[ad_1]

(Source: imgflip)

Due to reader demands, I decided to split my weekly series "Best Stocks of Dividends to Buy This Week" in two parts.

One will be the article in the weekly watch list (with the best ideas for new money at any time). The other will be an update of the wallet.

To also make these more digestible, I divide the intro of the weekly series into a revised introductory and reference article on the 3 rules of using the margin in a safe and cost-effective manner ( which will no longer be included in these upcoming articles).

To minimize reader confusion, I will provide portfolio updates every two weeks. This means an update every two weeks on:

- my retirement portfolio (where I keep 100% of my savings)

- the Bunker dividend growth model portfolio (100% undervalued aristocrats and dividends)

Due to insufficient reader interest (and it takes an average of 7 hours per update), I interrupt the Deep Value Dividend Growth update series.

Why evaluation matters ALWAYS

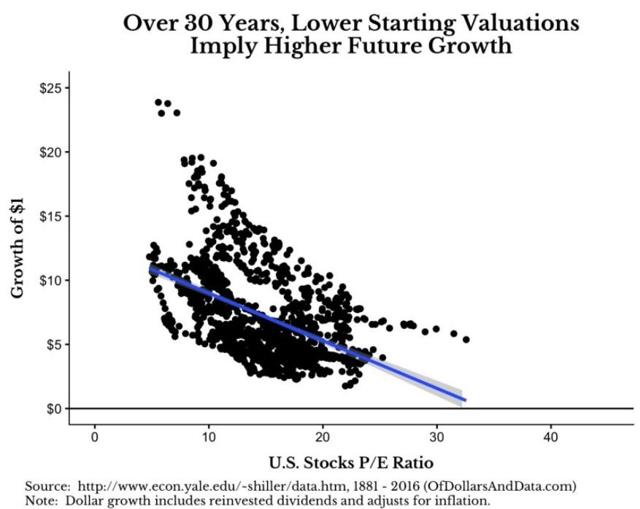

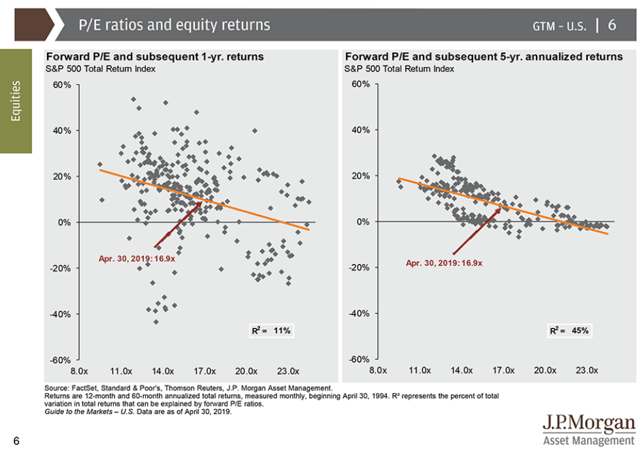

Even the best companies can make terrible investments if you pay too much. A Yale study of market returns from 1881 to 2016 found that the initial P / E ratio had a significant effect on total returns up to 30 years. In addition, over the past few decades, valuation has accounted for around 45% of the market's 5-year forward market returns.

In other words, investors who buy long-term can not blindly buy large companies at any price, but they must remember Buffett's famous phrase: "It's far better to buy a wonderful business at a fair price than just doing a business at a great price. "

The corollary of this quote is what I call "the Buffett rule", which is to never pay more than fair value, even for companies of the highest quality. This will reduce your total returns and, since something big is still on sale, there is no reason to take the lead in buying quality, low-risk dividend stocks.

After all, patience is the ultimate virtue of the long-term investor because, as Buffett also stated, "the stock market is designed to transfer money from the most active to the patient."

But there is another reason why the assessment is always worth keeping in mind.

(Source: Ploutos Research) Current data up to April 2019

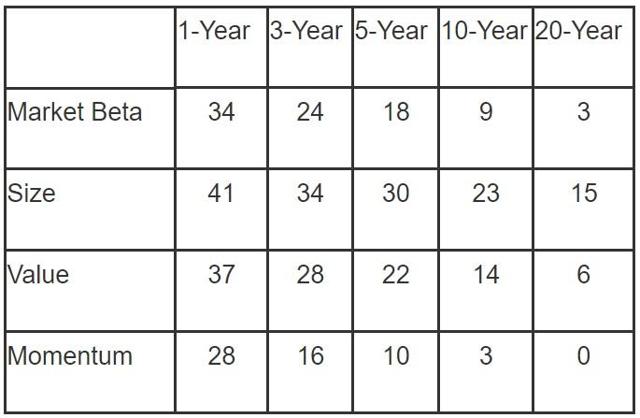

Value investing is one of the proven "alpha factors" that has consistently beaten the market over time. This includes the January rebound (the strongest return of the S & P index in January in 32 years), when value stocks were the best alpha strategy of all.

Of course, value investing does not work all the time – no investment strategy works.

Likelihood that the strategy is underperforming the S & P 500 over slippery periods of time

(Source: Advisors Perspectives)

But it is precisely because all investment strategies go through periods of underperformance that alpha factors continue to function for decades. Some of Peter Lynch's best long-term investments have not even reached financial equilibrium before four years. If a single approach could guarantee returns higher than those of the market year after year, all the countries of the world would use it and the strategy would thus lose its advantage.

Okay, so maybe the value investment is great and the valuation is worth keeping in mind before you buy any stock . But how do you find big companies that trade in Buffett's legendary "fair value"? There are many approaches, but I personally consider that four of the most useful solutions for investors in long-term dividend growth.

