[ad_1]

Bitcoin is back, according to the long-time bull Tom Lee.

Despite the fall of cryptocurrency at the start of Friday's session, a symptom of concern over the legitimacy of another digital currency called Tether, the situation is on the rise and perhaps even already in a bull market, Lee told CNBC.

"Last year was terrible for crypto, a massive bear market, and we published an article this week that just highlighted … 11 signs indicating that, historically, it only occurs in a bull market. So I think the evidence is accumulating that there is a bull market. "Lee, who is Managing Partner and Director of Research at Fundstrat Global Advisors, said Thursday on" Futures Now ".

Of the 11 signs indicating that "crypto winter" is over, Lee's main bullish drivers for Bitcoin are related to blockchain, technical indicators and trading volumes.

The first sign appeared in January, when Lee's team noticed that blockchain trading volumes – a technology that some people are using to buy and sell bitcoin – have turned positive year-on-year. The crisis was fueled by turmoil in Venezuela and Turkey, where people who had lost confidence in their currencies may have opted for bitcoin, Lee said.

"By taking these two countries, they account for nearly 30% of the increase in chain activity, so this is significant," he said. "People say," Listen, I do not believe in using these local currencies. I do not trust banks. I will start using bitcoin. "And that's what makes the volume in the chain really take off."

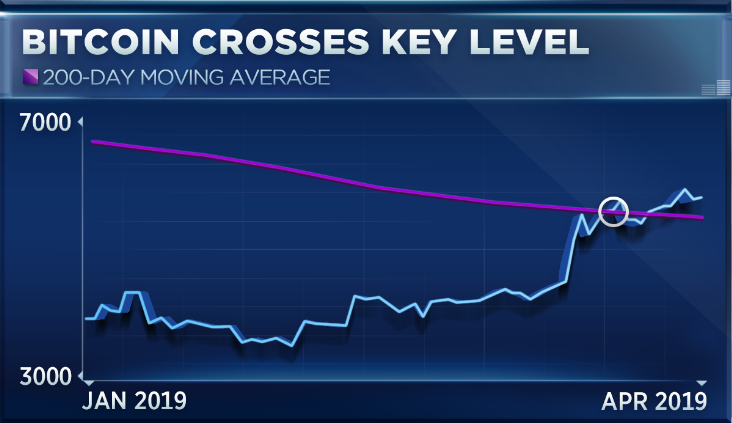

The second sign came in April, when bitcoin closed above its 200-day moving average, a widely accepted technical indicator of bullish momentum.

The third sign stems from a Fundstrat survey of over-the-counter brokers, which Lee says is "very important in terms of how institutional investors negotiate cryptography." They explained to the company that activity levels based on the number of customers had increased by 60% to 70% and that transactions per customer had increased.

"I think you see signs that the fundamentals are improving, that the techniques are improving and that there is now a real activity, basically, crypto hodlers," said Lee, using a sector term that refers to people who hold cryptocurrencies rather than trading or selling them. .

Lee's eight other bullish signs include the contraction in supply; a positive shift in Fundstrat's Bitcoin Misery Index; consensus among the "original" bulls of Bitcoin that the background was set for Bitcoin; and a recent "gold cross" for Bitcoin, or when the 50-day moving average exceeds 200 days.

All this, he said, shows that bitcoin is not over and that these catalysts are "likely" to lead it to unprecedented new heights "towards" 2020.

Lee, who had predicted a bull market for bitcoin in 2019 in March, added that the standard deviation of cryptocurrency compared to the S & P 500 – which is about 2.5 – this year – could also contribute to its rise.

"One thing to keep in mind is that every time the S & P took a big step forward (…), it almost always led to a big crypto hit later in the day. year, "he said. "So, I think … a standard deviation of 2.5 for bitcoin would bring the amount to $ 14,000.I'm not saying that's where it's going to go, but it's the magnitude of movement that would allow a catch-up. "

Bitcoins were traded Friday in a wide range due to the weakness of the broader cryptocurrency market, at around $ 5,100 per coin. In an interview with CNBC on Friday, Lee pointed out that Tether-related issues do not have "much effect on Bitcoin" because most people are "very attached because [they] do not want to be long bitcoin. "

[ad_2]

Source link