[ad_1]

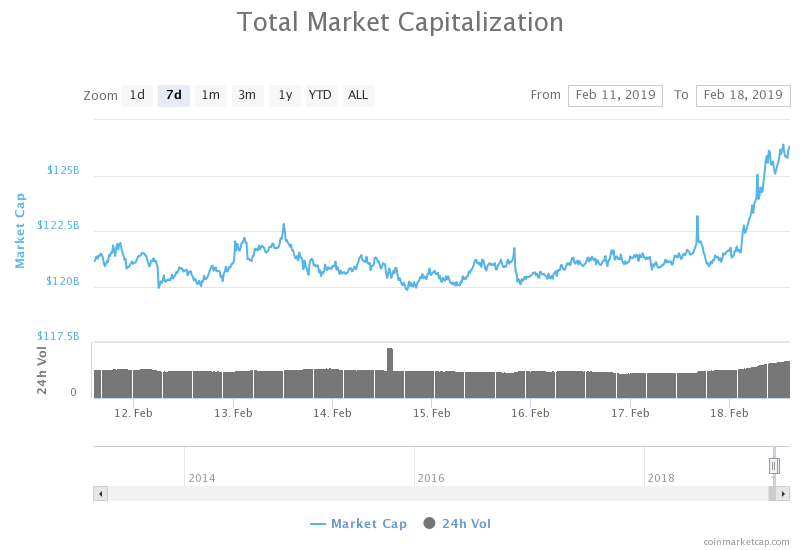

The cryptocurrency market began the week with an impressive recovery, rising from $ 120.91 billion to $ 126.391 billion a day.

The cryptocurrency market made considerable gains over the weekend. | SOURCE: COINMARKETCAP.COM

At 9:00 UTC, the world market capitalization of cryptography was estimated at 126.30, up 4.45% from Sunday's low, with the top 10 coins heading to their green territories. Bitcoin, the leading cryptocurrency in the index, gained 3.01% on a 24-hour adjusted trading schedule calculated by TradingView.com. Ethereum, the second largest cryptocurrency, did better by advancing 10% at the same time.

The top 10 crypto-currencies are all up, led by Ethereum. | SOURCE: COINMARKETCAP.COM

Bitcoin Cash, the Bitcoin clone project run by Roger Ver, was the second best-performing cryptocurrency in the top 10. It increased by more than 7% per 24-hour adjusted period. Stellar and XRP, at the same time, jumped nearly 2.80%. Competitor Ethereum EOS jumped more than 3.5%.

The worst-performing cryptographic currencies of the past 24 hours have been litecoin and tron. While the creation of Charlie Lee grew by only 1.16%, the project currency Justin Sun posted a profit of 0.08%.

American-Chinese trade war

The return of crypto bulls coincides with positive developments in global financial markets. With trade talks between the United States and China continuing this week in Washington, the two economies are seeking to conclude the "trade war" on a positive note. The President of the United States, Donald Trump, said that they would remove tariffs on China once they would approach a "real trade deal" with Beijing.

Important meetings and calls on the trade agreement with China, and more, today with my collaborators. Great progress has been made on so many different fronts! Our country has fantastic potential for future growth and greatness at an even higher level!

– Donald J. Trump (@realDonaldTrump) February 17, 2019

The announcement was followed by a dazzling response from the Asian market. Mainland China's shares posted stronger gains on Monday, which also boosted equity markets in the region. Stock markets in Japan, Australia, South Korea and Singapore also closed Monday on a positive note.

REPORT ON THE ASIAN MARKET (MONDAY) | SOURCE: CNBC

Until now, the cryptocurrency market has shown a strong intraday correlation with its Asian counterpart. The association is likely to continue as the trend moves towards the European session. According to CNBC analysts, the European market has had mixed beginnings. Resource stocks, which were exposed to China, led the gains. Nevertheless, pan-European shares remained unchanged during this morning's session.