The use of these four valuation methods can tell us which are the best-quality dividend growth stocks to buy at a given time, regardless of the overvaluation of the broader market.

Discounted cash flow

Basically, any business is worth the present value of all its future cash flows. It is an evaluation method as basic as possible. However, in reality, the future is uncertain and the discount rate you use, as well as your growth assumptions, can make sure that a DCF model says just about everything you want.

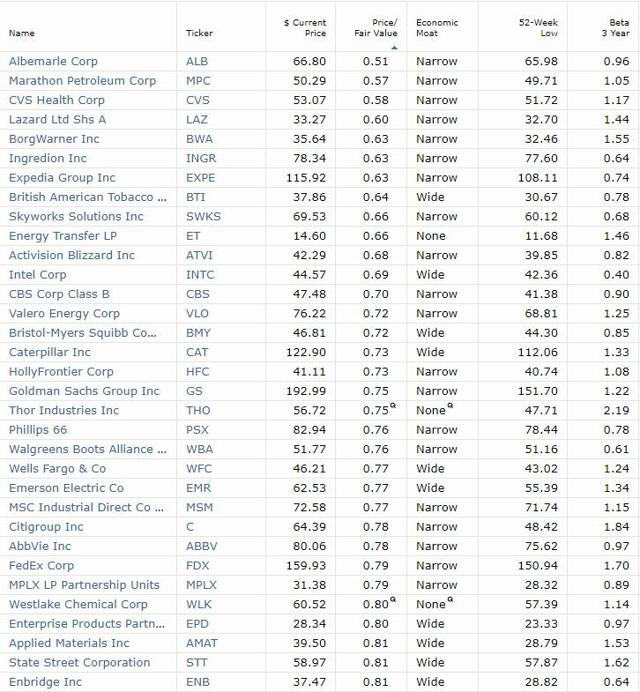

That's why I consider Morningstar's 100% conservative, fundamentally and fundamentally conservative analysts an excellent source of fair values estimated according to DCF.

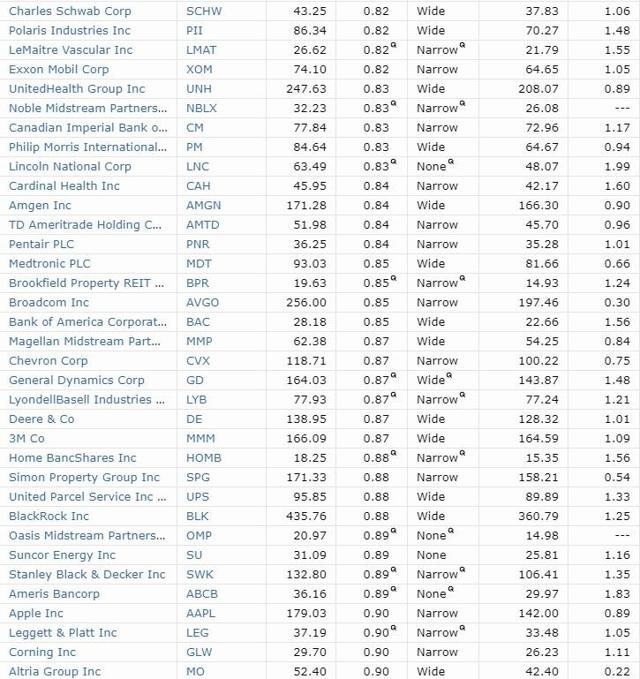

(Source: Morningstar) Note: "Q" indicates a valuation estimate based on a quantitative model – data as of May 24.

These analysts generally assume slower growth than the consensus of analysts and even sometimes the direction itself. As a result, 4-star and 5-star Morningstar rated companies can be considered "strong buy" or "strong buy" recommendations, respectively, from analysts whom I consider to be the best in the industry. They also take into account the uncertainty surrounding the business model / risk profile of a company. Thus, 4 and 5 star companies offer a complete margin of safety that can potentially make good investments.

Note that companies rated "Q" are quantitative models and slightly less reliable.

Do you want a more quantitative approach to DCF? Well, here are the values of my watch list sorted by price / fair value, with each company being at least 10% undervalued relative to the estimate of the intrinsic value of Morningstar.

(Source: Morningstar) data as of May 24

The lower the price / fair value estimate, the greater the margin of safety to invest.

But DCF is far from the only evaluation method to consider.

Price-To-Earnings

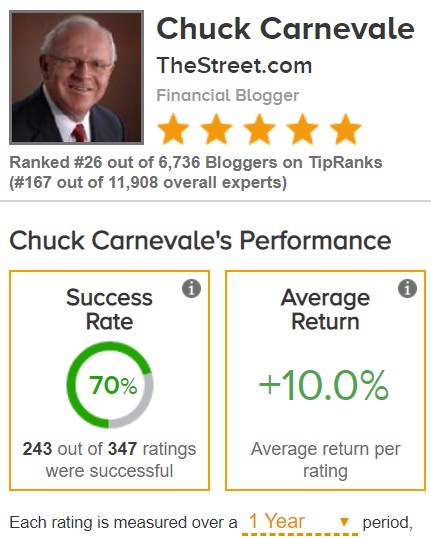

Remember that Yale's evaluation study that looked at stocks based on the P / E ratio? Well, the venerable P / E ratio is one of the most popular valuation methods and for good reason. While no method of evaluation is perfect, a good rule of thumb (from Chuck Carnevale, the king of value investing and founder of FAST Graphs) is to try not to pay more than 15 times the future profits for a company. Chuck's historical PE valuation approach has made him a legend in Seeking Alpha and, according to TipRanks, one of the best analysts in the country when it comes to generating revenue. money for investors.

