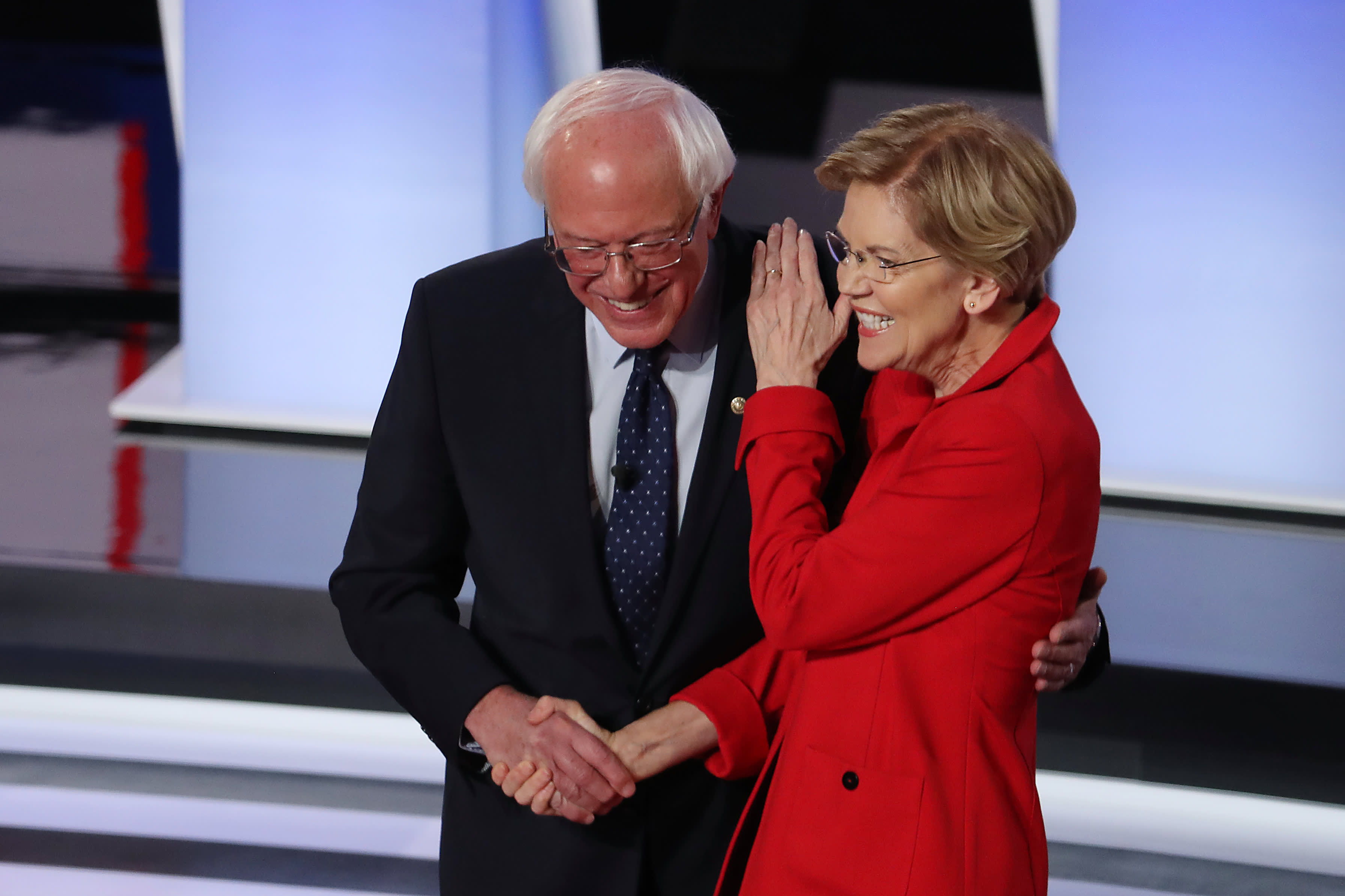

Democrat presidential candidates Senators Bernie Sanders (I-VT) (right) and Elizabeth Warren (D-MA) greet each other at the beginning of the Democratic Presidential Debate at the Fox Theater on July 30, 2019 in Detroit, Michigan.

Justin Sullivan | Getty Images News | Getty Images

Sen. Bernie Sanders unveiled a wealth tax on Tuesday to reduce income inequality and fund large social programs.

The proposal of the Democratic presidential candidate of 2020 follows a similar plan of Senator Elizabeth Warren, a Massachusetts Democrat who made the wealth tax a centerpiece of his presidential campaign. But Sanders 'measure, long opposed to an economic system that he believes favors corporations and the wealthy, would place the wealthiest Americans' assets more on top of those of his rival.

The Sanders campaign said the levy would apply to net worth in excess of $ 32 million and raise about $ 4.35 billion over the next 10 years. It plans to allocate funds to an affordable housing plan, universal child care and health insurance for all – the applicant's signature plan. The tax would halve the wealth of billionaires in 15 years, the campaign added.

The Vermont Independent Plan adds an extra touch to a primary race shaped by the Democrats' efforts to contain the excesses of America's biggest corporations and wealthiest Americans. Business and investor representatives cautioned against the policies of Sanders and Warren – although the candidates took criticism as a badge of honor.

In his wealth tax, Sanders proposes these rates for married couples:

- A 1% net worth tax of over $ 32 million

- A tax of 2% on the net value between 50 million and 250 million dollars

- A tax of 3% on the net value between 250 million and 500 million dollars

- A 4% tax on net worth between $ 500 million and $ 1 billion

- A net worth tax of 5% between $ 1 billion and $ 2.5 billion

- A tax of 6% on the net value between 2.5 billion and 5 billion dollars

- A 7% tax on net worth between $ 5 and $ 10 billion

- 8% tax on net worth over $ 10 billion

- All these parentheses would be cut in half for single depositors

In comparison, Warren's plan would impose a 2% annual tax on net worth greater than $ 50 million. This would impose a net worth of households greater than $ 1 billion at 3%.

Her campaign said she would collect about $ 2.75 billion over a decade.

This story is growing. Please check again for updates.

[ad_2]

Source link