[ad_1]

Photographer: Anna Moneymaker / Pool / Getty Images

Photographer: Anna Moneymaker / Pool / Getty Images

US President Joe Biden is about to get a comprehensive first look at the job market he inherited.

Economists expect the January jobs report to show a stagnant and still high unemployment rate – standing at 6.7% – according to a Bloomberg survey ahead of Friday’s data. This is almost double the level before the pandemic struck early last year.

Monthly data should show a slight increase in hiring, compared to a loss of 140,000 jobs in December. While the US economy has shown strength in areas like housing and manufacturing over the past few months, the job market has struggled to gain momentum.

Federal Reserve Chairman Jerome Powell last week pointed to the unemployment of millions of Americans as a sign that the economic recovery still has a long way to go.

What Bloomberg Economics Says:

“The divergent ‘K’ path will be largely evident in the January jobs report, as sectors such as leisure, hospitality and restaurants / bars are expected to experience continued and significant job losses. While the economic plight of these displaced workers should certainly not be left unanswered, a crucial positive aspect of the jobs report will be to decipher the extent to which parts of the economy continue to recover.

–Carl Riccadonna, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For a full note, Click here

Biden called for an additional $ 1.9 trillion in economic aid to help offset the damage caused by the pandemic. If approved by Congress, it would provide more additional unemployment benefits, assistance to state and local governments, and additional direct payments to individuals.

That would increase the $ 900 billion package approved by lawmakers in December, which provided some support to employees and businesses. The continued threat of the virus and the erratic deployment of vaccines, however, are expected to weigh on recruitment, especially in service industries such as restaurants and hospitality.

The US Treasury will announce its latest borrowing needs and how it plans to fund them this week. And the week will also include a wave of regional Fed chairmen speaking on the job market and economy, including Raphael Bostic of Atlanta, Loretta Mester of Cleveland and James Bullard of St. Louis.

Federal Reserve Chairman Jerome Powell has made it clear that the US central bank is far from coming out of massive support for the economy during the ongoing coronavirus pandemic. Here, he’s answering a question from Bloomberg’s Mike McKee during his virtual press conference.