(Source: TipRanks) – Data as of May 24, note that the historical performance of the stock market over a year is 9.1% and that 60% is considered a good success rate for analysts.

Chuck generally compares companies to their historical P / E ratios, and is among the 1.4% of all analysts monitored by TipRank (based on 12-month returns from its recommendations). Although 12 months is not "long-term", the fact is that Mr. Carnevale is a fantastic equity analyst and his historical valuation approach beats 98.6% of bloggers / analysts, including 5,300 working at Wall Street.

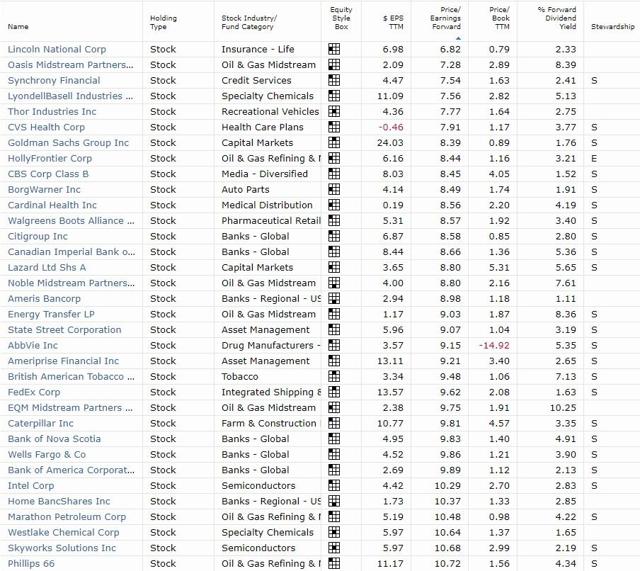

Here are dozens of companies with advanced P / E of 15 or less.

(Source: Morningstar) – Data as of May 24

Note that the stewardship rating is Morningstar's estimate of the quality of the management team. P = mediocre (my policy is to avoid all these companies if I share the Morningstar rating, which I do not do on Altria (NYSE: MO)), S = standard (medium to good) and E = copy (very good to excellent)).

Blue-Chips, nearly 52 weeks (or several years), "Blue Pitch Blue-Chips"

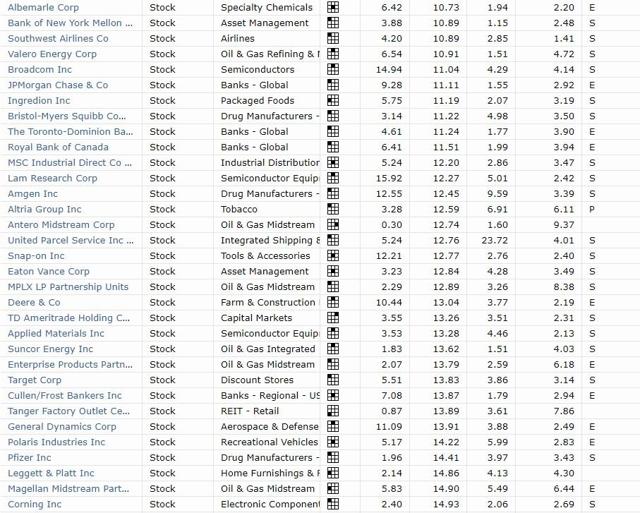

(Source: Google Sheets) – Data as of May 24, companies in bold type are "heavyweight" type recommendations for limited limit value orders.

I maintain a watch list of all companies tracked and applying a quality score of 11 points based on the security of dividends, the business model and the quality of management. All dividend stocks can be ranked from 3 to 11, and my watch list (180 companies and slowly changing over time) includes only those with a quality score of 8 or higher.

- 8: Blue-chip (buy a modest discount at fair value) limit of 5% to 10% of your wallet

- Ages 9+: SWAN stocks: Buy with confidence at fair value or better, limit yourself to 5% to 10% of your portfolio

I've programmed this watchlist to track prices and use the 52-week minimum as a means of estimating a target price at which a premier stock or SWAN stock becomes a Buffett-type investment. This means that a first-class action / SWAN is:

- trading near his 52-week low (or often several years)

- undervalued dividend yield theory (more information about this in a moment)

- offers a high probability of achieving a significant multiple expansion within 5 years and thus achieving a long-term total return greater than 15% over the period considered

Basically, "investing in the big money" is about getting high risk returns with low risk stocks, buying them when they are the least popular ("be greedy when others are scared").

Dividend yield theory: exceptional returns on the market since 1966

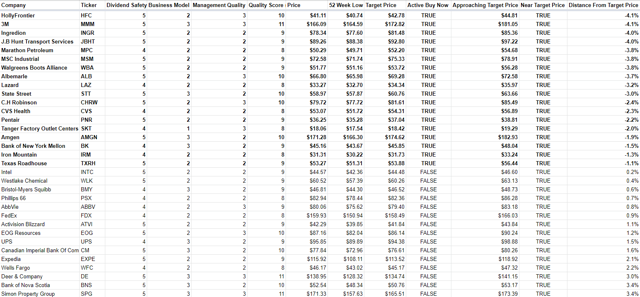

This group of dividend growth blue chips represents what I consider the best stock you can buy today. They are presented in 5 categories, sorted by the most undervalued (based on the dividend yield theory using an average return over 5 years).

