[ad_1]

Normally, when I see exciting tech- nical startups embarking on IPOs at high valuations, I groan and acknowledge that we are in a speculative growth type of market. Ordinarily, I keep these reflections for myself, but I feel compelled to write about my disgust for Beyond Meat's (BYND) IPO Price Action because of a combination of its extreme valorization and the lack of viability of its product.

I am not here to comment on the flavor or the sensation in the mouth because they are subjective and some people can appreciate the product. Instead, I want to discuss nutrition and misconceptions resulting from the way this product is marketed. In the end, unsatisfactory nutritional content will hamper product demand and its assessment is based on extremely high demand.

Those who follow my work know that I am an analyst specializing in REITs. Beyond Meat is therefore well outside of my usual research, but I am a nutritionist by training and holds a B.S. in Dietetics from UW Madison.

The food industry is one of the most dishonest in marketing and in many cases this marketing endangers the health of an unsuspecting public.

There are examples of safe deception, such as when bottled water announces having 0 calories. Such disinformation generally starts with a grain of truth (in fact, it does not contain 0 calories), but the information is placed on the package to trick the uninformed consumer into believing that this water is somehow more healthy than the brand it would otherwise drink.

The misinformation campaign is much more pernicious when a company is trying to mislead consumers into thinking that an unhealthy product is good for them. I do not intend to attribute the motives of Beyond Meat, nor can I say that the company wanted to deceive the consumers. However, 2 things are clear:

- Beyond the meat advertises the product as being nutritionally sound

- The product is NOT nutritionally sound. It's probably worse than real beef.

We intend to demonstrate these 2 points and to follow the consequences on future revenues and value.

Announced as healthy

Let's start with the packaging. Most food packages try to highlight the best solutions. It's rational and normal. I think Beyond Meat's packaging does advertise its strengths.

Source: Beyond the meat

I believe beyond the meat that this product contains no soy or gluten and that it contains 20 grams of protein.

Factually correct, but it completely misses the point. Real beef is also soy-free, gluten-free and high in protein.

Having such allegations on the label only sends platitudes that reinforce the public's misconceptions. The public is predisposed to think that herbal products are healthier and Beyond Meat capitalizes on misinformation.

Without lying, the company puts forward the idea that Beyond Meat cakes are healthier than beef.

Although I am not satisfied with the packaging, it is normal advertising in the food industry. The Beyond Meat website and the YouTube video go a bit too far.

We see Kyrie Irving (of which I am a big fan) who performs various basketball and large print exercises.

"Give athletes better performance and faster recovery"

Now it's a baseless claim if I've ever seen one. Kyrie Irving may have said that the product helps him recover faster, but because he is involved in society, he is clearly biased.

From a nutritional standpoint, there is no reason to think that this product is in any way good for sports performance.

Let's take a look at nutrition facts.

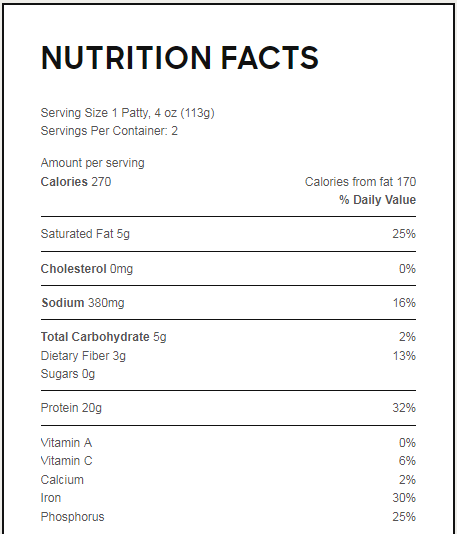

Source: Beyond the meat

If you have already looked at nutrition labels, be aware that they usually contain total fat. Beyond the meat has conveniently omitted this line item.

Fortunately, it can be calculated backwards. The fat contains 9 calories per gram, so 170 calories come from fat, about 19 grams, of which 5 are saturated. It is extremely rich in fats and saturated fats. 63% of total calories come from fat.

This is based on a 4 oz serving. Let's take a look at 4 ounces of real beef to compare.

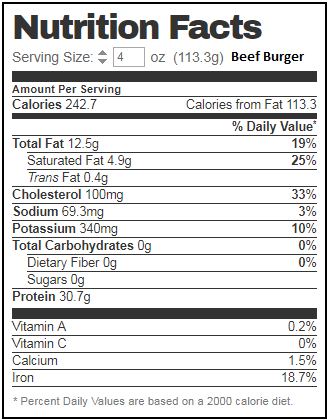

Source: Nutritionix

Real beef has significantly less fat at 12.5 grams per 4 ounce serving. About 47% of calories come from real beef fat, compared to 63% from Beyond Meat. Beef is also less caloric when entering at 242.7 compared to 270 for the same 4 ounces of meat beyond.

Nutritionally, the advantage of having meat in your diet is primarily a high quality protein, rich in essential amino acids. Beef is well known as a complete protein, containing the 9 essential amino acids in balanced concentrations. Pea protein, such as that used in Beyond Meat, is a relatively good substitute as a substantially complete protein. The problem here is the macronutrient ratios.

- By eating real beef, you get 30.7 grams of protein for 12.5 grams of fat; a decent report.

- Eating beyond the meat, we get 20 grams of protein for 19 grams of fat; a bad ratio.

Essentially, real beef has fewer calories, less protein and less fat. In my opinion, real beef is the healthiest option and it is a shame because real beef is not a particularly healthy food.

