[ad_1]

Photographer: Andrey Rudakov / Bloomberg

Photographer: Andrey Rudakov / Bloomberg

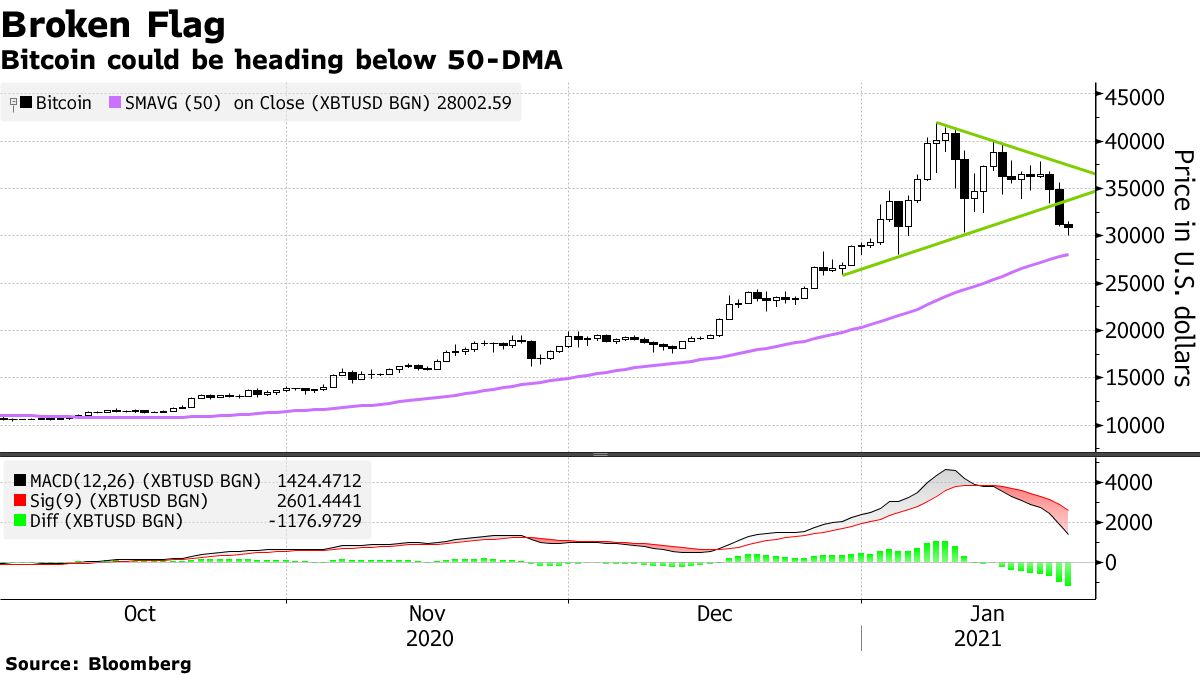

Bitcoin fell below $ 30,000 on Friday, extending a decline from an all-time high just two weeks ago and prompting new questions about the sustainability of the cryptocurrency boom.

The digital coin slipped 7.7% to around $ 28,818 in Asian trading before leveling off just above $ 30,000. Commentators have warned that a sustained decline below the latter level could portend further losses. The biggest cryptocurrency is on the way for one of its worst weeks since the pandemic rocked financial markets in March of last year.

