[ad_1]

A great thing about big companies like AT & T (T) is that they have important resources to develop and that opportunities are often open to them. The disadvantage is that all too often, these same companies make suboptimal decisions, whether for reasons of bureaucracy, shortsightedness or otherwise, but which do not necessarily detract from shareholder value, but will ultimately poor long-term results. Although I often try to talk about the benefits for business, sometimes it's worth discussing the disadvantages. This is the case, today, of what concerns me about a recent decision made by the AT & T management team.

Management has made a mistake

One thing that investors know all too well about AT & T is that the company is heavily indebted. At the end of last year, total debt amounted to $ 174.52 billion, while cash (of which $ 196 million is allocated) of $ 5.40 billion. Management has focused on debt reduction, but one of the last means that the company should have considered was to sell its stake in Hulu.

You see, in a press release issued on April 15, the company's management team announced that it had reached an agreement under which it was ceding to itself its remaining stake of 9.5 % in Hulu. This movement leaves The Walt Disney Company (DIS) having again established itself as the majority shareholder of the company, the only other partial owner today is Comcast (CMCSA). In exchange for its stake in Hulu, AT & T will receive a cash payment of $ 1.43 billion. This effectively values the streaming service at around $ 15 billion.

It is generally a good idea to sell a non-core asset in order to reduce a debt, especially when this asset does not have a real impact on the company today, it will result in a reduction of interest charges and non-essential assets. the asset actually loses money to a good clip. According to an investor presentation earlier this month, Disney said Hulu this year is expected to experience operating losses of about $ 1.5 billion, making this year the worst year for the company.

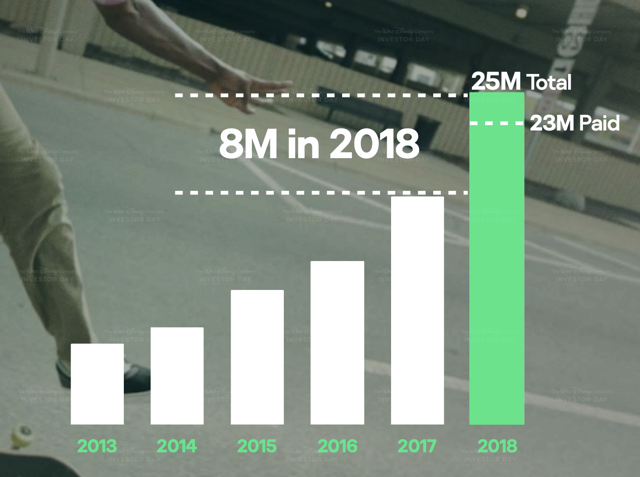

That said, exceptions should be made when non-core assets grow rapidly and when there is sufficient evidence to assert that the future of this asset will be promising. Already, between 2017 and 2018, Hulu boasted of being the fastest growing video service in the United States, with an increase of 8 million users during this year, from 17 million to 25 million. This implies a growth rate of 47.1%. Fortunately, it seems that the content provided by AT & T on Hulu, and more specifically by WarnerMedia, will remain on the platform, but I suspect that eventually, the lack of ownership of AT & T will lead to either Hulu to see more favorable conditions in the future, with AT & T being less generous than it would have been as a homeowner.

*Taken from The Walt Disney Company

If all that was Hulu, it was its current size of 25 million users, and if there was no sign of profitability in sight, the decision of ## 147 ## AT & T to divest itself of its property would be really wise. That said, according to Disney, the digital video advertising market will exceed $ 50 billion a year by 2022, and as the number of Hulu users increases, Disney thinks that the company's bottom line will grow. improve. The forecast operating loss of $ 1.5 billion this year is expected to be the worst, with every additional year improving from now on. By 2023 or 2024, the service is expected to generate profits. At this point, it will count between 40 and 60 million subscribers each month.

I believe that Disney sees the writing on the wall, which is why he is now trying to control as much as possible streaming services. In addition to becoming a majority shareholder of Hulu, the company recently announced the launch of its Disney + program. It also owns and operates a similar service for ESPN, called ESPN +, which has been available for several months. In a previous article, I discussed in detail Disney + and the expectations of the company, as well as ESPN + briefly. In the case of Disney +, the expectations are higher than for Hulu, but that does not mean that Hulu does not offer attractive potential.

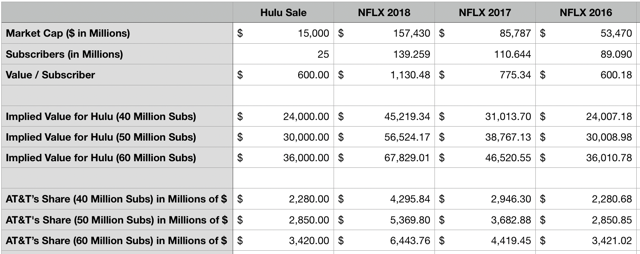

Today, Hulu's cost is $ 5.99 per month, with an ad-free version available for $ 11.99 per month and a Hulu + Live TV version on the market at $ 44.99. $ per month. No data has been made available regarding the combination of services between customers, but if we assume that the weighted average business figure is $ 10 per month for all services, in a few years this will represent between $ 400 and $ 600 million a month, or about $ 4.80 to $ 7.2 billion a year. In total, the service is valued by the parties to the transaction at approximately $ 600 per subscriber. Whether it is too high or too low is debated, but in the table below, I have made some estimates from the data available for Netflix (NFLX).

* Created by the author

Over the last three fiscal years (using today's market value of $ 157.43 billion for 2018, and using year-end market values for 2017 and 2016), I calculated that Netflix was costing between $ 600 and $ 1,130 per subscriber. By applying the same methodology to Hulu, which has between 40 and 60 million subscribers, we end up with a wide range of assessments between $ 31 billion and $ 67.80 billion by 2024. At that point, AT & T's 9.5% interest is expected to be $ 6.44 billion. Even with a figure of $ 600 per subscriber, we arrive at a valuation between $ 24 and $ 36 billion, which gives a value of $ 2.28 billion to $ 3.42 billion on the participation of AT & T in the society.

To take away

In my opinion, AT & T has just made a terrible mistake. I know that the company is focused on debt reduction and wants to focus on its core business, but hands over a stake in a fast growing company at a time when a large competitor (and, more than typical, a partner strategic) as Disney insist heavily on the same business is the recipe for complacency and delay. In the long run, I imagine it will not have a negative impact on society, but I think it will limit its potential and management will consider it a significant blunder.

Crude Value Insights offers an investment service and community focused on oil and natural gas. We focus on cash flows and the companies that generate them, generating value and growth prospects with real potential.

Subscribers can use a standard account of more than 50 years, in-depth analyzes of E & P's cash flow and a live discussion of the industry.

Sign up today for your free two week trial and get a new lease on oil and gas!

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link