[ad_1]

Analysis provider Ecoinometrics posted a tweetstorm that shows the current downward spiral from Bitcoin’s all-time high is one of the “longest declines Bitcoin has had to manage during a bull market after the halving.” Moreover, on the same day, analyst and economist Julio Moreno pointed out in a recent blog post that “in bitcoin, volatility is your friend”.

Analyst discusses Bitcoin’s second longest pullback ahead of next price move

Most people in the industry understand that bitcoin (BTC) prices have seen better days and many onlookers are wondering when the crypto asset will rebound. The point is, we really don’t know, but people are taking advantage of previous chart patterns from past bull markets and have measured a number of time periods.

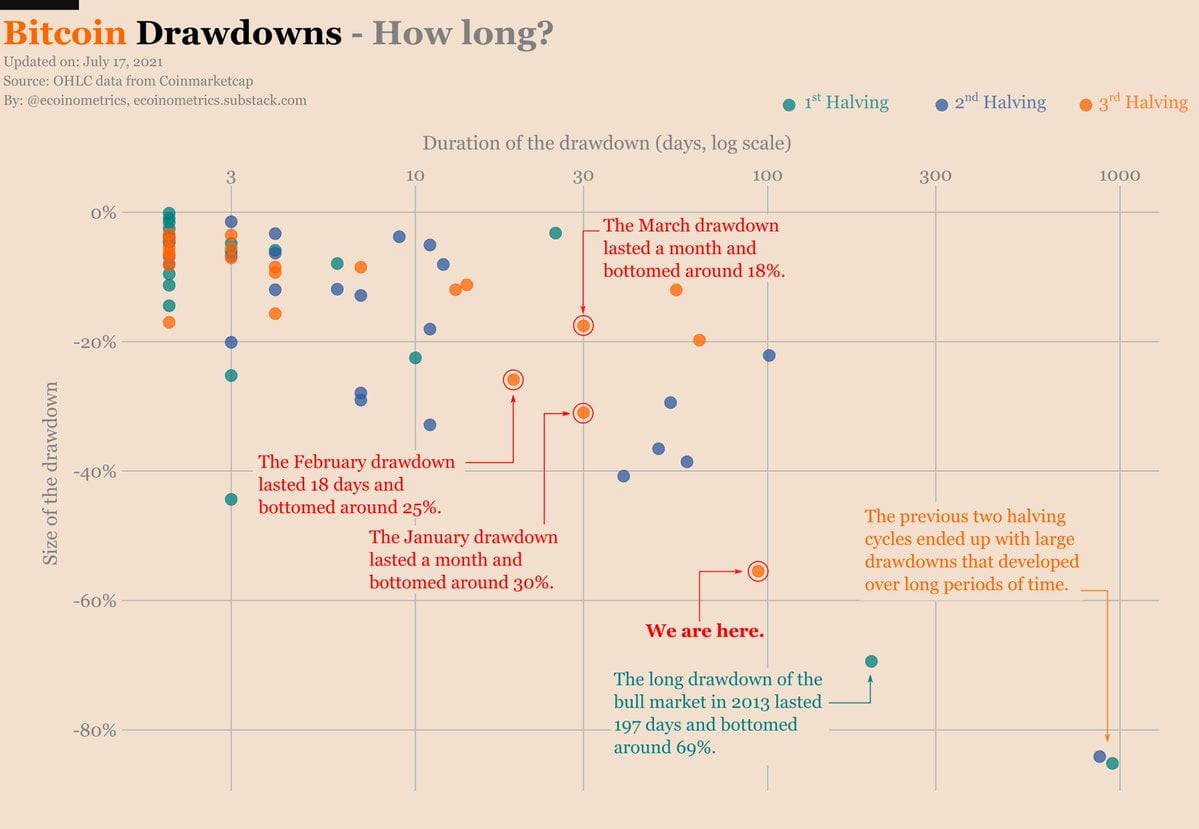

Recently, Bitcoin.com News has released at least two market reports that show speculators believe this bull run resembles action that took place in 2013. According to the analytics provider Ecoinometry, the current slowdown is the second longest drop since 2013 and there is still a lot of time on the clock.

“Bitcoin after halving [on] July 17, 2021 ”, Ecoinometrics tweeted. “431 days after the 3rd half [and] BTC at $ 31,678. Another week stuck in this draw, 95 days since the last ATH, at -55% below the ATH, and volatility continues to decline, ”added the analyst. The ecoinometry further underlined:

This is one of the longest drawdowns Bitcoin has faced in a bull market after the halving. But 95 days is still only half the duration of the big drawdown of 2013… In terms of price trajectory, this correction also looks very similar to 2013. If we continue like this, BTC will stay stuck around $ 30k for a certain time.

The analyst also added that bitcoin’s one-month volatility was also on the decline but “historically speaking it’s not particularly low.”

“So from that point of view, it’s possible that the trading range will stay quite narrow for longer,” Ecoinometrics concluded.

Analyst and economist Julio Moreno agrees with Ecoinometrics’ volatility assessment and shared a recent blog post he wrote on bitcoin volatility. Moreno’s report explains how people try to discredit bitcoin on price volatility, and his study asks whether or not “volatility [is] a bad thing.”

The analyst notes in his report that he doesn’t think volatility is necessarily a bad thing. “I would say no, because it increases with each cycle with the price gains. When is the price of bitcoin more volatile? Mainly at the top of the market, after a significant appreciation in prices, ”said Moreno’s report. Its bitcoin volatility report concludes:

What do changes in bitcoin’s price volatility imply about its future trend? Accumulation has been best at low levels of volatility and is usually reached before a big price move.

What do you think of Ecoinometrics valuations and Julio Moreno’s reports? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Ecoinometry

Warning: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link