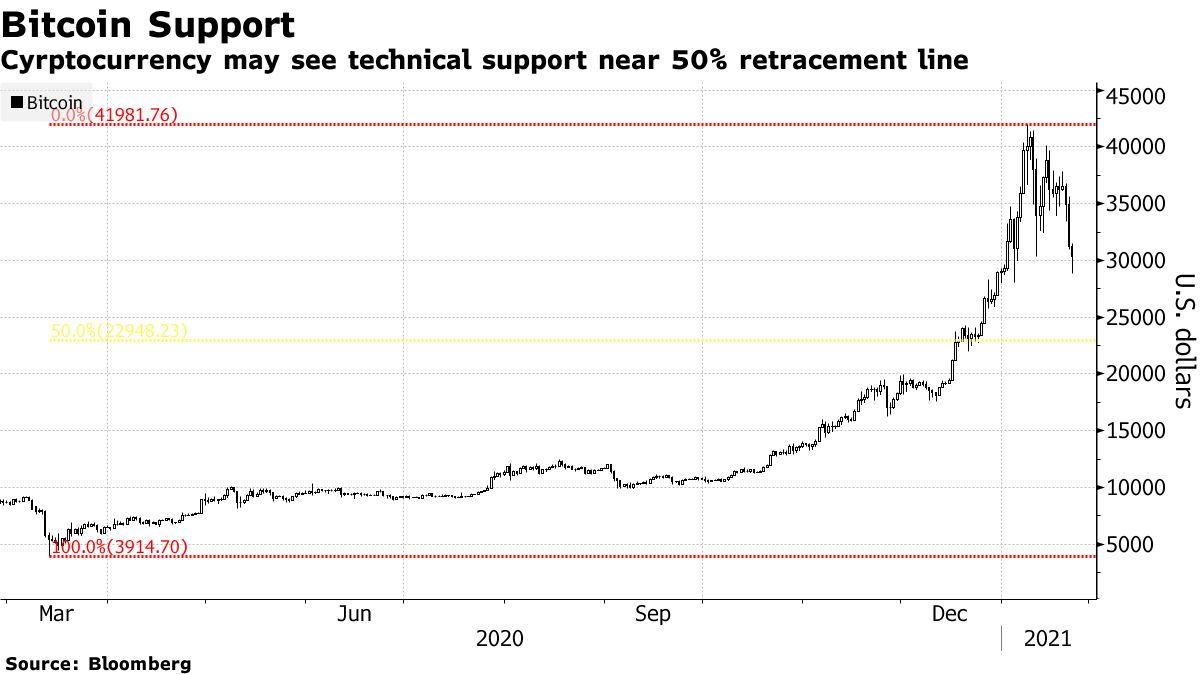

“This level looks very vulnerable and a breakout below is bad news in the short term for Bitcoin and cryptos in general,” Craig Erlam, senior market analyst at Oanda Europe, wrote in a note Thursday. “I wouldn’t be surprised to see a $ 20,000 test before too long.”

Bitcoin’s surge to a record high of nearly $ 42,000 on January 8 embodied the adoption of risk in stimulus-flooded financial markets. Some argue that Bitcoin is also emerging as a more mainstream investment with a role to play in hedging risks such as a weak dollar and faster inflation. Others see little more than the speculative mania as the digital coin has more than tripled in the past year.

Identifying who is primarily responsible for the Bitcoin rally is one of the many crypto mysteries – Bitcoin funds, momentum hunters, billionaires, day traders, corporations and even institutional investors have all been cited.

For example, Grayscale Investments, which initiated a Bitcoin Trust, considering the total inflows of more than $ 3 billion on its products in the fourth quarter. This week, BlackRock Inc. dipped its toes into the crypto universe for the first time, claiming that cash-settled Bitcoin futures are among the assets that two funds were allowed to purchase.

Recent comments by Janet Yellen may be among the reasons Bitcoin faded this week, said Jehan Chu, managing partner of blockchain consultancy Kenetic Capital in Hong Kong. During his confirmation hearing in the Senate, Yellen Noted crypotcurrency as an area of concern for the financing of terrorism and crime.

Describing these fears as “unfounded,” Chu said a “natural correction” is underway and profit taking will “not” reverse Bitcoin’s unprecedented assimilation into Wall Street’s DNA, leading to levels of $ 100,000 this year ”.

Some strategists are more skeptical. For example, UBS Global Wealth Management recently warned that nothing was preventing the erasure of renowned digital currencies amid regulatory threats and competitors issued by the central bank.

Bitcoin was trading at $ 31,190 at 1:09 p.m. in Tokyo on Friday. The larger Bloomberg Galaxy Crypto Index fell about 2.5%. Asian cryptocurrency stocks stocks, like those in Japan Monex Group Inc., also slipped.

– With the help of Mark Cranfield, Dave Liedtka and Olivia Raimonde

[ad_2]

Source link