- High yield (yield over 4%)

- Rapid growth of the dividend

- Dividend Aristocrats

- Kings Dividend

- A master watch list of quality dividend stocks capable of generating a total long-term return of 13% at an average annual growth rate (CAGR) at target yields

The objective is to allow readers to know which are the best growth stocks of the low-risk dividend to buy at a given time. You can think of them as my "utmost conviction" recommendations for conservative income investors, which represent what I consider to be the best opportunities for low risk investors available in the market today. Over time, a portfolio of these watch lists will be highly diversified, low risk, and an excellent and secure source of revenue.

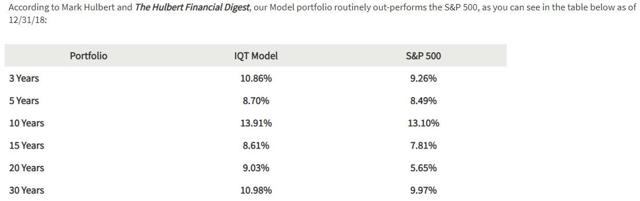

The ranking is based on the discount to fair value. The valuations are determined by the dividend yield theory, which Investment Quality Trends, or IQT, has shown to work well for dividend stocks since 1966, generating catastrophic long-term returns for the market with much lower volatility.

(Source: Investment Quality Trends)

Indeed, for stable corporate income stocks, returns tend to return to the average, which means a cycle around a relatively fixed value approximating fair value. If you buy a dividend when the return is well above its historical average, you will outperform when its valuation returns to its normal level over time.

For the purposes of these valuation-adjusted total return potentials, I use the Gordon Dividend or GDGM growth model (method used by Brookfield Asset Management (BAM)). Since 1954, it has been relatively accurate to model long-term total returns using the following formula: yield growth + dividends. In fact, assuming no valuation change, a stable business model (little change over time) and a constant payout ratio, dividend growth follows the growth in cash flow.

The valuation adjustment assumes that a stock's return will return to its historical norm in 10 years (over this period the stock price is purely a function of the fundamentals). Thus, these total return models of valuation are based on the following formula: yield + 10-year projected dividend growth (consensus of analysts, confirmed by the historical growth rate) + revival of return on yield return to 10 years.

For example, if a stock with a historical average return of 2% trades at 3%, the return is 50% higher than its historical return. This implies that the stock is (current yield of 3% – historical yield of 2%) / current yield of 3% = undervalued at 33%. If the average of the shares returns over 10 years, it means that the price will increase by 50% over 10 years only to correct the undervaluation.

This represents a total annual return of 4.1% just from the average evaluation regression. If the stock raises its cash flow (and dividend) by 10% over this period, the total return that can be expected from this stock would be a 3% return + a dividend growth (and of FCF / share) + a 4.1% increase in valuation = 17.1%.

The historical margin of error for this corrected model of valuation is about 20% (the most accurate I have discovered yet).

Top 5 high-yield blue chips to buy today

| Business | Teleprinter | Sector | yield | Return at fair value | Historical yield range | Discount at fair value | Expected annualized growth in cash flows over 5 years |

Adjusted total return potential of the valuation |

| Enbridge | (IN B) | Energy | 5.9% | 3.9% | 2.3% to 6.6% | 34% | 6% | 18.7% |

| Altria | (MO) | Consumer Staples | 6.1% | 4.0% | 3.1% to 14.4% | 34% | 8% | 17.5% |

| Kimco Realty | (KIM) | REIT | 6.2% | 4.2% | 2.7% to 24.5% | 32% | 4.0% | 15.4% |

| LyondellBasell Industries | (LYB) | Basic materials | 5.1% | 3.7% | 0.2% to 5.1% | 28% | 4.0% | 11.4% |

| Magellan Midstream Partners (uses K1) | (MMP) | Energy | 6.4% | 5.0% | 2.7% to 12.0% | 27% | 6.5% | 15.2% |

(Sources: Management Tips, GuruFocus, F.A.S.T. Charts, Simply Secure Dividends, Dividend Yield Theory, Gordon Dividend Growth Model) Note: The margin of error on the total return potential is 20%.

Top 5 fastIncreasing dividends of blue chips to buy today

| Business | Teleprinter | Sector | yield | Return at fair value | Historical yield range | Discount at fair value | Expected annualized growth in cash flows over 5 years |

Adjusted total return potential of the valuation |

| FedEx | (FDX) | Industrial | 1.6% | 0.7% | 0.3% to 1.5% | 50% | 13.9% | 21.3% |

| A.O. Smith | (AOS) | Industrial | 2.0% | 1.1% | 0.8% to 3.4% | 44% | 7.5% | 14.9% |

| Thor Industries | (THO) | Consumer discretionary | 2.8% | 1.6% | 0.8% to 2.7% | 36% | 5.7% | 12.9% |

| Industrial MSC | (MSM) | Industrial | 3.5% | 2.3% | 1.1% to 3.1% | 32% | 10.7% | 17.3% |

| Snap-On | (SNA) | Industrial | 2.4% | 1.6% | 1.2% to 5.6% | 32% | 10.0% | 16.0% |

(Sources: Management Guide, GuruFocus, FAST Charts, Simply Secure Dividends, Dividend Yield Theory, Gordon Dividend Growth Model) – The total return potential error margin of the rating is 20% .

