[ad_1]

FAANG shares displayed on Nasdaq.

Adam Jeffery | CNBC

Washington's apparent attack on big tech companies such as Alphabet, Facebook and Amazon could be a blessing in disguise for investors as they represent a massive buying opportunity.

The Alphabet and Facebook shares fell 3.4% and 2.3%, respectively, for the week. Amazon was up 1.6%, but was 4.4% behind the S & P 500. These measures come after several reports raised fears that some of these technology companies would be subject to strict regulations in the future, even to be divided.

Nevertheless, the chances of these companies being split are slim and their fundamentals point to further growth in the long term. Therefore, this sudden drop could be an entry point for investors looking for exposure to some of the best performing stocks in recent years.

"I look at opportunities like this, when the market will sell, to initiate or strengthen my positions," said Kim Forrest, founder of Bokeh Capital. "These are not fashions, they are the very foundations on which you build your business, if you will, steel and oil companies of the 1950s and 1960s." I see nothing disappearing.

Alphabet fell after several reports said that the Justice Department was preparing an antitrust investigation on Google. Facebook has come under pressure after the Wall Street Journal announced that the Federal Trade Commission had been given permission to investigate the impact of its practices on competition. The Washington Post also announced that the FTC and the judiciary had reached an agreement under Amazon under the microscope of the FTC, exerting pressure on the e-commerce giant.

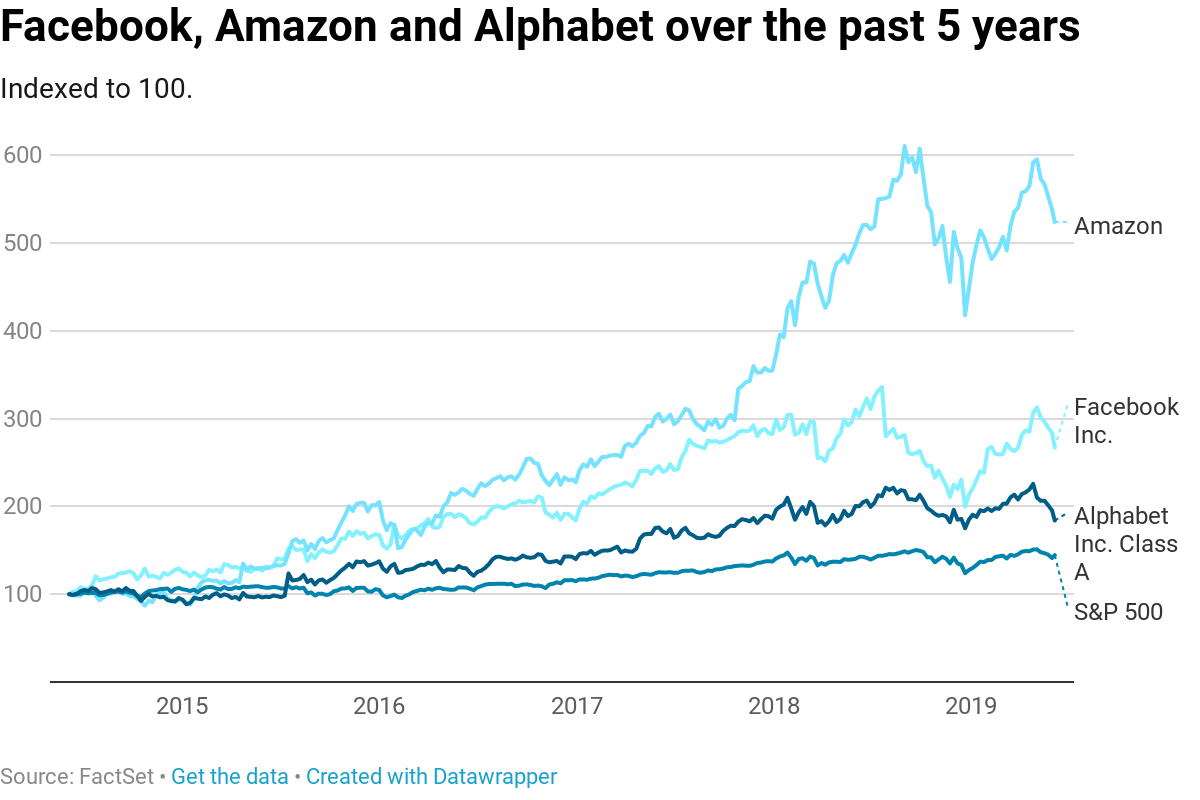

The news comes at a time when shares of parent companies Google, Facebook and Amazon – which are among the most popular actions of the last five years – show cracks. The alphabet has increased more than 88% in the last five years, while Facebook has grown by 177%. Amazon stocks increased their value by 447% during this period.