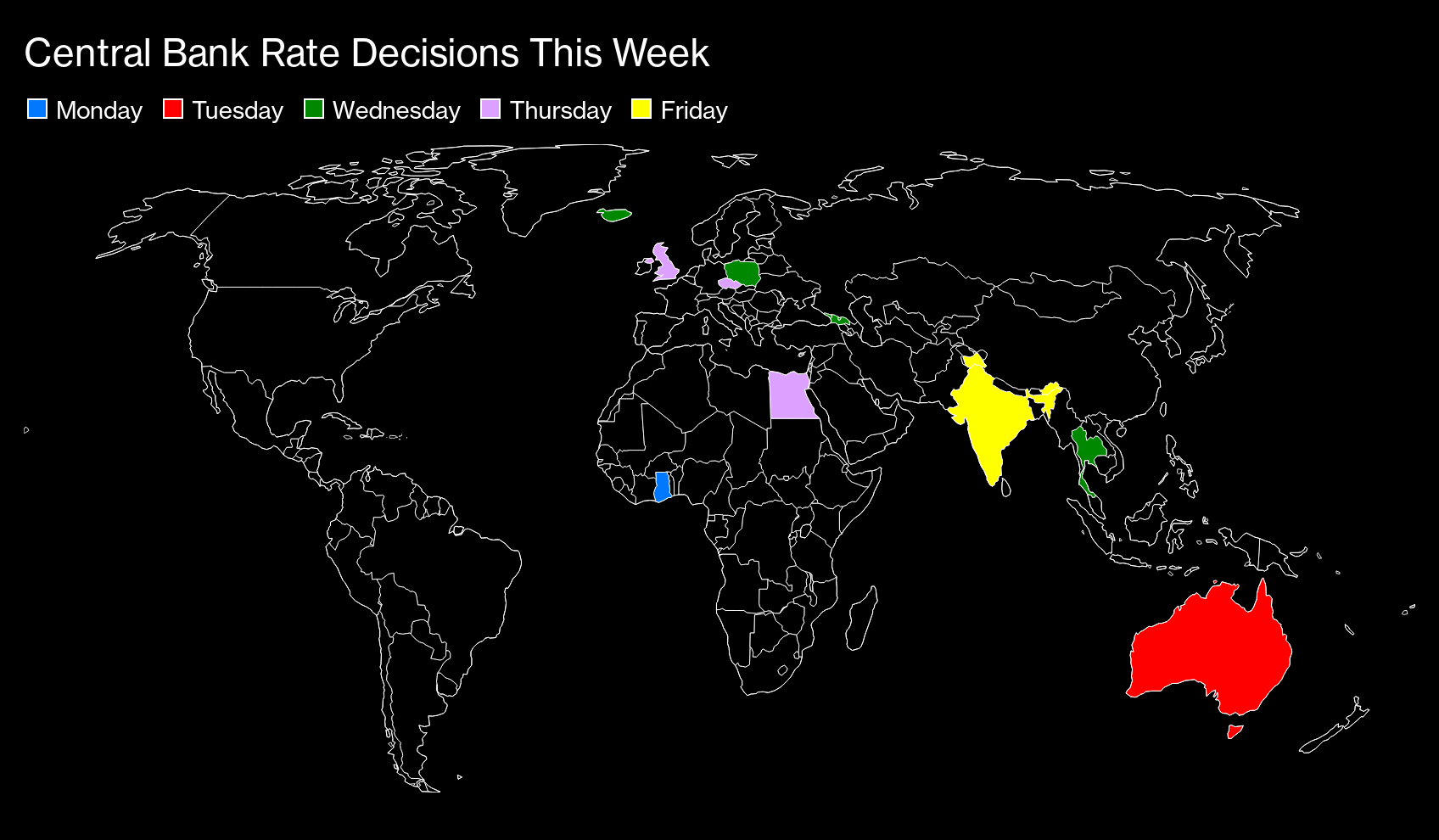

Elsewhere, PMIs in Asia provide the latest snapshot of the state of recovery, while euro area gross domestic product could herald the start of a double dip recession. Central banks from the UK, India and Australia are among those meeting, and Canada’s jobs report is also due.

Click here to see what happened over the past week and here’s our roundup of what’s happening in the global economy.

Asia

Manufacturing PMI reports from Asian countries are expected to show the state of recovery in a region that has been recently boosted by the fallout from China’s strength. An official gauge of China manufacturing output released on Sunday slipped for a second month in January, while remaining comfortably in expansion territory.

From India The budget will be announced on Monday, with a spending spree likely as the government tries to find a way out of the pandemic-induced crisis. The central bank meets on Friday.

Central bank rate decisions this week

South Korea’s January export data will provide insight into whether the recovery of momentum Global trade slowed earlier this year, with lockdowns limiting activity in many major economies.

Japanese Prime Minister Yoshihide Suga is likely to decide whether or not to extend a emergency state. It will assess to what extent current reviews have contained the infections versus the economic damage to continue longer. Household spending figures for December are likely to show consumers were already cutting spending before the new emergency was declared.

Finally, it’s a busy week for the Governor of the Reserve Bank of Australia, Philip Lowe. He will announce a policy decision Tuesday, deliver a speech Wednesday and release his quarterly statement on monetary policy on Friday, before being toasted by a parliamentary committee later today.

Europe, Middle East, Africa

With the Bank of England set to allow its current dose of monetary stimulus to run its course, attention will be focused on its assessment of the latest lockdown in the economy and the viability of negative interest rates as an easing tool. The BOE will likely approve the measure but will hint that it is in no rush to bring borrowing costs below zero.

The central banks of Poland, the Czech Republic, Iceland, Ghana, Mauritius and Egypt are also expected to keep tariffs in abeyance this week.