The 5 best aristocrats to buy today

| Business | Teleprinter | Sector | yield | Return at fair value | Historical yield range | Discount at fair value | Expected annualized growth in cash flows over 5 years |

Adjusted total return potential of the valuation |

| A.O. Smith | (AOS) | Industrial | 2.0% | 1.1% | 0.8% to 3.4% | 44% | 7.5% | 14.9% |

| AbbVie | (ABBV) | Health care | 5.4% | 3.6% | 0.9% to 5.5% | 32% | 5.7% | 14.4% |

| Walgreens Boots Alliance | (WBA) | Consumer Staples | 3.4% | 2.4% | 1.0% to 3.1% | 29% | 3.4% | 10.2% |

| Leggett & Platt | (LEG) | Consumer discretionary | 4.3% | 3.0% | 2.4% to 9.7% | 31% | 5.2% | 12.6% |

| 3M | (MMM) | Industrial | 3.5% | 2.5% | 1.8% to 4.8% | 27% | 6.4% | 12.7% |

(Sources: Management Tips, GuruFocus, F.A.S.T. Charts, Simply Secure Dividends, Dividend Yield Theory, Gordon Dividend Growth Model) Note: The margin of error on the total return potential is 20%.

Top 5 kings of dividends to buy today

| Business | Teleprinter | Sector | yield | Return at fair value | Historical yield range | Discount at fair value | Expected annualized growth in cash flows over 5 years |

Adjusted total return potential of the valuation |

| 3M | (MMM) | Industrial | 3.5% | 2.5% | 1.8% to 4.8% | 27% | 6.4% | 12.7% |

| Parker-Hannifin | (PH) | Industrial | 2.2% | 1.8% | 1.1% to 3.4% | 17% | 7.0% | 11.0% |

| Lowe & # 39; s | (LOW) | Consumer discretionary | 2.0% | 1.8% | 1.2% to 2.5% | 13% | 15.6% | 19.0% |

| Hormel Foods | (HRL) | Consumer Staples | 2.1% | 1.8% | 1.2% to 2.8% | 12% | 8.5% | 11.3% |

| Parts of origin | (GPC) | Industrial | 3.1% | 2.8% | 2.1% to 6.1% | 9% | 8.5% | 13.0% |

(Sources: Management Tips, GuruFocus, F.A.S.T. Charts, Simply Secure Dividends, Dividend Yield Theory, Gordon Dividend Growth Model) Note: The margin of error on the total return potential is 20%.

Dividend shares with a potential for long-term total return greater than 13%

These are the blue chips that, in my opinion, will generate 13 +% of total returns to target yields. It should be noted that all estimates of total return are calculated on an annualized basis over five to ten years. Indeed, total return models are the most accurate over longer periods (5 years or more) when prices are traded only on fundamentals and not on sentiment. This allows valuations to return to the mean and allows relatively accurate modeling of returns (80% to 95%).

The list itself is ranked according to the long-term total return potential of the CAGR relative to the target return. Target or higher yielding stocks (in bold) are good purchases today.

This week, I added the Pentair dividend aristocrat (PNR) to the watch list.

| Business | Teleprinter | Current yield | Return at fair value | Target yield | Historical yield range | Expected long-term cash flow growth (analyst consensus or management advice) |

Total annualized return potential adjusted to long-term valuation with a target return |

| Brookfield Asset Management | (BAM) | 1.4% | 1.5% | 1.5% | 1.1% to 4.2% | 18.0% | 20% |

| EOG Resources | (EOG) | 1.3% | 0.7% | 0.7% | 0.3% to 1.1% | 19.0% | 20% |

| Automatic data processing | (ADP) | 2.0% | 2.3% | 2.3% | 1.7% to 4.3% | 17.5% | 20% |

| British American Tobacco | (BTI) | 7.0% | 4.0% | 6.0% | 2.7% to 8.6% | 8.0% | 19% |

| MasterCard | (MY) | 0.5% | 0.7% | 0.7% | 0.1% to 0.8% | 17.6% | 18% |

| Boeing | (BA) | 2.3% | 2.4% | 2.4% | 1.4% to 5.4% | 15.3% | 18% |

| Antero Midstream Corp | (A M) | 9.4% | 8.6% | 8.6% | 0.1% to 9.4% | 9.0% | 18% |

| Citigroup | (C) | 2.8% | 2.3% | 2.5% | 0% to 78.6% | 14.2% | 17% |

| Lowe & # 39; s | (LOW) | 2.0% | 1.7% | 1.7% | 1.2% to 2.5% | 15.6% | 17% |

| Ameriprise Financial | (GPA) | 2.7% | 2.4% | 2.6% | 1.1% to 5.0% | 11.8% | 17% |

| NextEra Energy Partners | (NEP) | 4.2% | 3.9% | 3.9% | 0.4% to 5.4% | 13.5% | 17% |

| Oasis Midstream Partners (uses K1) | (OMP) | 9.0% | 4.4% | 4.4% | 2.1% to 11.5% | 13.0% | 17% |

| Deer & Company | (OF) | 2.2% | 2.5% | 2.5% | 1.3% to 4.3% | 13.6% | 16% |

| Visa | (V) | 0.6% | 0.7% | 0.7% | 0.1% to 0.8% | 15.3% | 16% |

| MPLX (uses k1) | (MPLX) | 8.4% | 6.1% | 7.0% | 0.5% to 9.3% | 5.0% | 16% |

| Nike | (NKE) | 1.1% | 1.2% | 1.2% | 0.9% to 2.4% | 14.8% | 16% |

| S & P Global | (SPGI) | 1.1% | 1.3% | 1.3% | 0.6% to 5.0% | 13.9% | 15% |

| Lazard (Uses K1) | (LAZ) | 5.7% | 3.5% | 5.0% | 0.8% to 4.8% | 2.7% | 15% |

| Home Bancshares | (HOMB) | 2.9% | 1.5% | 2.0% | 0.7% to 2.8% | 10.2% | 15% |

| TD Ameritrade | (AMTD) | 2.3% | 1.7% | 2.0% | 0.2 to 2.4% | 10.0% | 15% |

| Microsoft | (MSFT) | 1.5% | 2.5% | 2.5% | 1.1% to 3.1% | 12.3% | 15% |

| ONEOK | (OKE) | 5.3% | 5.1% | 5.1% | 2.4% to 12.8% | 10.0% | 15% |

| Realty Trust Property | (EPRT) | 3.9% | 5.0% | 5.0% | 1.5% to 6% | 10.0% | 15% |

