[ad_1]

Does Beyond Meat (NASDAQ: BYND) contain nicotine in its products? No, they do not. But it seems that they should do so to justify the current assessments.

BYND was the most successful "Unicorn" IPO launched this year, rising from $ 25 to over $ 90 in less than a month.

Driven by consumer spending and a well-differentiated product, BYND has gained market support, which believes it can disrupt the traditional meat market. However, as its share price has appreciated, the expectations of the integrated market have become increasingly noble and it no longer appears to be valued in the industry's ranges, meaning that A potential upside could be fully taken into account.

For equity prices to continue to rise, BYND is likely to follow in the footsteps of highly dependent core consumers, such as tobacco and alcohol companies. However, their product does not correspond to a similar mold, so that market expectations can be unjustifiable.

Market assessments and expectations

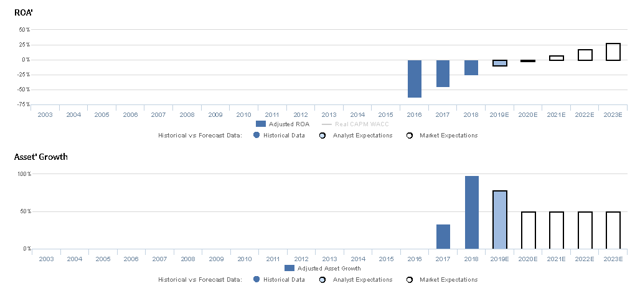

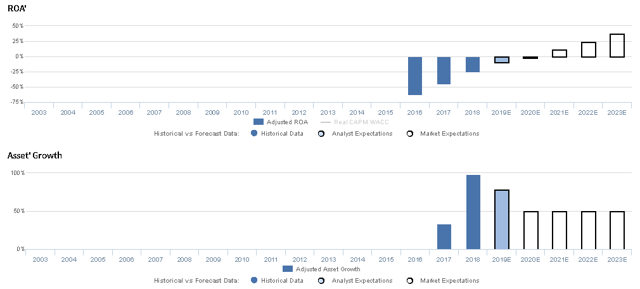

The chart below illustrates the actual economic performance and measurement performance of Beyond Meat, Inc. after many significant adjustments to reported financial data. Here you can find the reason for being Uniform Adjusted Financial Reporting Standards (UAFRS) or "Uniform Accounting" standards, as well as the theory behind this model.

Both panels explain the company's historical performance, as well as consensus estimates for forecast years, as well as market forecasts for profitability and growth.

Apostrophe after ROA & # 39; and Asset & # 39; is the symbol of "premium", which means "adjusted" according to the uniform accounting, and these metrics will be called "uniform" in this report. These calculations have been modified with complete adjustments to eliminate inconsistencies and distortions in the financial statements relating to earnings, assets, liabilities and cash flows, as reported. To better understand the PVP graph and the following discussion, please refer to our guide here.

Source: Valens Research Database

When pricing its IPO, markets expected a slight influence of profitability for BYND

When BYND had to go public, its IPO was priced at $ 25. At these levels, the company was expected to see the uniform ROA expand and influence positively, from -25% in 2018 to 12% in 2023, accompanied by a 50% aggressive growth of Uniform Asset, while the start-up continues to invest in efforts to maintain its net growth in all distribution channels, expand its infrastructure and product offerings, and further develop its brand and market share.

Analysts have similar expectations, predicting that the Uniform ROA would increase by -2% by 2020, accompanied by robust growth of 78%, fueled by a reinvestment of its post-IPO capital.

As an early stage food company, focused on alternatives to herbal meat products, BYND has seen a very negative profitability, but an improvement. The uniform ROA has improved from -63% in 2016 to -25% in 2018, thanks to the expansion of materials in uniform margins and uniform turns. At current valuations, the markets are banking on expectations of a positive inflection of uniform margins, along with further improvements in uniform towers.

With the company having rapidly developed its distribution channels and manufacturing capabilities, Uniform Asset growth has been robust and positive over the last two years, from 34% to 98%. As a result, sales growth has also been robust, consistently exceeding 100% since 2017.

To place the reasonableness of the above forecasts in a reasonable context, the estimates can be compared to those of its closest counterparts, namely pure-play meat, fish and dairy manufacturers and processors. These competitors include meat giants Tyson Foods, Inc. (TSN) and Hormel Foods Corp. (HRL), as well as Dean Foods Co. (DF), Lifeway Foods, Inc. (LWAY), Pilgrim's Pride Corp. (PPC) and Sanderson Farms, Inc. (SAFM).

Peer comparisons imply a reasonable IPO goal

Source: Valens Research Database

The initial stock market valuations of BYND announced that the single return on investment would remain close to the median levels of the industry in the long run. Not only are these expectations reasonable, but they also risk selling short of the company's growth potential and competitive advantages, as BYND intends to go beyond mere market share in alternative meats by disrupting the market. traditional meat market.

