[ad_1]

Worse, in the last decade, investors would have put their money better in the S & P 500 than their stock. The Financial Times, who interviewed Buffett, did the math by stating that investing a dollar in every Berkshire Hathaway and in an S & P fund 10 years ago would be $ 2.40 and $ 3.20 today, respectively. Ouch.

Do not pour salt into the wound, but unlike Berkshire Hathaway, bitcoin – which Buffett once called "squirrel raccoon" – is rampant on the stock market. Maybe it is not bitcoin that is dangerous for the health of investors.

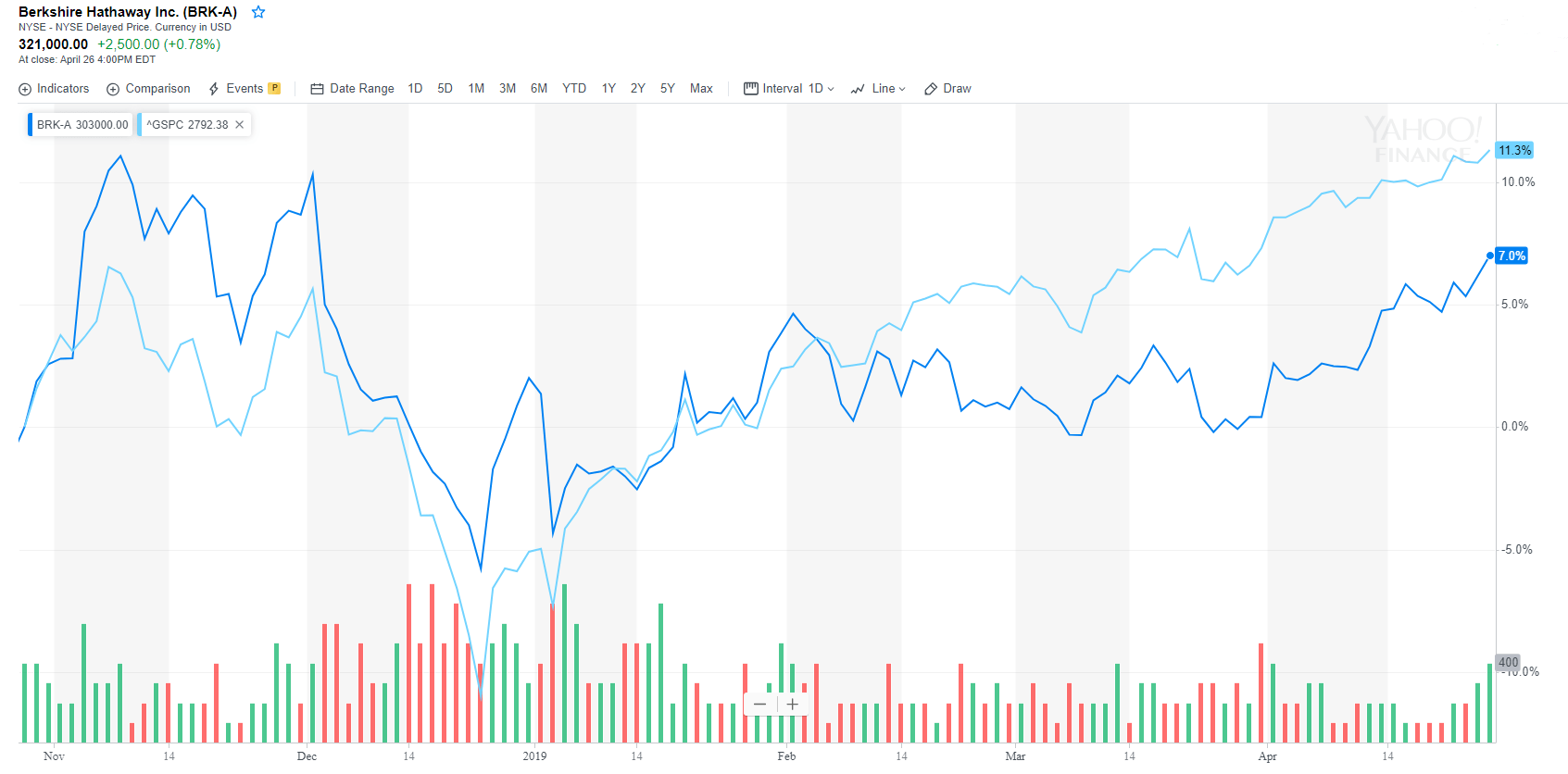

The S & P 500 has outperformed Warren Buffett's shares since the beginning of the year. | Source: Yahoo Finance

Salt in Buffett's Wound

For more than five decades, Berkshire Hathaway has outperformed the S & P 500 index by 2.5 million percentage points, according to the FT. That's why it's so shocking that the stock has been lagging behind for 10 years.

At the same time, as CCN has already indicated, bitcoin yields of over 400% over the last two years far exceed the returns of about 20% generated by the S & P 500. If Buffett 's action can not beat the S & P 500 for investors, it' s no wonder. an axis to grind with Bitcoin, which does just that.

Returns two years:

S & P 500: 19.9%

Gold: 1.3%

Oil: 31%

Bitcoins: 457%Due to the asymmetrical and uncorrelated nature of Bitcoin, it is imperative that each portfolio include some exposure to digital currency. #GetOffZero

– Pomp (@APompliano) April 23, 2019

His Achilles heel is high-tech, not just crypto. Buffett avoids FANG actions – Facebook, Amazon, Netflix and Google's parent Alphabet – and most technologies at all costs (with the exception of Apple). This is what drives gains on the stock market.

.@ WarrenBuffett bitcoin: "it's probably square rat poison". # brk2018

– Becky Quick (@BeckyQuick) May 5, 2018

As one of the richest people on the planet, staying true to itself has paid dividends to Buffett. It invests only in companies from which it obtains the economic models. But what have you done for me lately? Buffett himself admits that the prospects for Berkshire Hathaway are not better than those of a broader stock market, stating to the Financial Times:

"I think this: if you want to join something that can have a tiny wait for better [returns] as the S & P, I think we can be on the safest. "

A chance to beat the S & P? Do not hold your breath.

"If we're lucky," Buffett told the FT.

Rebel with a cause

Not all stocks have a strong growth and Buffett's conservative style has served him well over the years. It has a history of under-promising and surplus. Bitcoin is the opposite. The community is eating bullish price predictions. In fact, higher, better it is, and in many ways, it has become a self-fulfilling prophecy. Bitcoin is not Buffett's style, he said it clearly. But maybe somewhere deep down, he's really jealous of something that calls into question his investment mantra, let alone the trend. There is no balance sheet, no product that you can taste or smell. It's uncomfortable for Buffett who, according to the FT, ingested 25% of his "caloric intake" at Coca-Cola, a stock in which he paid $ 1 billion in the 1980s. This prayer puts him in the # 39; ease?

Yet, Bitcoin has and continues to challenge the odds. Bitcoin is a rebel but not a cause. It has a clear mission of decentralization and has managed to democratize opportunities. Buffett does a disservice if he does not recognize it, even though Berkshire Hathaway never has bitcoin.

[ad_2]

Source link