[ad_1]

On 19 April, after the long-awaited start of Binance's main channel, the price of the Binance coin (BNB) jumped 10% against the US dollar, becoming the second crypto asset (after EOS in May 2018) since 2017 absolute record.

Other cryptographic assets that approach the NBB, the digital assets created before 2019, are down about 20 to 50% against the dollar, with most other chips falling by nearly 99 % against the US dollar since the market peak in 2017.

How Binance Coin (BNB) is the first cryptography to surpass ATH Since 2017

On January 12, 2018, Binance Coin reached a record $ 24.46 after recording a 12-fold increase in value in just two months.

Over the last 24 hours, BNB has gained 11.2% against the US dollar and reached $ 24.77 following the highly anticipated launch of Binance's main network, recording an impressive 309% gain since the beginning of the year.

The sharp rise in the value of the NBB over a relatively short period of time suggests that investors in cryptographic assets are confident in the long-term growth of cryptocurrency, especially in the decentralized exchange (DEX) and decentralized application (DApp).

Following the launch of Binance Chain's main network, several blockchain projects such as Red Pulse and Mithril have moved from intelligent contract protocols such as Ethereum to Binance Chain.

$ MITH will be one of the first token migration projects on @Binance_DEX. Our community thanks you for your support! https://t.co/zvG7tvtL2b

– CZ Binance (@cz_binance) April 18, 2019

Other large-scale projects such as Enjin, which would have entered into a strategic partnership with Samsung, announced support for Binance Chain and BNB.

L & # 39; Enjin Wallet will fully support #Binance Chain, including $ BNB active and @Binance_DEX exchange functions.

We are delighted to be part of this @ binance revelation and provide #EnjinWallet users with a convenient, secure and accurate trading platform.https: //t.co/kP8zz6Vbht pic.twitter.com/vLhnEwpNLF

– Enjin (@enjin) April 19, 2019

However, even before the ramp-up of Binance Chain's launch on the main network, BNB recorded a strong performance against bitcoin and the US dollar throughout the 16-month bear market.

BNB's strong performance in 2018 is mainly attributable to its coin-etching mechanism, in which the profits generated by Binance, the crypto-crypto exchange, are used to buy back BNB from its holders.

The dynamics of the NBB created by the buyback mechanism was fueled by the launch of a decentralized exchange in the first half of 2019, accompanied by the launch of its own blockchain protocol.

In the coming days, Binance is expected to launch the second largest chip exchange in the history of the cryptocurrency market. BNB, which is currently based on Ethereum ERC20 token Binance.

Interesting, 2nd largest exchange in history. Learn something new every day! https://t.co/SCPCHwC4c6

– CZ Binance (@cz_binance) April 19, 2019

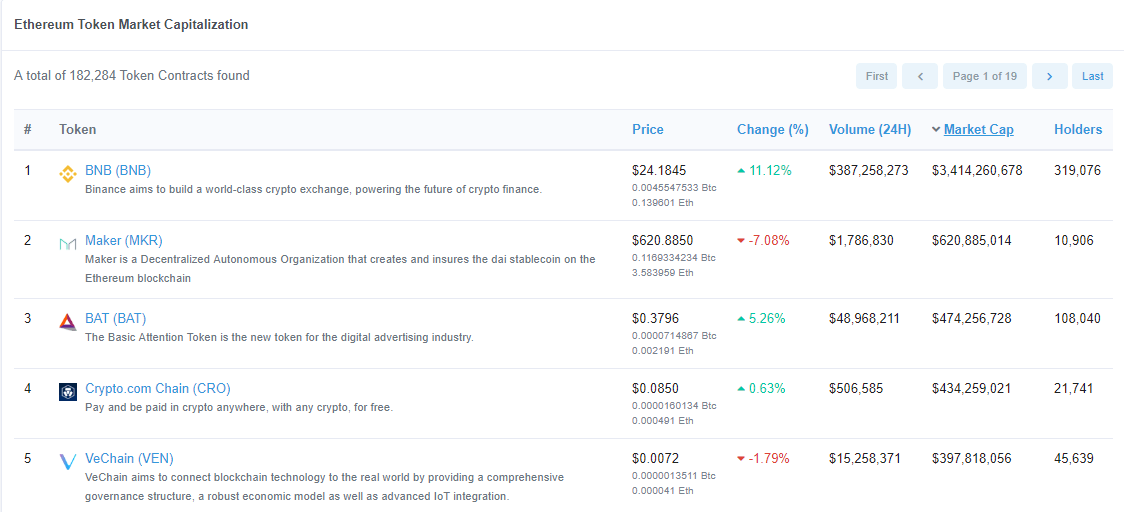

BNB remains the most valuable pledge on Ethereum by a large margin with a market capitalization $ 3.4 billion. The second most valuable marker of the protocol, Maker, is valued at $ 620 million.

What BNB needs to prove now

If the NBB price has performed well throughout 2018 due to the buy-back mechanism and resumed in 2019 in anticipation of the exit of the network, Binance Chain may have to show a real potential in terms of high throughput and blockchain of great ability to keep these huge gains.

Although Binance Chain's primary objective is to support decentralized exchanges, it will have to demonstrate to investors that projects such as Mithril and other blockchain platforms that plan to migrate to Binance Chain can work seamlessly through the protocol. .

Investors' eyes are now probably focused on how the Binance team will pursue its plans for further decentralization of its activities. DEX.

Update April 19 at 19:40 (Pacific Time): An earlier version of this article indicated that the NBB was the only piece to reach its highest level since 2017, however, EOS reached its highest record in May 2018. The title and article have been updated to reflect this fact.

Binance Coin, currently ranked No. 7 by market capitalization, is on the rise 12.54% in the last 24 hours. BNB has a market capitalization of $ 3.41 billion with a 24-hour volume of $ 395.47 million.

CryptoCompare's graphic

Binance Coin is up 12.54% in the last 24 hours.

Filed Under: Altcoins, Crypto Exchanges, Price Watch

Warning: The opinions of our writers are solely theirs and do not reflect the opinion of CryptoSlate. None of the information you read about CryptoSlate should be considered as investment advice. CryptoSlate does not support any project that may be mentioned or associated with this article. The purchase and trade of cryptocurrencies must be considered as a high-risk activity. Please do your own due diligence before taking any action related to the content of this article. Finally, CryptoSlate takes no responsibility if you lose money by exchanging cryptocurrencies.

[ad_2]

Source link