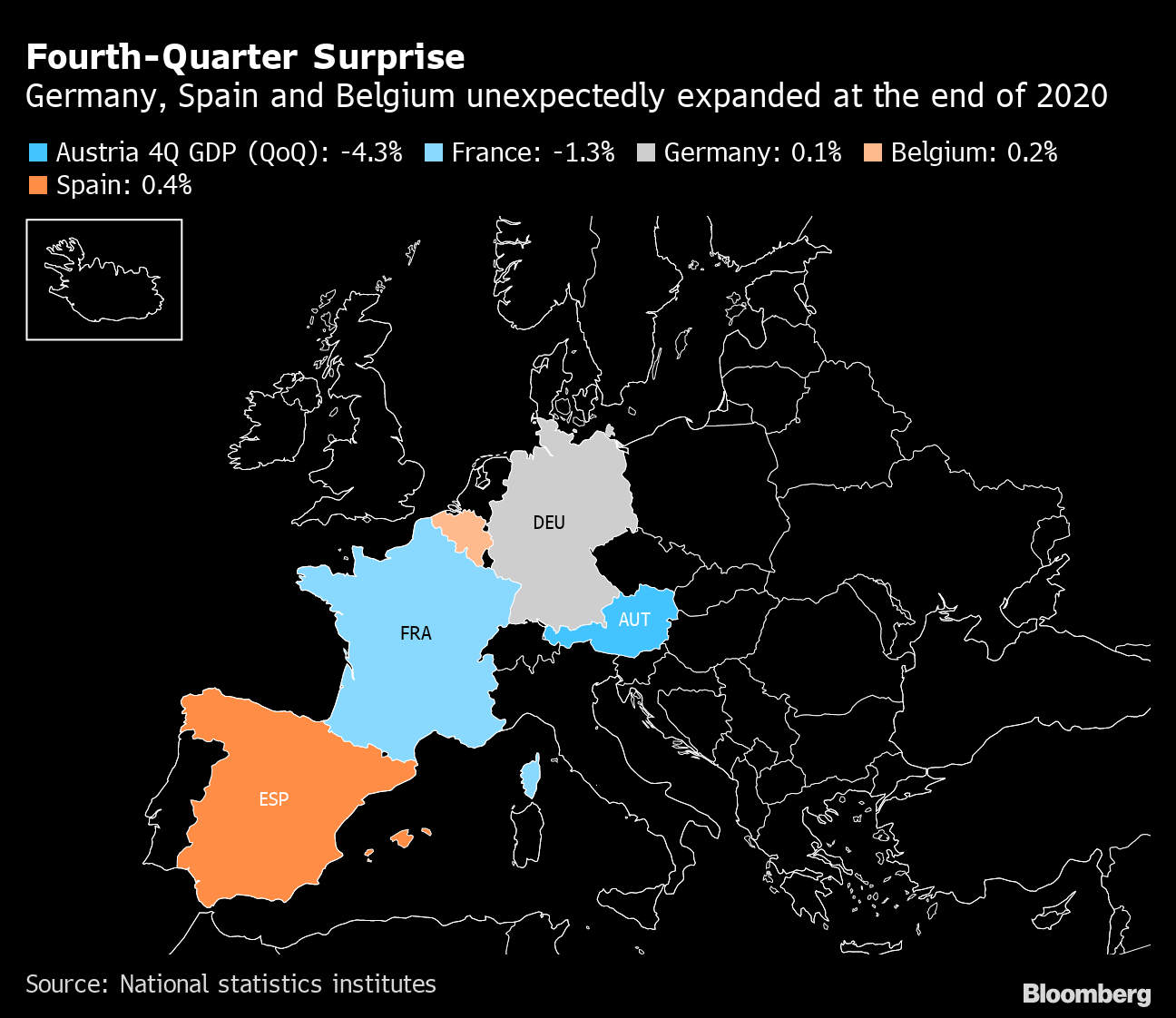

On the data front, fourth quarter GDP eurozone will probably show that the economy has contracted, surprising resilience in Germany, Spain and France could mean that the region as a whole is not doing as badly as expected. Sweden, Latvia, Serbia and the Czech Republic also publish output data.

Fourth Quarter Surprise

Germany, Spain and Belgium unexpectedly expanded at the end of 2020

Source: national statistics institutes

Russia is expected to announce on Monday that its economy shrank 3.8% in 2020, a less dramatic blow than seen in many economies due to its relatively small service sector.

