[ad_1]

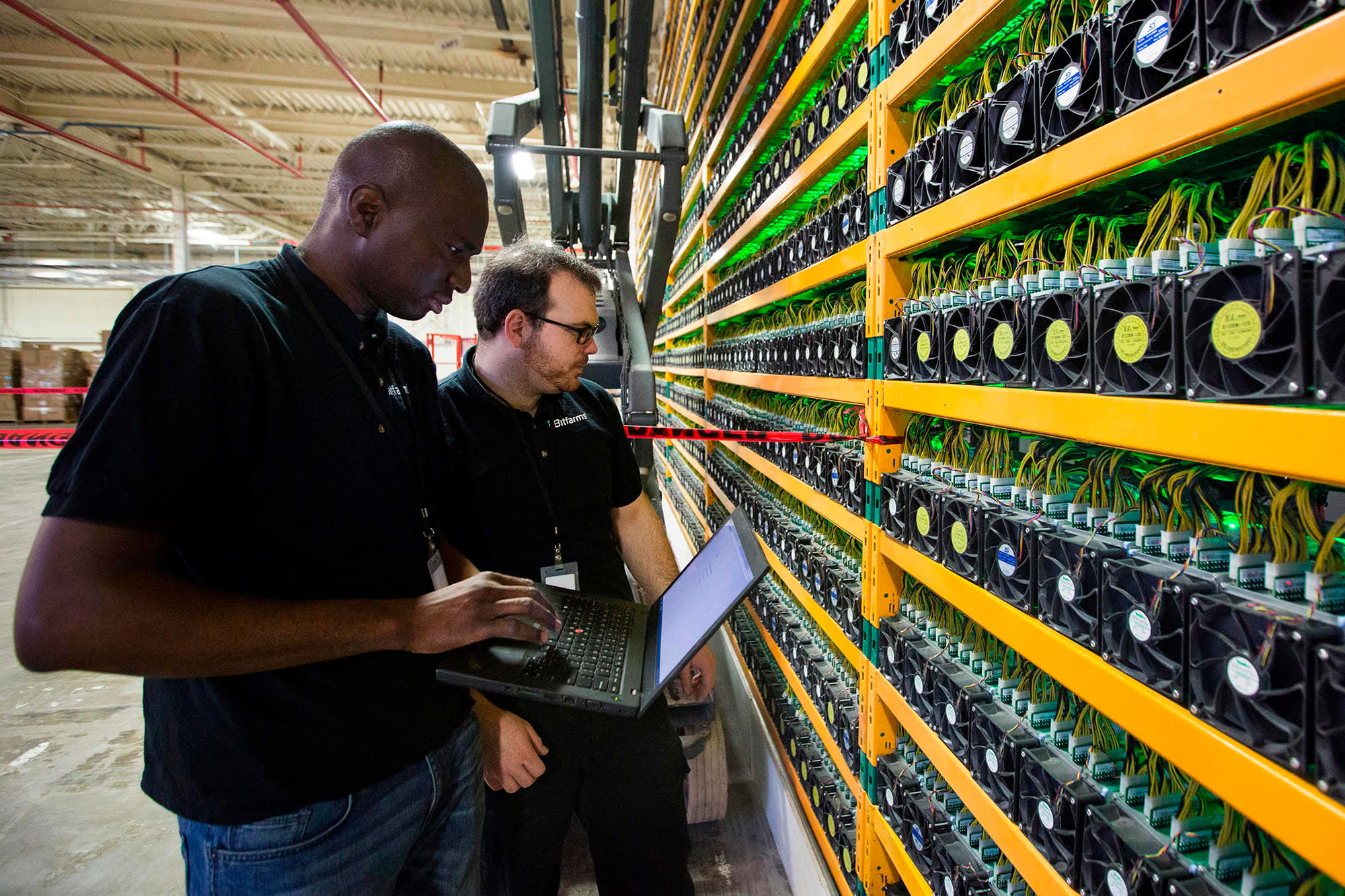

Two technicians work in a bitcoin mining facility in Quebec.

lars Hagbarg | AFP | Getty Images

For years, bitcoin critics have slandered the world’s largest cryptocurrency for polluting the planet. But new data from the University of Cambridge shows that the geography of mining has changed dramatically in the past six months, and experts tell CNBC it will improve bitcoin’s carbon footprint.

The great crackdown on crypto in China this spring has sparked a chain reaction in the mining world.

On the one hand, half of the world’s bitcoin miners were taken offline virtually overnight. Fewer people mining meant fewer machines running and less energy consumed overall, which reduced bitcoin’s environmental impact.

Beijing’s new crypto rules have also permanently taken many older and more inefficient equipment offline.

And most importantly, with China shutting down its doors to cryptocurrency mining sparked massive migration. Miners are now moving towards the cheapest energy sources on the planet, which are mostly renewable.

“The bitcoin network is ruthless in its pursuit of the lowest cost,” said Mike Colyer, CEO of digital currency company Foundry. “Miners around the world are looking for renewable stranded energy. It will always be your lowest cost. Net-net, it will be a big win for bitcoin’s carbon footprint.”

The mining exodus from China

China has long been the mecca of the crypto mining world, accounting for nearly three-quarters of all bitcoin miners at its peak, according to the Cambridge Center for Alternative Finance. But after Beijing decided to evict its miners in May, more than 50% of the hashrate – the collective computing power of miners around the world – abandoned the network.