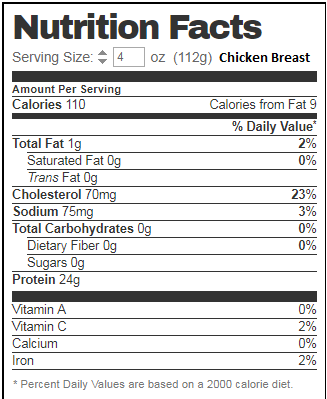

Anyone looking for a healthy protein solution would be well advised to turn to chicken. Not vegetarian chicken. No fake chicken. Just clean the chicken breasts without skin and without bone.

Protein at its best.

Who are the clients?

Customers can be viewed as a group of people looking for particular attributes of the product.

This product is not a valuable product because it is sold at a high price of $ 12 a pound ($ 6 for 8 oz), which is significantly more than the real beef.

Target Source

Thus, the customers of Beyond Meat are divided into 3 categories:

- Those who buy for environmental or social reasons

- Those who buy for health reasons

- Those who buy by curiosity

I think there is a fair argument that Beyond Burgers is better for the environment and for the welfare of animals than real beef. That being said, it's not good for the environment or animals, it simply causes less damage. This product is the environmental equivalent of the consumption of any other herbal food. I suspect that environmental and social concerns will continue to be a powerful driver of demand for the product.

However, the other 2 sources of demand are likely to fall considerably. Curiosity purchases only work once per client. They try the product and curiosity is satisfied after which the product must survive alone to be redeemed.

Until now, shopping for health reasons is going well, but as we have shown above, these sales are based on a misconception that the product is healthier than beef. In the end, the truth always wins out, and as this product becomes more known, a growing portion of the base of potential buyers will learn that it is extremely rich in fat.

I believe that sales will continue to increase in the short term because the IPO has generated a significant craze for the product, which will greatly increase sales of curiosity products. However, I think this boom will be short-lived because the product does not have enough self-sustaining value to keep customers out of the socially conscious society.

Most of us want to do what we need and help the environment / animals, but there is a limit to the length that the general population will go. Paying about double the price of a product that contains more fat and less protein, and whose taste is probably as good for most people, is a big question in terms of the breadth of quality products .

As such, I am skeptical that BYND sales can explode explosively as the price is built into the stock.

Evaluation

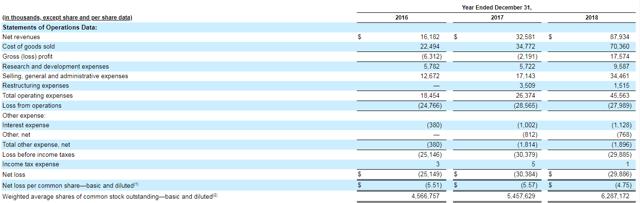

Until now, sales are pretty impressive: the turnover has grown rapidly from $ 16 million in 2016 to $ 88 million in 2018.

Source: IPO Prospectus

The market seems to extrapolate this growth rate for a while with a huge rebound after the IPO.

It was released early May at $ 25 and closed on 5/7/19 at $ 79.17. A triple in less than a week.

Such a move does not guarantee that the security is overvalued because the IPO may simply be undervalued. Let's see some indicators.

- The P / E can not really be used because the revenues are negative, so it would be infinite.

- The book value does not work because it is a corporation that does not have property, plant and equipment and is valued at the product's request.

I would propose to value it on EV as a multiple of the turnover figure. With revenues of about $ 88 million in 2018 and a VE of $ 4.47 billion, it is a VE / income of 50.8 times.

Obviously, the market is experiencing significant growth. Mature food companies such as Tyson Foods (TSN) and Hormel Foods (HRL) trade at 1.01X and 2.22X EV / sales, respectively.

Source: SA

This means that to be worthy of this assessment, BYND needs to increase its sales organically, multiplied by 25, which equates to about $ 2.2 billion in annual sales.

I do not think the basic environmental market is large enough to support sales of this magnitude. Earnings as large as it would require people to buy for other reasons. Once the fat content is more widely known, health-related purchases disappear and curiosity purchases will naturally decline.

It seems unlikely that BYND can live up to market valuation.

It's a short?

In my opinion, it is too risky to sell short a stock as new and as volatile in its market price. ESG investments are a powerful force that could drive up market prices long before rational prices are apparent.

So, I'm heading clearly but I'm keeping it on my watch list as a potential potential in the short term once the craze has stopped.

Conflicts of interest. We regularly hold and trade the same securities as those purchased or sold on behalf of 2MCAC's advisory clients. This circumstance is communicated to customers on an ongoing basis. As trustees, we favor the interests of our clients over those of our corporate and personal accounts in order to avoid conflict and adverse selection in the negotiation of these common interests.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: This article is provided for informational purposes only. This is not a recommendation to buy or sell a title and it is strictly the opinion of the author. The information in this article is impersonal and is not tailored to the investment needs of a particular person. This is not a recommendation that a particular security or strategy is appropriate for a specific person. Investing in securities held by the public is speculative and carries risks, including possible loss of capital. The reader must determine if an investment is appropriate and accept responsibility for his investment decisions. Dane Bowler is a representative investment advisor to 2MCAC, a Wisconsin-registered investment advisor. Comments may contain forward-looking statements that are uncertain by definition. Actual results may differ materially from our expectations or estimates, and 2MCAC and its affiliates can not be held responsible for the use of the opinions, estimates, forecasts and results of this article, as well as the reliability of such information. this. Positive comments made by others should not be construed as recognition of the writer's abilities as a representative of the investment advisor.

[ad_2]

Source link