[ad_1]

Joe Biden on a display in the Times Square neighborhood of New York City.

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

Follow Bloomberg on Telegram for all the investment news and analysis you need.

The markets love Joe Biden’s turn as President of the United States.

The S&P 500 Index on Wednesday released its best day one reaction to a presidential inauguration since at least 1937 with a 1.4% jump on the outlook for around $ 2 trillion in stimulus spending. Global equities, meanwhile, hit again peaks of all time.

Biden’s formal transition to the White House has cemented investor confidence in companies linked to his policies, while those that fall short of his priorities lose out. Clean energy stocks have risen, continuing their gains since Biden won the election. Defense equipment manufacturers and prison operators – sectors that have been successful under Donald Trump – have plummeted.

Here’s what’s moving the markets as Biden takes office.

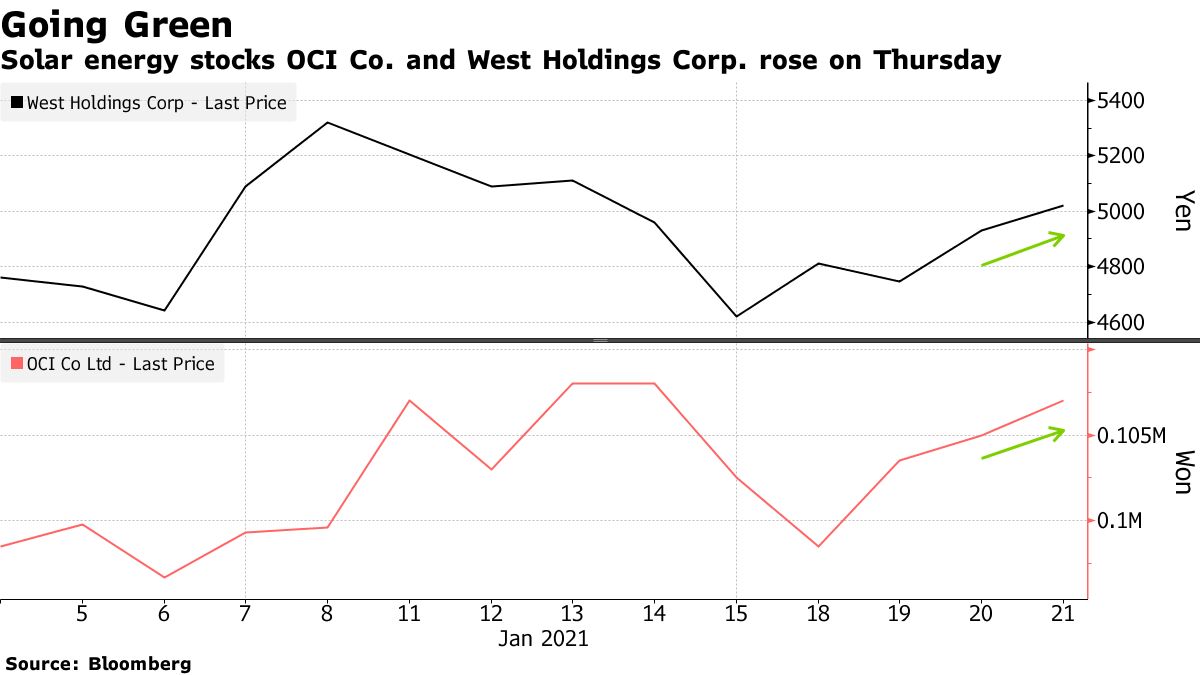

Renewable energies in favor

Some clean energy stocks in South Korea and Japan increased on Thursday with Biden signing radical action to fight climate change just hours after taking office. He is preparing to bring the United States back into the Paris climate agreement and has imposed a moratorium on oil leasing in parts of the Arctic.

South Korea OCI Co., a manufacturer of solar equipment, grew 9%, and that of Japan West Holdings Corp., which builds solar power generation systems, gained 4.5%.