Today, bitcoin consumes around 70 terawatt hours of energy per year, or 0.33% of the world’s total electricity production. That’s almost half of what it was in May and roughly equates to the annual energy consumption of countries like Bangladesh and Chile.

The exodus from China also means that a lot of older mining equipment that was likely to be retired for a long time will never be put back into service.

“It got a lot of the most energy efficient platforms off the ground, probably forever,” explained Alex Brammer of Luxor Mining, a cryptocurrency pool designed for advanced miners.

Colyer says the global bitcoin network will now be mostly made up of more efficient platforms that get about double the hash power for the same amount of electricity. “This continues to dramatically improve the safety / energy ratio of the bitcoin network,” he said.

But not all Chinese miners fall into obscurity. Many have started repatriating elsewhere, gravitating to the world’s cheapest energy sources.

“The good thing about bitcoin that is underestimated by many naysayers is that it’s … like a portable market; you can bring it straight to the power source,” Steve explained. Barbour, founder of Upstream Data, a company that manufactures and provides portable mining solutions for oil and gas installations.

Because large-scale miners compete in a low-margin industry, where their only variable cost is usually energy, there is an incentive to migrate to the cheapest energy sources in the world.

“They have to constantly reduce their electricity costs, which is their number one expense, in order to be competitive,” said Ria Bhutoria, former research director for Fidelity Digital Assets.

Data shows large numbers of these miners are heading to cheaper pasture in the United States

The United States has quickly become the new hotspot for the world’s crypto miners. In the past six months, the country has dropped from fifth to second and now accounts for almost 17% of all global bitcoin miners. Although China still held the top spot in April, with a share of 46%, the US market share is likely much higher now since the Chinese government started the miners in May.

US-based bitcoin mining operators have seen a huge increase in their business. Whit Gibbs, CEO and founder of Compass, a bitcoin mining service provider, said retail hardware and hosting sales have increased nearly 300% since mid-June.

Darin Feinstein, founder of Blockcap and Core Scientific, said he saw a rapid increase in mining operations seeking to relocate to North America, primarily the United States, and Fred Thiel of Marathon Digital, another major player in the industry. mining company, told CNBC that if the roughly 500,000 former Chinese mining rigs looking for homes in the United States are deployed, that would mean North America would account for nearly 40% of the global hashrate by the end of 2022.

In the long run, this is good news for bitcoin’s carbon footprint.

Clean energy on the rise in the United States

Energy consumption is not equivalent to carbon emissions. While it is relatively easy to determine the amount of energy consumed by the bitcoin network, it is much more difficult to determine its carbon footprint.

An accurate reading of bitcoin’s carbon emissions would require an exact knowledge of the energy mix used to generate the electricity used by each bitcoin mining operation. A unit of hydroelectricity, for example, does not have the same environmental impact as an equivalent amount of electricity from coal. And bitcoin mining operations in China were known to both.

But overall, the market is pushing North American energy sources to go greener.

Each year, the investment bank Lazard publishes a breakdown of energy costs by source. Its 2020 report shows that many of the most common renewable energy sources are either equal or cheaper than conventional energy sources like coal and gas. And the cost of renewable energy keeps dropping.

Thiel says most new miners in North America will be powered by renewables, or gas offset by renewable energy credits. Gibbs estimates that more than 50% of bitcoin mining in the United States is powered by renewable energy.

Miners migrating to North America are also preparing for a future in which their energy use is questioned by putative investors – and possibly regulated.

Brammer has helped Chinese clients find new homes. He says most are aware of the political and normative winds in North America and want to protect themselves against regulatory risks in the future by establishing new facilities in locations primarily powered by renewables.

“The bigger ones are also looking at the potential to go public or looking for investors to help them grow,” Brammer told CNBC. “They realize that public procurement today has no appetite for extracting proof of work fueled by non-renewable resources. [energy sources]. I haven’t even had a discussion yet on a deal involving coal-fired power, which makes us happy. “

Bitcoin mining engineer Brandon Arvanaghi told CNBC that in the long term, the migration to the United States, where innovation around bitcoin and renewables is already underway, will be a major boost to the energy mix of the bitcoin.

“Places like Texas have cheap electricity, in large part thanks to wind power subsidies,” Arvanaghi said.

Miami Mayor Francis Suarez also popularized the idea of mining bitcoin with nuclear power in Florida.

“And all of this is largely voluntary – the federal and state governments haven’t even gotten involved in demanding a renewable mix,” Arvanaghi continued.

Then there is Kazakhstan

However, not all minors head to renewable destinations.

Kazakhstan is now just behind the United States in terms of share of the global bitcoin mining market, with around 8% of all crypto mining activity. It is home to coal mines that provide cheap and abundant energy, but also significant emissions of carbon dioxide.

However, several mining experts told CNBC they believe China’s neighbor Kazakhstan is only a temporary stopover on a longer migration to the west.

Brammer sees large miners going there in the short term with older generation equipment. “But as older generation machines reach the end of their lifespan, these companies are likely to deploy new machines in more stable, energy efficient and renewable jurisdictions,” he said.

A law newly signed by the president that will introduce additional taxes for crypto miners from 2022 is also likely to dampen Kazakhstan’s popularity.

“This will dramatically change the incentives for people to deploy capital in Kazakhstan,” Brammer said.

[ad_2]

Source link