Latin America

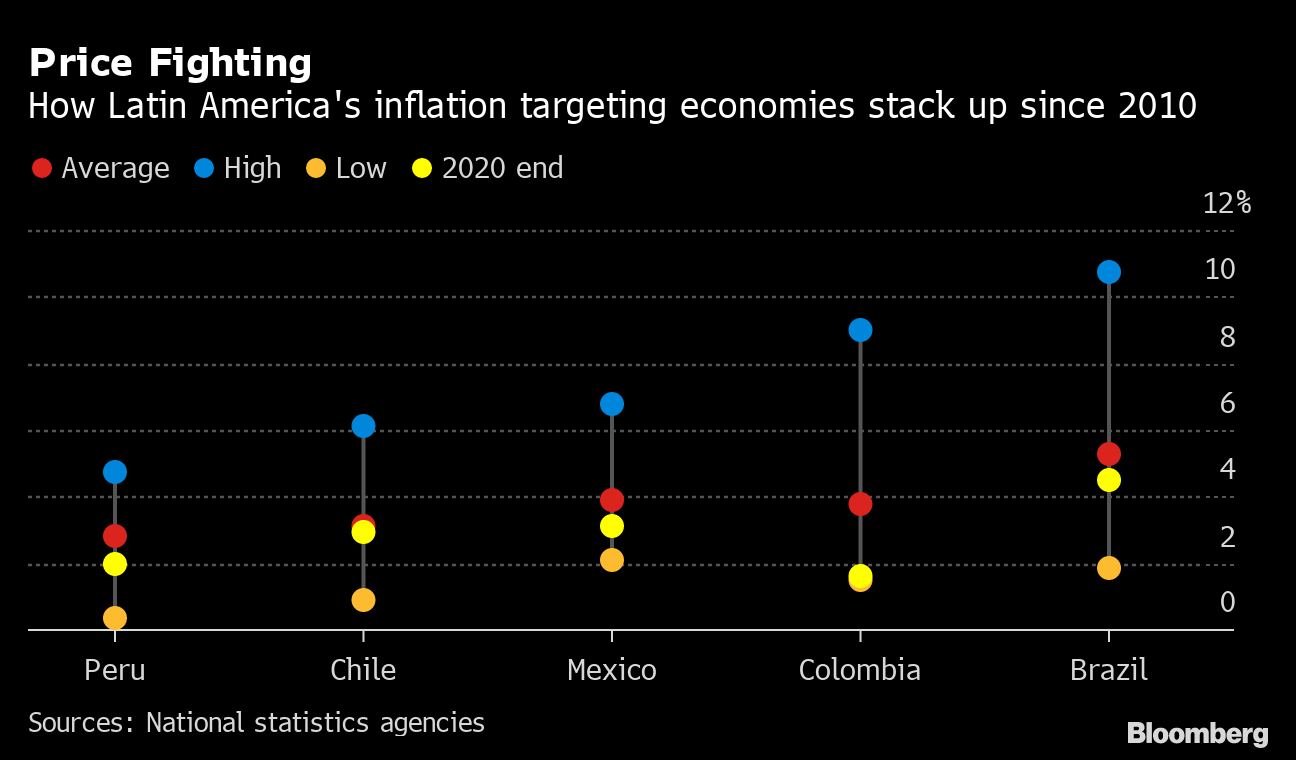

Peruvian consumer price data for January and Monday are expected to bring the annual rate to nearly 2%. The central bank expects it to slow to 1.6% this year.

Fight against prices

How Latin America’s Inflation-Targeted Economies Compare Since 2010

Sources: national statistical agencies

In 2020, Colombia beat Peru to post the slowest annual inflation rate among the largest economies. Friday’s data will show a slight uptick, but leaving the headline figure still well below target. Analysts expect economic activity figures released Monday in Chile in December to turn negative as the patchy recovery from recession has slowed.

