[ad_1]

Bitcoin has just tested the largest area of resistance from $ 5,800 to $ 6,000. This is the area that lies between BTC / USD and the next uptrend. Some professional analysts and traders do not expect the price to rise above this level this year, be it bullish or bearish. Those who are bearish of course expect the price to fall much lower from here, but even those who are significantly bullish expect the price to trade between a narrow range. for the time being and breaking this zone of resistance towards the beginning of 2020. people who never expected that the $ 5,800 to 6,000 dollars would be broken as support, but now that the price is trading in here, they expect it to be broken in one go, by resistance. This analysis is about realistic bulls and does not wear moon boys or fate boys. To do this, we will consider two possibilities at the same time.

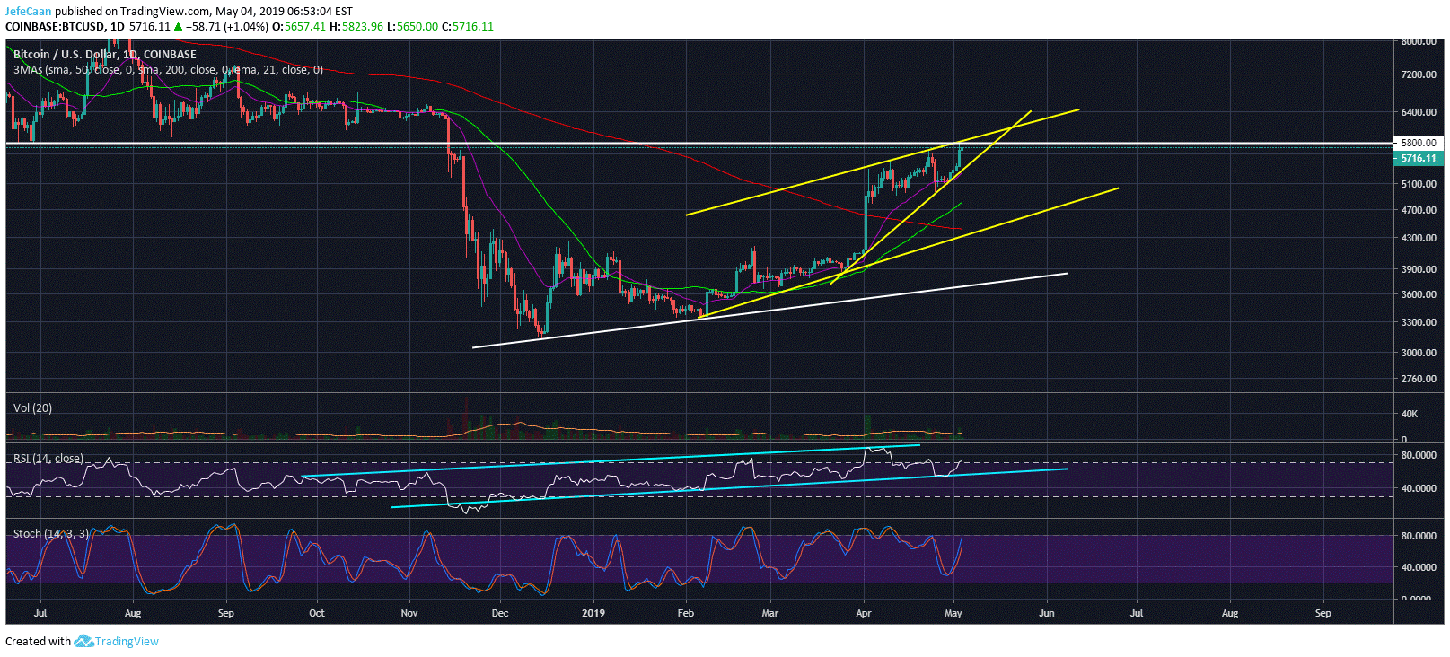

The daily chart for BTC / USD shows that the price has just hit $ 5,800 and is now trading at $ 5,700 after a retracement. BTC / USD is trading in a bullish corner in the bearish case and in an ascending channel in the bullish case. We drew both on the same chart to discuss both cases simultaneously. Bulls and bears may disagree on many things but this is a point where they can find a common ground. Bulls think the price is in a rising channel while the bears think it's in a rising wedge. Let's say the price is in both at once. So, if the price is in a rising wedge, it will have to break down and if it is in an ascending channel, it will still have to go down because it has tested the top of the channel. This means that bulls and bears agree that the price goes down at least at the bottom of the channel.

