[ad_1]

Bitcoin (CRYPTO: BTC) takes a break after running yesterday as the global cryptocurrency market cap rose 0.65% to $ 2.29 trillion.

What happened: The apex coin traded down 1.26% to $ 54,144.86 on a 24-hour basis. Over a seven-day period, BTC fell 23.69%.

Ethereum (CRYPTO: ETH), the second largest cryptocurrency by market cap, rose 1.95% over 24 hours to $ 3,611.94. For the week, ETH is up 19.58%.

On the theme of Shiba Inu Dogecoin (CRYPTO: DOGE) traded 0.85% higher at $ 0.25 over 24 hours. Over the past seven days, it has increased 20.99%.

See also: How to buy Bitcoin (BTC)

Self-proclaimed DOGE-Killer, SHIBA INU (SHIB), took breaks in a spectacular rally, falling 21.67% to $ 0.00002335. Over the past seven days, SHIB has gained 220.44%.

SHIB fell 21.74% and 24.05% respectively against BTC and ETH.

The best 24 hour winner was Ghost (FTM), which climbed 22.43% over 24 hours to $ 2.01. FTM climbed 64.57% during the week.

Why it matters: Delphi Digital, an independent research firm, noted that as BTC took a hiatus, Layer 1 projects and decentralized finance were once again in the limelight.

See also: Shiba Inu users say they can’t trade crypto on Coinbase Pro

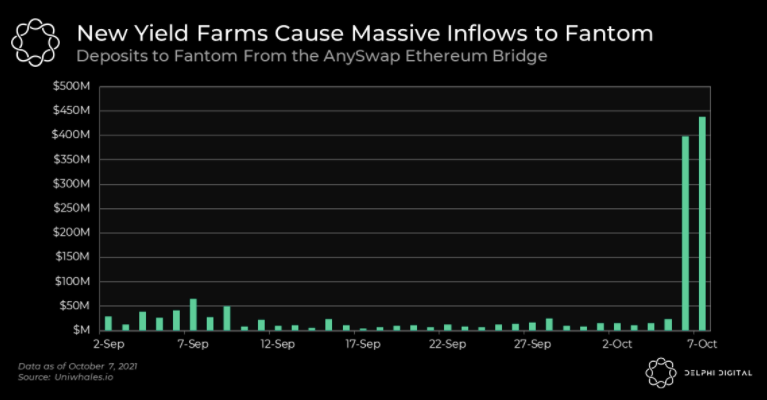

“Ethereum flows to Fantom averaged $ 10 to 25 million per day in September. But over the past two days, flows to Fantom have increased by an unprecedented amount thanks to a new farm of yield, ”wrote Delphi Digital in a market update.

New Yield Farms Spurring Fantom (FTM), courtesy of Delphi Digital

New Yield Farms Spurring Fantom (FTM), courtesy of Delphi Digital

Algorand (SOMETHING), avalanche (AVAX) and FTM all increased the total value locked in the past 40 days, according to Digital Delphi. The common link between all of these projects is the announcement of incentives that attract yield farmers.

The recent BTC rally was awarded to a large purchase order, with whales, or a single whale, buying close to $ 1.6 billion value of cryptocurrency on a centralized exchange in just five minutes, according to CryptoQuant, a chain analysis company.

$ BTC the price jumped + 6.4% in less than 2 hours, what happened?

1. Someone bought for $ 1.6 billion $ BTC via stock market orders in just 5 minutes

2. Bitcoin has decided where to go. A new ATH is possible

3. Greed in the crypto market. FOMO started?Check https://t.co/sfh8C2Kotp

– CryptoQuant.com (@cryptoquant_com) October 6, 2021

Some analysts, however, point the finger at the futures market and advocate caution.

QCP Capital, a Singapore-based digital economy trading company, said it has seen “bearish-type trades with the spot rally” in the futures segment, CoinDesk reported.

“A total of 1,200x BTC end-October BTC calls were sold yesterday, followed by the purchase of over 500x 50/45,000 puts end-October spread today. In the very short term, we might see corrective action on BTC prices. “

Read more : What is driving the adoption of Bitcoin, Dogecoin and Ethereum in India and Vietnam?

[ad_2]

Source link