| American Express | (AXP) | 1.3% | 1.5% | 2.0% | 0.7 to 8.7% | 10.0% | 15% |

| Brookfield Infrastructure Partners (uses K1) | (BEEP) | 4.8% | 4.6% | 4.6% | 3.7% to 8% | 10.0% | 15% |

| EQM Partners Midstream (uses K1) | (MSE) | 10.3% | 4.1% | 5.5% | 0.9% to 10.7% | 7.0% | 15% |

| Lincoln National Corp | (LNC) | 2.3% | 1.7% | 2.2% | 0.1% to 27.1% | 10.0% | 15% |

| Albemarle | (ALB) | 2.2% | 1.5% | 1.5% | 0.8% to 3.0% | 13.3% | 15% |

| UnitedHealth | (A H) | 1.5% | 1.5% | 1.5% | 0.1% to 1.7% | 12.0% | 14% |

| CVS Health | (CVS) | 3.8% | 2.1% | 2.7% | 0.6% to 3.3% | 4.6% | 14% |

| Black rock | (BLK) | 3.0% | 2.5% | 2.5% | 1.2% to 3.5% | 11.3% | 14% |

| Energy Transfer LP (uses K1) | (NYSE: ET) | 8.4% | 6.4% | 7.0% | 2.2% to 18.3% | 6.0% | 14% |

| Noble Midstream Partners (uses a K1) | (NBLX) | 7.6% | 3.9% | 3.9% | 0.8% to 7.4% | 10.3% | 14% |

| QTS Realty Trust | (QTS) | 3.8% | 3.2% | 3.2% | 0.9% to 4.7% | 11.0% | 14% |

| TC Energy Corp | (TRP) | 4.4% | 3.9% | 4.5% | 3.1% to 5.9% | 8.0% | 14% |

| Apple | (AAPL) | 1.7% | 1.7% | 1.8% | 0.4% to 2.8% | 11.0% | 14% |

| Brookfield Renewable Partners (uses K1) | (BEP) | 6.3% | 5.7% | 6.5% | 3.8% to 8.4% | 6.5% | 14% |

| TerraForm Power | (TERP) | 5.9% | 5.0% | 6.0% | 0.5% to 16.3% | 6.5% | 14% |

| Bank of America | (LAC) | 2.1% | 1.8% | 2.0% | 0.2% to 59.1% | 10.5% | 14% |

| Equinix | (EQIX) | 2.0% | 2.1% | 2.2% | 0.6% to 2.5% | 10.0% | 14% |

| Roper Technologies | (POR) | 0.5% | 0.6% | 0.8% | 0.3% to 1.0% | 10.0% | 14% |

| Synchrony Financial | (SYF) | 2.4% | 1.8% | 2.4% | 0.4% to 2.9% | 8.2% | 14% |

| Discover Financial | (DFS) | 2.1% | 2.0% | 2.5% | 0.3% to 4.9% | 8.0% | 14% |

| Broadcom | (AVGO) | 4.1% | 3.3% | 3.3% | 0.2% to 4.6% | 11.2% | 14% |

| zoetis | (ZTS) | 0.6% | 0.7% | 0.7% | 0.2% to 1.1% | 13.1% | 14% |

| American tower | (TN) | 1.8% | 1.9% | 2.1% | 0.6% to 2.1% | 10.0% | 13% |

| Goldman Sachs | (GS) | 1.7% | 1.3% | 1.6% | 0.7% to 2.6% | 6.7% | 13% |

| Magellan Midstream Partners (uses K1) | (MMP) | 6.4% | 4.7% | 5.1% | 2.7% to 12.0% | 6.5% | 13% |

| Texas Instruments | (TXN) | 2.9% | 2.5% | 2.5% | 0.9% to 3.5% | 10.0% | 13% |

| Philip Morris International | (PM) | 5.4% | 4.5% | 4.5% | 0.8% to 6.8% | 7.6% | 13% |

| Southwest Airlines | (LUV) | 1.4% | 0.8% | 1.0% | 0.1% to 1.3% | 8.9% | 13% |

| Marathon Petroleum | (MPC) | 4.2% | 2.7% | 3.0% | 0.5% to 4.1% | 10.0% | 13% |

| State Street | (STT) | 3.2% | 1.9% | 2.7% | 0.1% to 4.9% | 5.5% | 13% |

| Skyworks Solutions | (SWKS) | 2.2% | 1.3% | 1.5% | 0.1% to 2.5% | 9.5% | 13% |

| Iron Mountain | (MRI) | 7.8% | 6.2% | 6.6% | 0.2% to 8% | 4.6% | 13% |

| A.O Smith | (AOS) | 2.0% | 1.1% | 1.6% | 0.8% to 3.4% | 7.5% | 13% |

| Amgen | (AMGN) | 3.4% | 2.6% | 3.3% | 0.5% to 3.2% | 5.5% | 13% |

| C.H. Robinson | (CHRW) | 2.5% | 2.3% | 2.4% | 1.3% to 2.8% | 10.0% | 13% |

| Texas Roadhouse | (TXRH) | 2.3% | 1.8% | 1.8% | 0.5% to 2.3% | 11.5% | 13% |

| Banks Cullen / Frost | (CFR) | 2.9% | 2.7% | 2.9% | 1.9% to 4.7% | 9.5% | 13% |

