[ad_1]

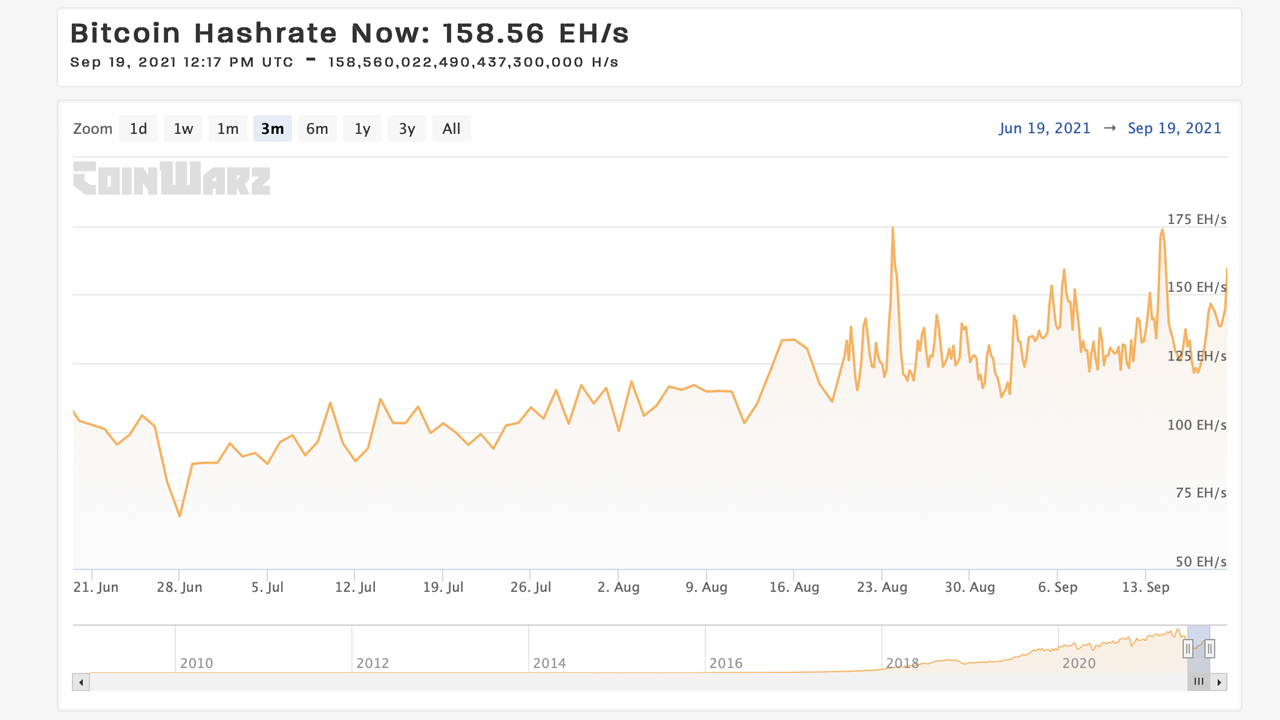

Bitcoin’s hashrate has increased over the past two weeks, hitting 174 exahash per second (EH / s) twice since June 28. Currently, Bitcoin’s network hashrate is trading at 158 EH / s, up 128% from the low of 83 a few days ago when it hit 69 EH / s. Meanwhile, the unknown hashrate has declined significantly as 96% of mystery miners registered at the end of June have disappeared.

Bitcoin Hashrate has been gaining strength since the end of June

About 83 days or more than two months ago, Bitcoin’s hashrate had fallen to a low of 69 exahash per second (EH / s) on June 28. The fall was initiated by the crackdown in China against Chinese mining operations and a large majority of facilities forced to relocate.

Even long before the Chinese government’s crackdown, Chinese miners were already on the move, and research from the Cambridge Bitcoin Electricity Consumption Index (CBECI) project indicated that by April 2021, China’s hashrate dominance had fallen to 46. %.

Since June 28, Bitcoin’s hashrate has risen significantly, climbing 128% in the past 83 days. On two occasions, the hashrate rose to 174 EH / s on August 23 and to 173.7 EH / s on September 14. At the time of writing, the hashrate is around 158 EH / s and has held steady above 125 EH / s. area in the past two weeks.

A number of other hashrates, from various exploitable blockchains, have also increased significantly. Ethereum’s overall hashrate had fallen to 504 terahash per second (TH / s) over two months ago and today it is 740 TH / s. Ethereum’s hashrate has increased by approximately 46.82% since June 25, 2021.

Bitcoin’s difficulty set to increase again, unknown hashrate leaves network

Bitcoin (BTC) also expects a further increase in difficulty after four consecutive increases in mining difficulty from the height of block 693,504. The BTC network hashrate has jumped every two weeks with increases of 6.03 %, 7.31%, 13.24% and 4.54% from block height 699.552.

The metrics show that the current difficulty is $ 18.42 trillion and that in less than two days an increase is expected. At current hash speeds, the change is estimated to be about 3.52% greater than today at $ 19.06 trillion.

BTC is getting harder to mine and at 19.06 trillion it is slowly approaching the difficulty seen before June 13, 2021. Prior to that date, Bitcoin’s mining difficulty was above the 20 trillion area and was much harder to find blocks since Jan 9. , 2021 at block height 665,280.

Before BTC block height 665,280, mining difficulty was 18.6 trillion or less. Today, the three main mining pools dedicated to the BTC chain hashrate are F2pool with 26.06 EH / s, Antpool with 22.68 EH / s and Poolin with 21.46 EH / s. Interestingly, the unknown or stealthy hashrate miners dropped to 306.55 petahash per second (PH / s) or 0.22% of the network.

For some contrast, on June 22, 2021, an unknown hashrate was capturing around 10 EH / s of Bitcoin hash power at that time and over 12% of the global SHA256 hashrate. The metrics show that the drop from 10,000 PH / s to 306.55 PH / s means that 96.93% of the stealth hashrate is all but gone within 89 days.

What do you think of the steady increase in Bitcoin’s hashrate over the past few months? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, coinwarz.com,

Disclaimer: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link