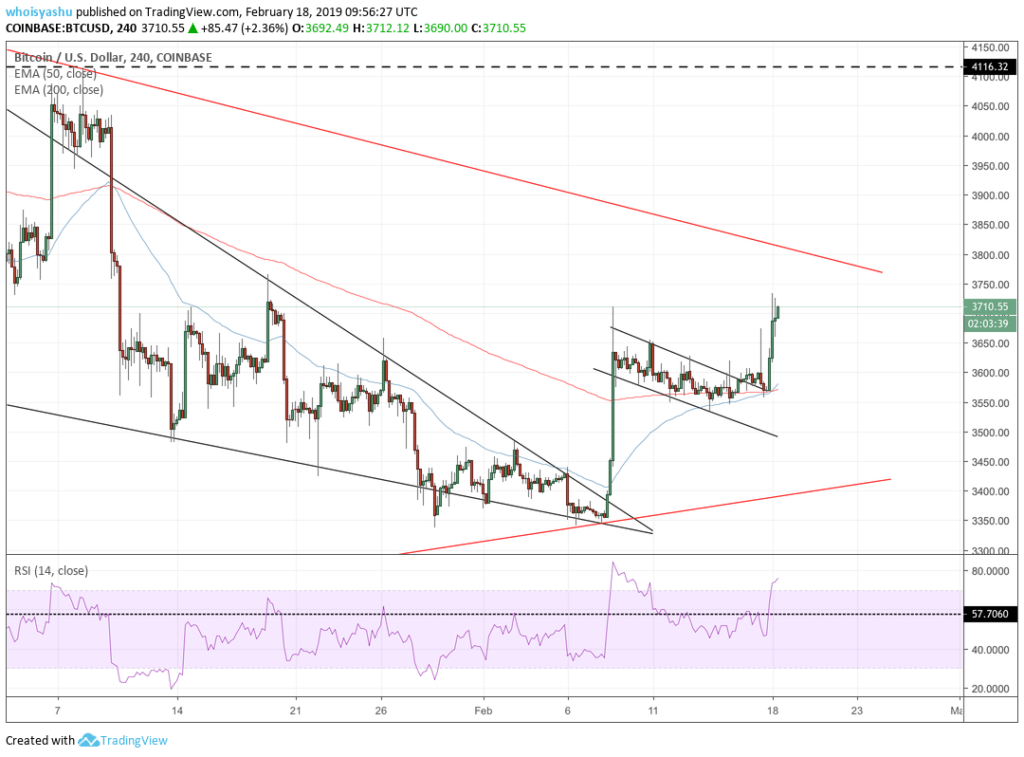

Techniques: Bitcoin and Ethereum

In examining individual cryptocurrency currencies, Bitcoin confirmed an upward trend after being removed from what was a bullish flag pattern all that time (we had also discussed a theory of the downside in this analysis). The BTC / USD rate now seeks to test a downward trend line in the medium term (shown in red in the graph below) for a possible rebound / escape.

The price of bitcoin jumped during Sunday trading. MAP 4H | SOURCE: COINBASE, TRADINGVIEW.COM

A slowing of volume and volatility may indicate a downside potential before testing the red trend line above. In the event of a trend reversal, the BTC / USD rate could find support for the 50-period moving average (indicated by the blue curve in the graph above).

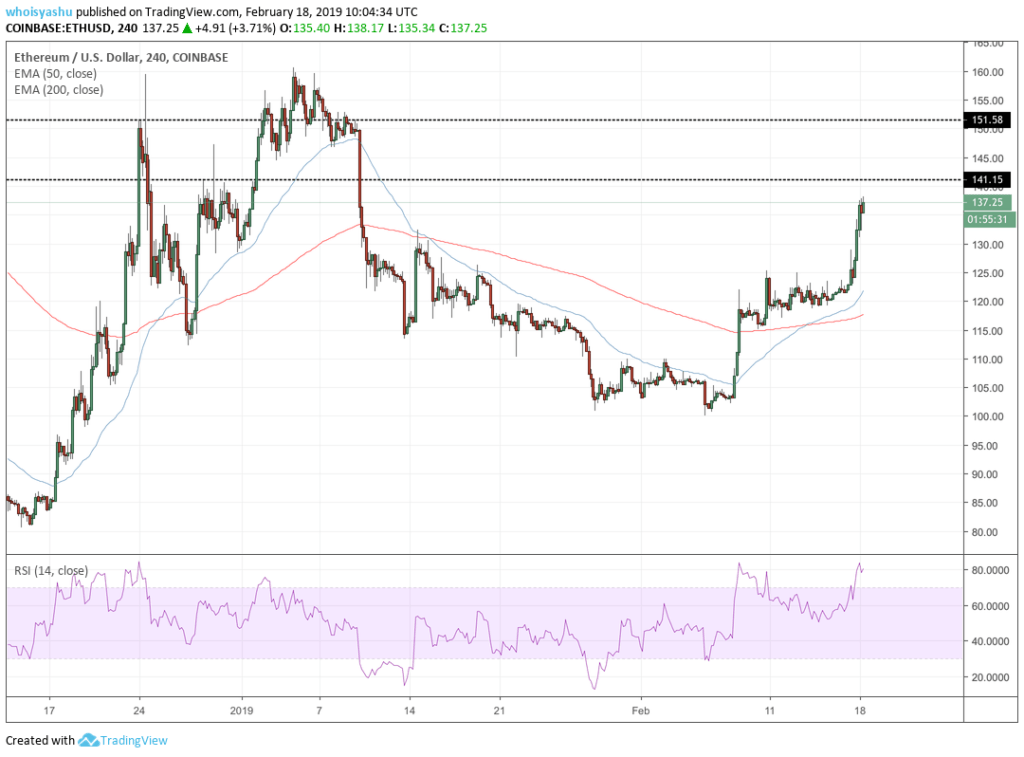

With regard to Ethereum, the best performing asset among the ten best performing coins, a potential deviation is possible in the area defined by $ 141-151.

Ethereum was the best-performing currency of large caps versus the dollar. MAP 4H | SOURCE: COINBASE, TRADINGVIEW.COM

At the same time, the cryptocurrency has a support in its moving average of 50 periods (the blue curve). The last weeks curve served as resistance during the downtrends and support during the upward trends. Therefore, the break below would confirm a big downward movement.

Click here for a table of Ethereum prices in real time and here for a Bitcoin price chart.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link