| Intel | (INTC) | 2.8% | 2.8% | 2.9% | 2.0% to 4.5% | 10.0% | 13% |

| Moody & # 39; s | (MCO) | 1.1% | 1.3% | 1.5% | 0.9% to 2.5% | 10.5% | 13% |

| Search Factset | (SDS) | 1.0% | 1.2% | 1.4% | 0.8% to 2.0% | 10.0% | 13% |

| Bristol-Myers Squibb | (BMY) | 3.5% | 2.6% | 3.2% | 2.0% to 7.1% | 6.3% | 13% |

| Industrial MSC | (MSM) | 3.5% | 2.3% | 2.3% | 1.1% to 3.1% | 10.7% | 13% |

| UPS | (UPS) | 4.0% | 2.9% | 3.1% | 2.4% to 4.6% | 9.4% | 13% |

| Medtronic | (MTD) | 2.2% | 2.1% | 2.7% | 1.0% to 2.9% | 7.9% | 13% |

| Abbott Laboratories | (ABT) | 1.7% | 2.1% | 2.2% | 1.4% to 7.9% | 11.0% | 13% |

| Parts of origin | (GPC) | 3.1% | 2.8% | 3.4% | 2.1% to 6.1% | 8.5% | 13% |

| PepsiCo | (DYNAMISM) | 3.0% | 2.9% | 3.5% | 2.1% to 3.6% | 7.7% | 13% |

| General Dynamics | (GD) | 2.5% | 1.9% | 2.3% | 1% to 4.9% | 9.8% | 13% |

| McDonalds | (MCD) | 2.4% | 3.0% | 3.5% | 2.1% to 5.0% | 8.0% | 13% |

| Broadridge Financial | (BR) | 1.6% | 2.0% | 2.2% | 1.1% to 3.2% | 10.2% | 13% |

| Stanley Black & Decker | (SWK) | 2.0% | 2.0% | 2.0% | 1.4% to 5.4% | 11.0% | 13% |

| Suncor Energy | (SU) | 4.1% | 3.0% | 3.1% | 0.4% to 4.0% | 9.7% | 13% |

| Intercontinental exchange | (ICE) | 1.3% | 1.3% | 1.4% | 0.3% to 1.5% | 12.6% | 13% |

| Waste Management | (WM) | 1.9% | 2.6% | 2.6% | 1.9% to 4.7% | 10.7% | 13% |

| EPR Properties | (EPR) | 5.7% | 6.1% | 7.3% | 4.5% to 24.8% | 4.0% | 13% |

| Merck | (MRK) | 2.7% | 3.1% | 3.3% | 2.4% to 6.7% | 9.4% | 13% |

| Brookfield Real Estate REIT | (OPI) | 6.7% | 5.0% | 5.0% | 1.2% to 8.4% | 8.0% | 13% |

| Enterprise Products Partners (uses K1) | (EPD) | 6.2% | 5.9% | 6.0% | 3.4% to 11.7% | 7.0% | 13% |

| Air Products and Chemicals | (ODA) | 2.3% | 2.4% | 2.4% | 1.7% to 4.1% | 12.3% | 13% |

| Jack Henry and associates | (JKHY) | 1.2% | 1.3% | 1.5% | 0.9% to 2.1% | 10.5% | 13% |

| Dominion Energy | (RE) | 4.7% | 3.8% | 4.9% | 3% to 5.8% | 5.5% | 13% |

| Disney | (DIS) | 1.3% | 1.5% | 2.0% | 0.9% to 2.2% | 8.5% | 13% |

| Emerson Electric | (DME) | 3.1% | 3.2% | 3.5% | 1.9% to 5% | 9.0% | 13% |

| Chevron | (CLC) | 4.0% | 3.9% | 4.6% | 2.3% to 5.7% | 7.0% | 13% |

| Home Depot | (HIGH DEFINITION) | 2.8% | 2.1% | 2.3% | 1.6% to 5% | 10.0% | 13% |

| 3M | (MMM) | 3.5% | 2.5% | 3.5% | 1.8% to 4.8% | 6.4% | 13% |

| Pentair | (NYSE: PNR) | 2.0% | 2.0% | 2.6% | 1.8% to 5.7% | 5.9% | 13% |

| JPMorgan Chase | (JPM) | 2,9% | 2,6% | 3.0% | 0,4% à 7,6% | 7,0% | 13% |

| LeMaitre Vasculaire | (LMAT) | 1.3% | 1.1% | 1.1% | 0,3% à 2,0% | 12,0% | 13% |

| Recherche Lam | (LRCX) | 2.3% | 2,4% | 3.0% | 0,3% à 3,6% | 8,0% | 13% |

| Telus | (TU) | 4,4% | 4,1% | 4,5% | 3,3% à 6,3% | 8,0% | 13% |

| Digital Realty Trust | (DLR) | 3,6% | 3,9% | 4.3% | 2,5% à 7% | 8,0% | 13% |

| LyondellBasell Industries | (LYB) | 5,1% | 3.7% | 4,8% | 0,2% à 4,9% | 4.0% | 13% |

| CyrusOne | (CÔNE) | 2,9% | 3.3% | 3.3% | 0,7% à 3,8% | 10,0% | 13% |

| Simon Property Group | (SPG) | 4,8% | 3.5% | 4,8% | 2,4% à 14,6% | 5,0% | 13% |

| Château de la couronne | (CCI) | 3.5% | 3,9% | 4,5% | 0,5% à 4,4% | 7,5% | 13% |

