[ad_1]

President Joe Biden’s White House economics team are determined to keep their election promise to raise taxes for the rich, emboldened by mounting data showing how wealthy Americans have fared financially during the pandemic .

With the Republican opposition and business lobby hardening to the administration’s tax plans, Democrats must decide how ambitious it is to try to revamp the tax code in what is almost certain to be a stand-alone bill. Interviews with senior officials show that the White House is increasingly convinced that evidence of widening inequality will translate into broad popular support for a tax-on-the-rich strategy.

Biden himself has become convinced of the need, saying last week that those who earn more than $ 400,000 can expect to pay more taxes.

“2020 has really shown him that there are so many weaknesses in society” that need to be addressed, said Heather Boushey, a member of the White House Council of Economic Advisers, in an interview. Funding spending priorities in light of the shortfall from the 2017 Republican tax cuts “really made the president sit down and think about both the huge needs and the questions we’re talking about as to how we tax, ”she said.

Behind the scenes, assistants worked on a proposal to pay for part of Biden’s long-term program. Raising income tax rates and capital gains on top earners, as well as corporate levies and expansion of inheritance tax, would help finance priorities such as infrastructure, climate change and support for childcare and home health care.

Lawmakers and the administration are stepping up discussions on measures that could be adopted later in the year. The Senate Finance Committee will hold a Thursday hearing on the impact on jobs and investment of the current international tax structure of the United States.

“Major reform”

Senior administration officials including David Kamin, deputy director of the National Economic Council, and Lily Batchelder, who has been asked to become assistant secretary to the treasury for tax policy, have been working for years on options to increase the incomes of Better-off Americans. .

Kamin, who along with Batchelder mapped out potential reforms in a 2019 article titled “Taxing the Rich: Problems and Options, ”said in an interview that the following options are among those under discussion:

- Removal of ‘building the base’ for estates, which revalues assets such as stocks and real estate at market prices, rather than their original purchase cost – reducing tax obligations

- Taxing the capital gains of wealthy Americans at higher income tax rates

- A minimum tax for large companies

“The idea of finally eliminating what is a massive loophole, in that Americans with the highest incomes escape tax on their wealth by attacking a base increase and then taxing the capital gains like ordinary income, is a major reform of our system, which I think is necessary, ”Kamin said in the interview.

“These would be major achievements, which would fundamentally change the way our tax system treats the richest Americans and the largest corporations so that they cannot evade taxes as they can now,” he said. he declares.

The administration is also considering reversing part of former President Donald Trump’s income tax cuts, according to aides.

“Anyone who earns more than $ 400,000 will see a small to large tax increase,” Biden said in an interview with ABC earlier this month. For those below that level, there will not be “a single penny of additional federal tax,” he said.

The main aspects of the plan still need to be detailed, including the specifics of the threshold for the tax increase. The White House clarified last week that the $ 400,000 figure applied to families, but Deputy Press Secretary Karine Jean-Pierre suggested on Friday that the level at which the tax hikes would go into effect for individuals is not yet fixed.

“It’s a bit early – we’re still working through the process,” Jean-Pierre said.