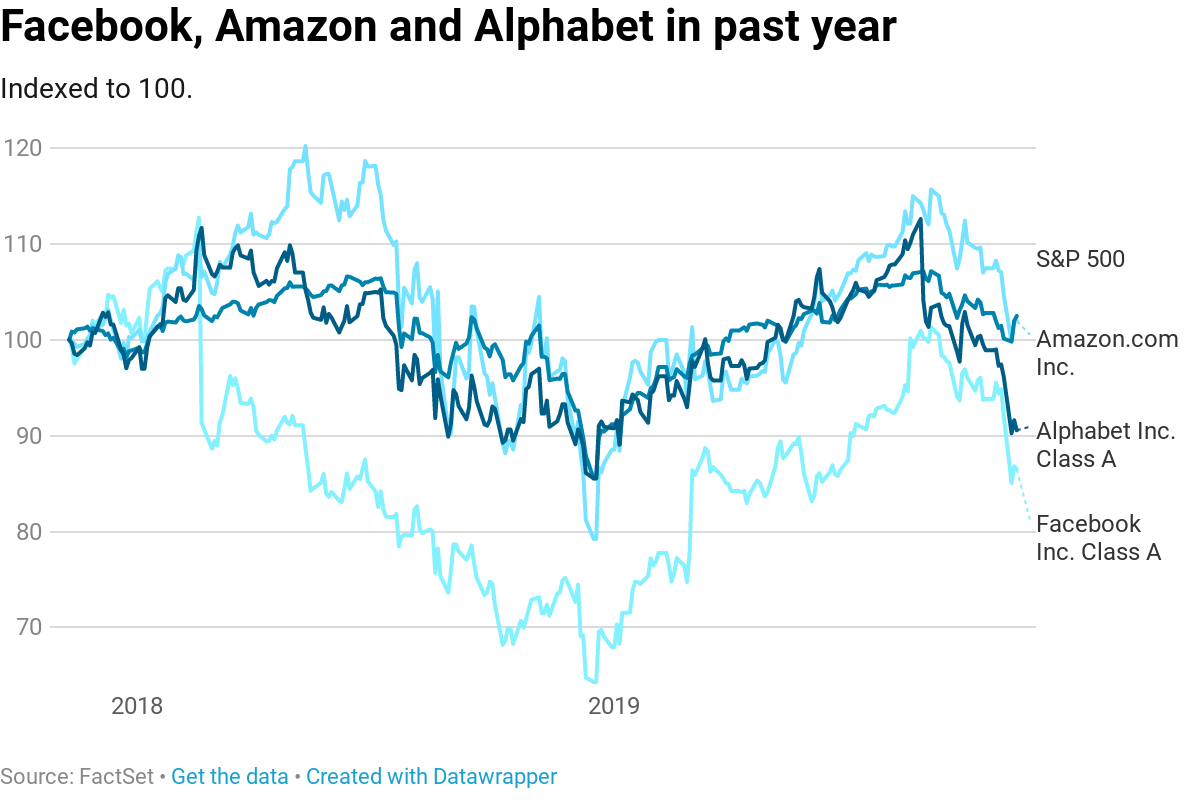

But their recent performance has been poor. Facebook shares have fallen 7.9% over the past 12 months, while Alphabet has lost nearly 6% over this period. Amazon is the only one that has been positive over the past year, registering an increase of more than 6%.

Tech has "really taken the chin higher than any other sector for two reasons: first, because it's the most profitable sector of the last two years." It's also a direct target of these tariffs, said Jeff Kilburg, CEO of KKM Financial. The final step is to "determine if Google and some of these technology giants will be dissociated." I think the answer is no, but the fact that it hits the newspapers on the first page puts some portfolios in a rebalancing perspective. " .

Alphabet is trading at 26 times earnings, its lowest multiple since 2015. Facebook's price-earnings ratio is close to 25 after reaching a record low of 18.7 at the end of December.

Technological breaks are unlikely

Investors worry about the possibility of a split of tech giants, but the chances of this happening are small.

In a note, Colin Sebastian, a technical analyst at Baird, said in a note that Facebook and Google could find a legal "safe haven" in the government's focus on "harm to consumers".

"In terms of anti-competitive behavior, the fact that Google and Facebook services are largely free for consumers and that the growth of Facebook and Instagram (and to a much lesser extent Amazon) have created increased competition for Google in recent years, would seem to dilute the arguments that the "duopoly" is hostile to consumers, "he said.

Investors can also look back at the last time a major tech company was confronted with antitrust litigation to find solace. Between 1998 and 2001, Microsoft was accused of monopolizing the operating system market. The company settled with the US government in November 2001 and its shares jumped nearly 300% during this period.

This does not mean, however, that investors need to be cautious, especially in the short run, as political rhetoric about big tech companies and their power intensifies in the 2020 elections.

"The current political environment is conducive to significant antitrust enforcement, especially for the very high-flying actions of FAANG," said BCA Research strategists in a March note. "Whether it is about electoral interference, data privacy issues, perceived ideological bias or a large accumulation of wealth, Americans from all political backgrounds are wary power of technology companies. "

But for investors who can bear the likely volatility of these stocks, this represents "a buying opportunity," according to Kilburg of KKM Financial.

Subscribe to CNBC on YouTube.

[ad_2]

Source link