In Europe, renewable energy stocks, including the wind company Vestas Wind Systems A / S and Siemens Gamesa Renewable Energy SA outperformed the Stoxx 600 Energy index, both gaining at least 2%.

Elsewhere, stocks exposed to retrofitting buildings to make them more energy efficient edged up and outperformed the construction sub-index, led by insulation manufacturers. Kingspan Group Plc and Rockwool International A / S with Dutch LED lighting company Signify NV.

Pounded outlets

The actions of the operators of US private prisons, long a target of Democrats, have plummeted. CoreCivic Inc. fell 7.8% and Geo Group Inc. fell 4.1% on Wednesday. Shares of both companies fell the most since December 22.

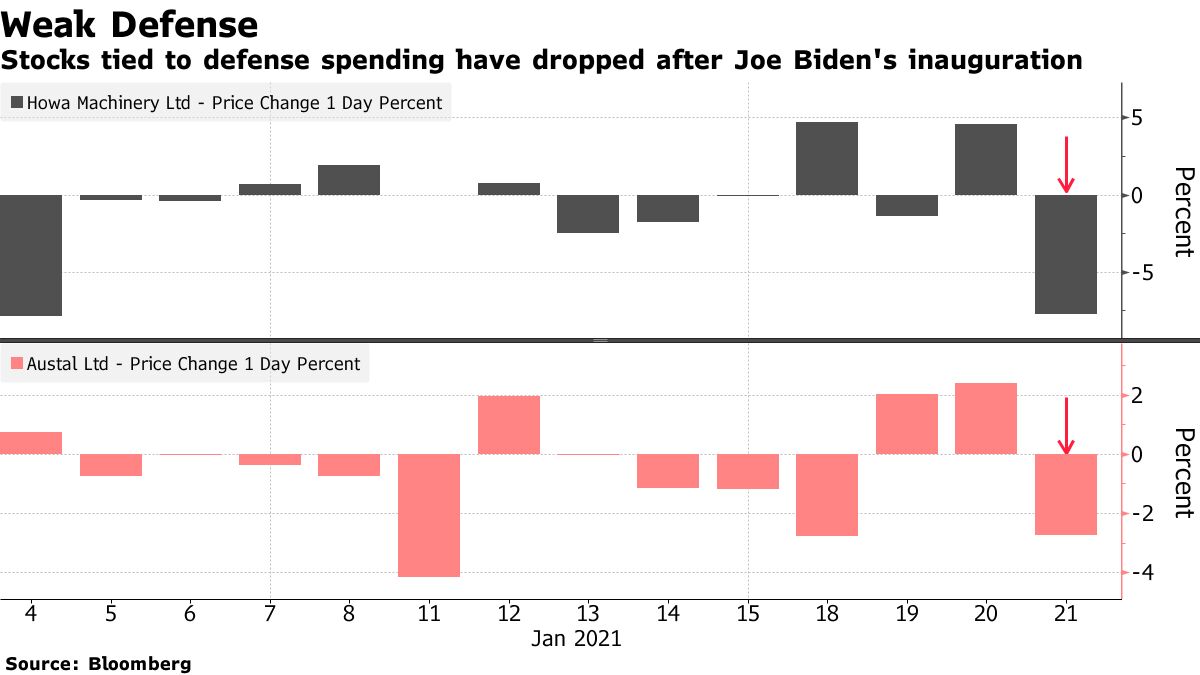

Drops of defense

Asian defense stocks fell on expectations that Biden’s less confrontational policies would mitigate global geopolitical risks and the need to increase spending in the sector. Japanese rifle maker Howa Machinery Ltd. fell 7.8% as Australian defense builder Austal Ltd., which makes about 77% of its revenues in the United States, fell 2.7%.

– With the help of Sam Unsted and Beth Mellor

(Add details on European stocks moving in 7th and 8th paragraphs)

[ad_2]

Source link