| W.P. Carey | (WPC) | 4,9% | 6.1% | 7,3% | 3,4% à 10,9% | 4.0% | 13% |

| Tour de puits | (BIEN) | 4.3% | 5,0% | 6,5% | 3,8% à 10,0% | 4.0% | 13% |

| MAGASIN Capital | (STOR) | 3.8% | 4,7% | 5,9% | 0,5% à 5,7% | 5,0% | 13% |

| Revenu immobilier | (O) | 3,9% | 4,6% | 5,7% | 3,3% à 11,2% | 5.3% | 13% |

| Moyenne | 3,4% | 2,9% | 3,2% | 9,5% | 14% |

(Sources: Conseils de gestion, GuruFocus, graphiques F.A.S.T., Dividendes simplement sécurisés, Théorie du rendement des dividendes, Modèle de croissance des dividendes de Gordon) Remarque: La marge d'erreur sur le potentiel de rendement total est de 20%.

Notez que les actions en gras ont toutes un rendement cible ou supérieur, ce qui signifie que le moment est bien choisi pour les ajouter à votre portefeuille ou à une position existante.

Bottom Line: Il est évident que votre meilleure chance de créer une richesse à long terme consiste à acheter régulièrement des sociétés de qualité sous-évaluées

Sauf en cas de forte surévaluation, il est clairement établi que le fait de rester pleinement investi est la meilleure chance qui existe pour les investisseurs réguliers d’accroître de manière exponentielle leur patrimoine avec le temps.

(Source: Vanguard)

C’est la raison pour laquelle je continue d’ajouter régulièrement des fonds de dividendes hautement sous-évalués à mon portefeuille de retraités.

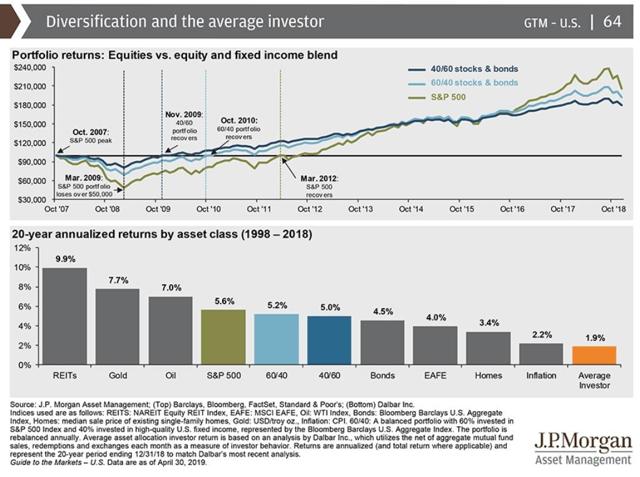

En revanche, la synchronisation du marché, qui est très difficile à réussir pour les professionnels, est quasiment impossible pour l'investisseur moyen. Au cours des 20 dernières années, le marché a été horrible du fait que le rendement moyen des investissements n’est plus que de 1,9%, ce qui empêche de nombreuses personnes de prendre leur retraite ou d’atteindre leurs autres objectifs financiers à long terme. Une bonne diversification et une bonne répartition de l'actif, et non une synchronisation du marché, constituent le meilleur moyen de protéger votre patrimoine contre les baisses inévitables du marché.

N'oubliez jamais ce que Peter Lynch (deuxième investisseur de l'histoire derrière Buffett) a dit:

Les investisseurs qui se préparent pour des corrections ou qui essaient d'anticiper des corrections ont perdu beaucoup plus d'argent que les pertes elles-mêmes… Si vous êtes sur le marché, vous devez savoir qu'il y aura des baisses … Quand ils vont commencer, personne ne le sait. Si vous n'êtes pas prêt pour cela, vous ne devriez pas être sur le marché boursier … Ce que le marché va faire dans un ou deux ans, vous ne le savez pas. Le temps est de votre côté sur le marché boursier. "- Peter Lynch (c'est nous qui soulignons)

Cette série de listes de surveillance hebdomadaires est conçue pour être un outil permettant de vous donner de solides idées en matière de placement. Vous pourrez ainsi toujours savoir quel est le meilleur endroit pour utiliser votre argent durement gagné au travail à tout moment. l'avenir est incertain et tout investissement est probabiliste.

My goal with these articles is to provide good investing ideas, in companies with high margins of safety that have less to fall in a market correction or bear market, and which are all coiled springs that are likely to deliver outsized total returns if their valuations return to historical levels. No matter how hot the market may get, quality blue-chips are always on sale.

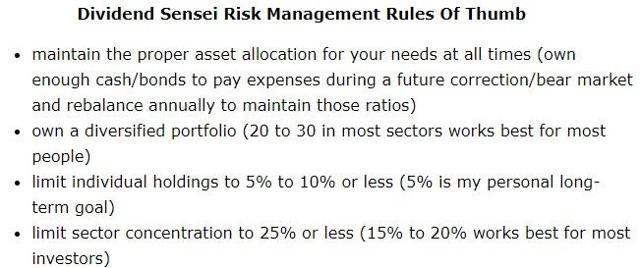

Just never forget that all of my dividend stock recommendations are purely meant as buying ideas for the equity portion of your portfolio and never as bond alternatives. Always use the appropriate risk management and asset allocation for your individual needs.

Disclosure: I am/we are long WBA, SKT, BPY, ABBV, ET, BIP, NEP, EPR, MPLX, IRM, AM, ENB, SPG, BLK, AOS, AAPL, UNH, MMM, ALB, LAZ, TXRH, BTI, LOW. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link