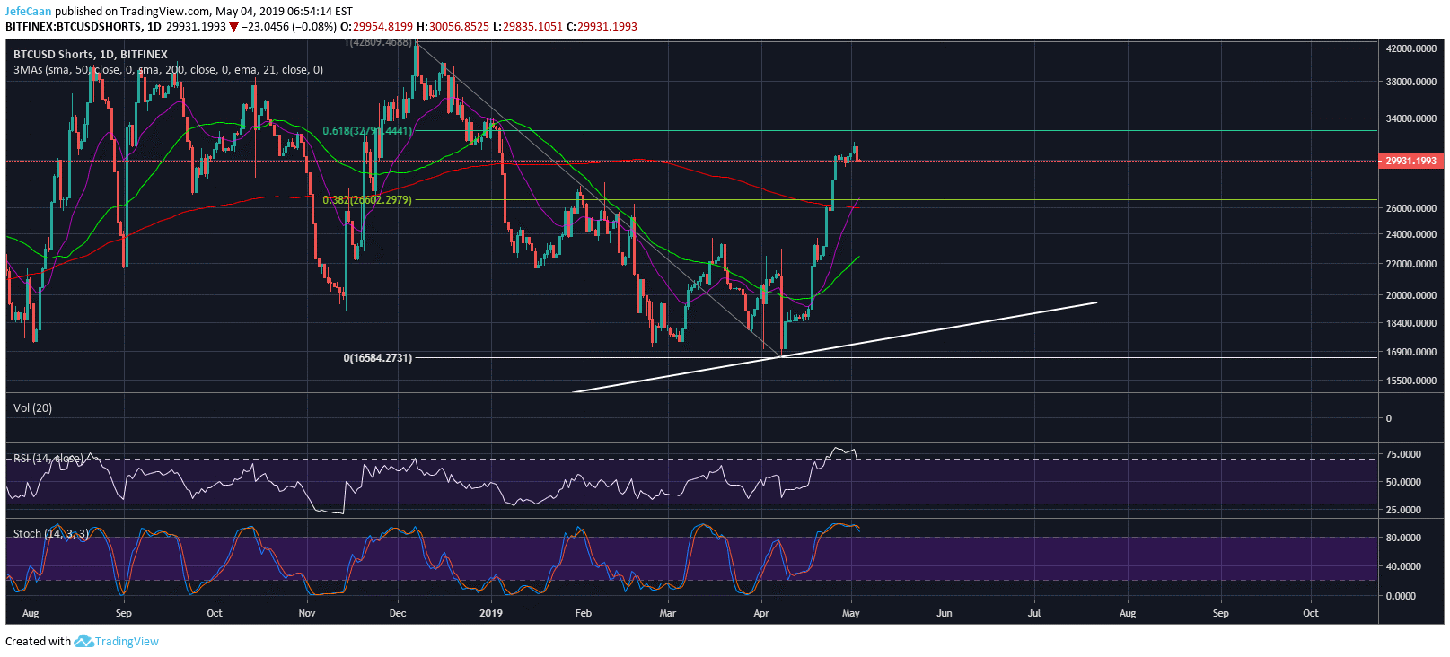

The fact that bulls and bears agree on a sharp drop from current levels greatly decreases the likelihood of a short compression at this stage. The daily chart of BTCUSDShorts shows that the number of marginal shorts should decrease in the days and weeks to come. This fall does not have to coincide with a sharp rise in the BTC / USD as the most likely scenario is that the BTC / USD is trading sideways from current levels over the next few weeks. As a result, most bears will lose confidence in the downward trend and we may see a decrease in the number of short films that are marginalized. Never in the history of Bitcoin (BTC), it broke the market structure and pumped into it as if nothing had happened. It's not just Bitcoin (BTC), it's very rare to see a financial asset doing that.

The area between $ 5,800 and $ 6,000 was an area of high demand until the price broke below and reached an interim low of $ 3,217. After that, $ 5,800 to $ 6,000 became a strong supply area. Whenever the price of bitcoin (BTC) approaches this level, we will see significant sales. This will continue for a long time until all sellers are out. Only then will buyers take control and the price will exceed this area. Until now, we are at the first stage of these tests and the overly optimistic feeling in itself reflects the fact that the market has not yet inflicted as much suffering as possible. In other words, the price has little room for maneuver from here but it has a lot of leeway to lower. It would therefore be extremely unreasonable to be optimistic about Bitcoin (BTC) relying on the possibility of a short tightening.

[ad_2]

Source link