Unlike traditional staple foods, BYND offers better alternatives to current vegetarian options and attempts to mimic the success of herbal dairy farmers, using packaging similar to traditional protein products. In addition, their products have the ability to appeal to meat consumers, as well as non-meat consumers, as they offer a healthier option without sacrificing quality or taste.

In addition, the potential of recent launches in Europe and upcoming launches in Asia provides a clear pathway to support sales growth, and continued investments in the manufacturing and research and development sectors should allow BYND to grow. further its activities and expand its product range. In addition, capital inflows from the IPO can help the company expand its existing network of supplier, co-manufacturer and supplier partnerships, thereby helping to reduce costs and hedge against price fluctuations. pea protein.

Thus, given the modest market expectations for BYND at a price of $ 25, a possible increase early in the session would have been more than justified.

Price dislocations were eliminated on the first day of trading

Source: Valens Research Database

While the IPO price revealed modest expectations, by the end of its first day of trading, BYND's share price had skyrocketed to $ 65.75, and it was trading over the average of companies with a uniform P / B of 28.0x (Fwd V / A). At these levels, while maintaining uniform asset growth at 50%, the market had much more ambitious expectations, predicting a flat investment return of -25% in 2018 to 28% in 2023.

Comparing with the same industry peers, market expectations for BYND's profitability were closer to median levels, but they remained relatively reasonable if the company can take advantage of the bottom line. the upside potential of its value drivers.

Source: Valens Research Database

After the first day of closing markets, markets anticipated BYND's expectations that it would become a leader among traditional meat suppliers, in terms of uniform ROAs. BYND has the ability to differentiate itself in the meat products market and to innovate to achieve these levels.

In addition, some parts of the business model offer an advantage in terms of profitability compared to traditional businesses. For example, since BYND does not need to use livestock or poultry, it does not have to worry about the high costs of raising and keeping animals, as well as the scale of funds required for the scale of these operations. Likewise, BYND's asset should also be smaller than its peers, as it can avoid the need for large farms and associated land associated with animal production. Since HRL, which has similar advantages over peers, has a similar uniform ROA, these expectations were logical.

However, at this higher price level, expectations were somewhat high, suggesting that most of the potential increase in inventory would have already been taken into account, and that BYND has been solidified as " Facebook "(NASDAQ: FB) meat producers, in a sense.

Beyond meat products, dependence should be created to justify current assessments

Source: Valens Research Database

Although the ratings suggest a very optimistic case for BYND at the end of its first day of trading, the market's euphoria has not slowed and the stock continued to rise rapidly, reaching the recent prices above $ 85. At these levels, with uniform asset growth still at 50%, the markets were expecting that the uniform ROA will rise to 38% by 2023, well above the historic highs of one of its competitors. meat producers.

Thus, BYND's prices no longer match those of counterparts in the traditional packaged food sector, as its expectations seem too high: more than 3 times the median of the sector and nearly 2 times that of its main competitor, TSN, which currently maximum profitability. Thus, other peers in the consumer staples segment must be identified to justify its valuations.

Source: Valens Research Database

Among consumer products in the consumer staples sector, only the tobacco industry has uniform ROA levels above those currently marketed by BYND at 45%. In addition, only tobacco companies, breweries and distillers have median profitability levels that exceed BYND's initial expectations of 12% ROA. In comparison, the BYND sub-industry, packaged foods and meats lag behind. The firm should be a major exception in the industry to justify valuations.

As can be deduced from the graph above, the universe of consumer staples companies with 35% + ROA is not surprising and, to guarantee an additional hike, BYND is expected to reach 40% + ROA with continued growth of 50% single asset (doubling every 1.5 years), at least, further reducing its available peer group. Although few companies meet these criteria, the largest companies, national and international, share interesting similarities.

Source: Valens Research Database

Coca-Cola Co. (KO) and Monster Beverage Corp. (MNST) are giants of soft drinks: Philip Morris International, Inc. (PM), Altria Group, Inc. (MO) and British American Tobacco plc (NYSE: BTI) are basic tobacco products and Anheuser-Busch InBev (BUD) and Kweichow Moutai Co. are liquor distributors. Although these seem to be three distinct industries, they all share one essential common trait; they revolve around legally addictive products (sugar, tobacco and alcohol).

Does Beyond Meat have nicotine in its products?

No.

Are Beyond Meat's products addictive?

Although market euphoria and positive reviews can make you think so, again, no.

BYND's ditches may be large and its products promising, but its price is set at a level that only companies that create addictions seem to be able to function better, at least in the consumer staples sector. Although these other competitors benefit from favorable winds, such as some consumers being physically unable or unwilling to change product, BYND does not have this luxury. As such, expectations are overly optimistic and a decline in equities may be justified in the long run.

Conclusion

Although the BYND IPO price has reasonably reduced the potential of the company, the market has corrected the dislocation at the end of the first day of trading. Since then, price appreciation is difficult to justify unless the company can create products as popular as those of companies that focus on addictive substances.

Disclosure: I am / we are short BYND. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link