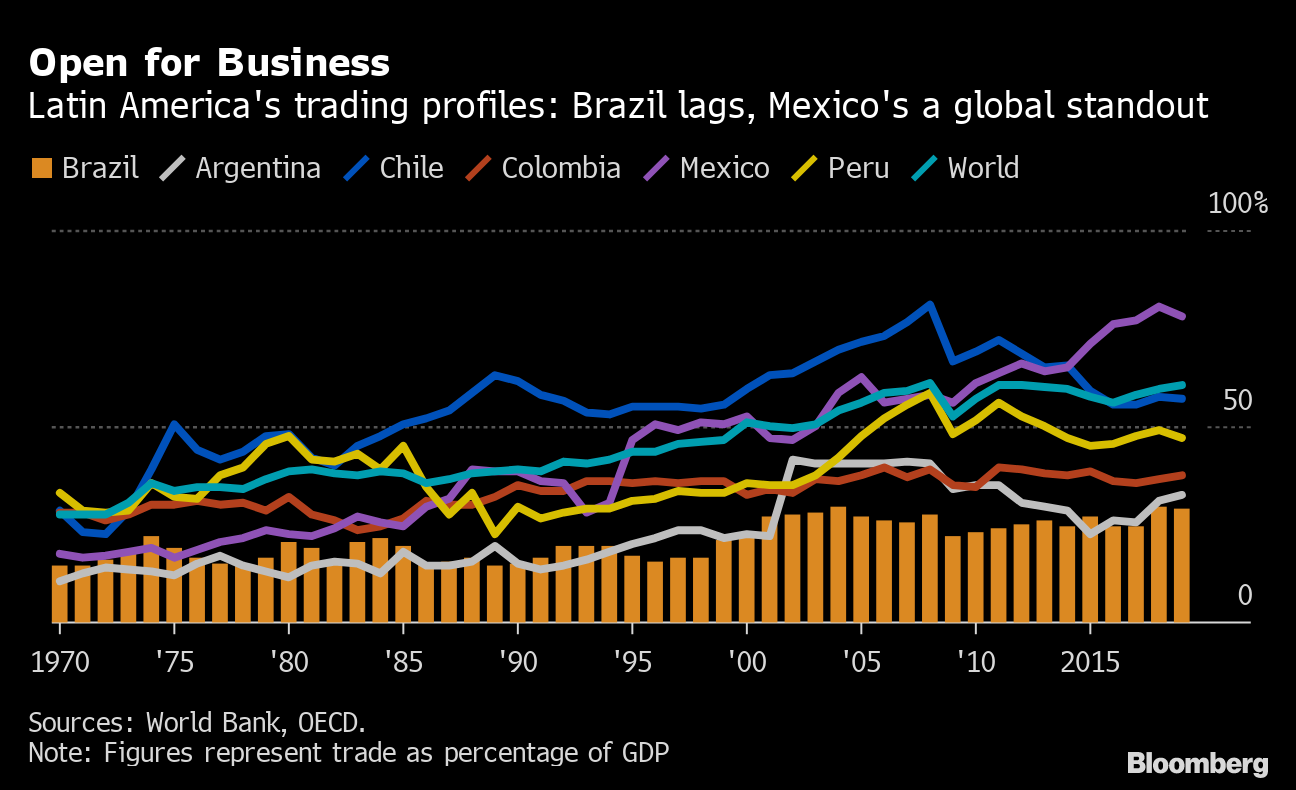

Open for business

Latin American Trade Profiles: Brazil Lags, Mexico A Global Star

Sources: World Bank, OECD.

Monday afternoon we will see Brazil export and import data. Surprisingly, trade plays a relatively small role in Latin America’s largest economy, which is one of the least open among peers in the Group of 20. Colombia’s central bank released the minutes of its meeting on Monday evening. January 29, during which policymakers kept their key rate at a low record high of 1.75%.

Look for Brazil’s industrial production report released on Tuesday to show a fourth monthly year-over-year increase for December. A drop from November would suggest that the pace of the recovery is moderating.

– With the help of Malcolm Scott, Vince Golle, Benjamin Harvey, Robert Jameson and Alaa Shahine

[ad_2]

Source link