[ad_1]

Photographer: Emile Wamsteker / Bloomberg

Photographer: Emile Wamsteker / Bloomberg

The forced liquidation of more than $ 20 billion in stakes linked to Bill Hwang’s investment firm draws attention to the underground financial instruments he used to build large stakes in companies.

Much of the leverage used by Hwang Archegos Capital Management has been provided by banks including Nomura Holdings Inc. and Credit Suisse Group AG through swaps or contracts for difference, according to people with direct knowledge of the transactions. This means that Archegos may never have owned most of the underlying securities, if any.

While investors who acquire a stake of more than 5% in a company listed in the United States generally must disclose their position and future transactions, this is not the case with stakes constructed through the type of derivatives apparently used. by Archegos. The products, which are made off-stock exchanges, allow managers like Hwang to take stakes in publicly-traded companies without having to report their holdings.

The rapid unfolding of Archegos reverberated around the world, after banks such as Goldman Sachs Group Inc. and Morgan Stanley forced Hwang’s company to sell billions of dollars in accumulated investments through highly leveraged bets. The sale upended Baidu Inc. shares to ViacomCBS Inc., and prompted Nomura and Credit Suisse to indicate that they face potentially large losses on their exposure.

One of the reasons for the wider fallout is the borrowed funds that investors use to amplify their bets: a margin call occurs when the market goes against a large and leveraged position, forcing the hedge. fund to deposit more cash or securities with its broker to cover losses. . Archegos was probably only required to deposit a small percentage of the total trade value.

The chain of events triggered by this massive unfolding is yet another reminder of the role hedge funds play in global financial markets. A short hedge fund squeeze in a Reddit-fueled frenzy for shares of Gamestop Corp. earlier this year resulted in a $ 6 billion loss for Gabe Plotkin’s Melvin Capital and sparked close scrutiny from US regulators and politicians.

The idea that a company can quietly accumulate disproportionate positions using derivatives could spark yet another wave of criticism directed at loosely regulated companies that have the power to destabilize markets.

While Friday’s margin calls triggered losses of up to 40% on some stocks, there was no sign of contagion in the markets as a whole on Monday. Compare that to 2008, when Ireland’s richest man at the time used derivatives to build such a large position in Anglo Irish Bank Corp. this ultimately contributed to the international rescue of the country. In 2015, New York-based FXCM Inc. needed rescue because of the losses suffered by its British subsidiary due to the unexpected imbalance of the Swiss franc.

Much of Hwang’s transactions remain uncertain, but market participants estimate that its assets have grown from $ 5 billion to $ 10 billion in recent years and that total positions may have exceeded $ 50 billion. Hwang did not respond to requests for comment.

CFDs and swaps are among the tailor-made derivatives that investors trade privately with each other, or over-the-counter, instead of going through public exchanges. This opacity helped worsen the 2008 financial crisis and regulators have since introduced a new set of rules governing assets.

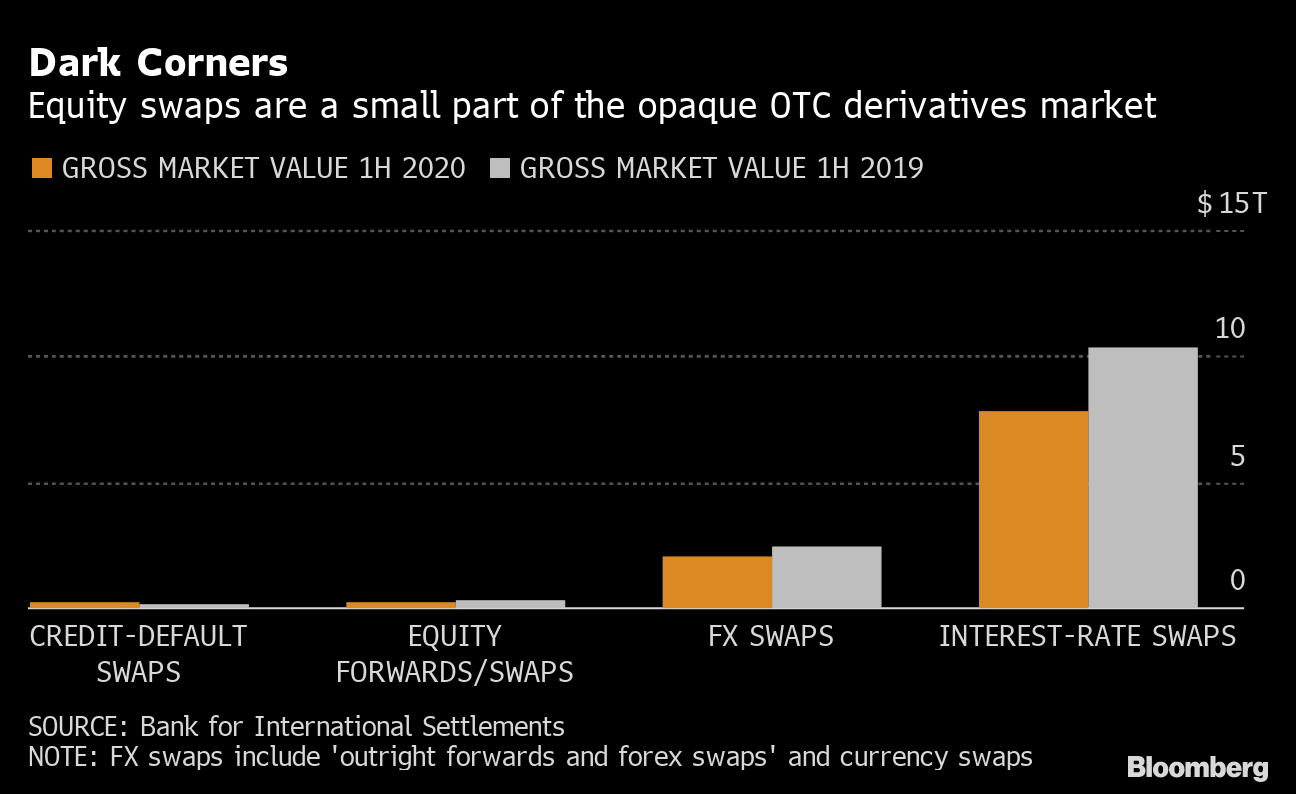

OTC equity derivatives occupy one of the smallest corners of this opaque market. Equity-linked swaps and forwards had a gross market value of $ 282 billion at the end of June 2020, according to data from the Bank for International Settlements. This compares to $ 10.3 trillion for interest rate swaps and $ 2.4 trillion for currency swaps and forwards.

Dark corners

Equity swaps are only a small part of the opaque OTC derivatives market

SOURCE: Bank for International Settlements

Regulators have started cracking down on CFDs in recent years over concerns that derivatives are too complex and too risky for retail investors, with the European Securities and Markets Authority in 2018 restrict distribution to individuals and cap leverage. In the United States, CFDs are largely prohibited for amateur traders.

Banks still favor them because they can make large profits without having to set aside as much capital as trading real securities, another consequence of the regulations imposed in the aftermath of the global financial crisis. Among hedge funds, equity swaps and CFDs have gained popularity as they are exempt from stamp duty in high tax jurisdictions such as the UK.

– With the help of Lulu Yilun Chen and Donal Griffin

(Updates with data on equity derivatives in the eleventh paragraph.)

[ad_2]

Source link