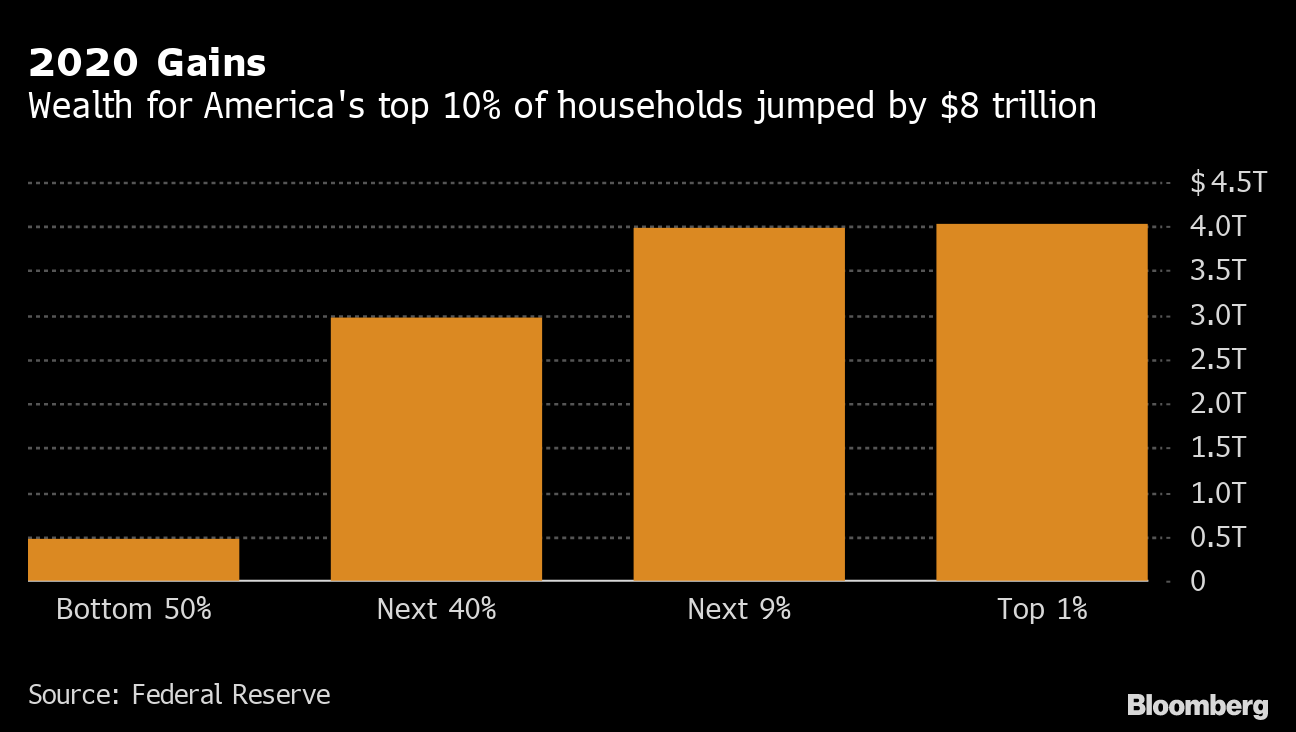

Earnings 2020

The wealth of the richest 10% of U.S. households has jumped by $ 8 trillion

Source: Federal Reserve

The said The K-Shaped Recovery, in which richer Americans thrived even as low-income workers and many middle-class workers suffered from job losses, evictions, food insecurity and risk to life. health associated with in-person work during Covid-19, has bolstered the administration’s intentions. .

The richest 1% of U.S. households added more than $ 4 trillion in wealth last year, as stocks hit record highs and property values soared, fueled in part by interest rates. historically low interest. The poorest 50% saw their net worth increase by a lot less $ 470 billion – and this was reinforced by the extraordinary income support provided in the Cares Act of March 2020.

A A new document from the Left Institute for Economic Policy showed that 80% of job losses in 2020 were concentrated among the bottom 25% of wage earners, while workers in the top half of the distribution saw losses. employment gains.

“It’s always true that recessions hit low- and middle-income people hardest, but I’ve never seen anything like it,” said Heidi Shierholz, director of policy at the institute and former chief economist of the department. work.

Republicans warn higher taxes will delay the recovery. The United States Chamber of Commerce has stated that the increase in levies on businesses United States a less attractive place to invest the profits and locate the head office. “

Republican warning

“Whatever new normal we return to after Covid-19, I think it’s important that the government stay as far away as possible to allow the economy to find its balance,” said Chris Campbell, former Republican of the Senate. assistant who served in the Treasury under the Trump administration.

Senate Minority Leader Mitch McConnell said last week there would be no bipartisan support for a tax hike, and predicted Democrats will use the reconciliation process – which allows projects to law to pass to the Senate by simple majority – for their proposals.

One tax issue on which lawmakers on both sides agree is the potential for hardening IRS enforcement. A Treasury Department monitoring report showed last week that the Internal Revenue Service has failed to raise more than $ 2.4 billion from high net worth individuals who owe back taxes to the federal government.

Biden’s lag

A National Bureau of Economic Research discussion paper this month separately stated that IRS random audits miss most tax evasion through offshore centers and intermediary businesses such as partnerships and limited liability companies. .

Biden’s current determination marks a shift in a decades-long political career with a few episodes of pushing for higher taxes. On the trail of the presidential campaign, he made a distinction with the plans of liberal competitors for a wealth tax, and as vice president he struck a deal with Republicans in late 2012 for make 82% of the tax cuts initially adopted by President George W. Bush permanent.

But the Liberals fully support his efforts now.

“We have seen him come up with, fight for, sign and sell one of the most progressive laws in three generations,” Senator Elizabeth Warren said in an interview, referring to the pandemic contingency plan. “There is now a momentum for real change, and tax policy is a critical part of that change.”

– With the help of Laura Davison and Alexandre Tanzi

(Add context on the rich and tax evasion in the paragraphs before and after the caption “Biden Shift”.)

[ad_2]

Source link