[ad_1]

The indicator, known as the bearish divergence of the Relative Strength Indicator (RSI), signals a downward trend and a decline in momentum.

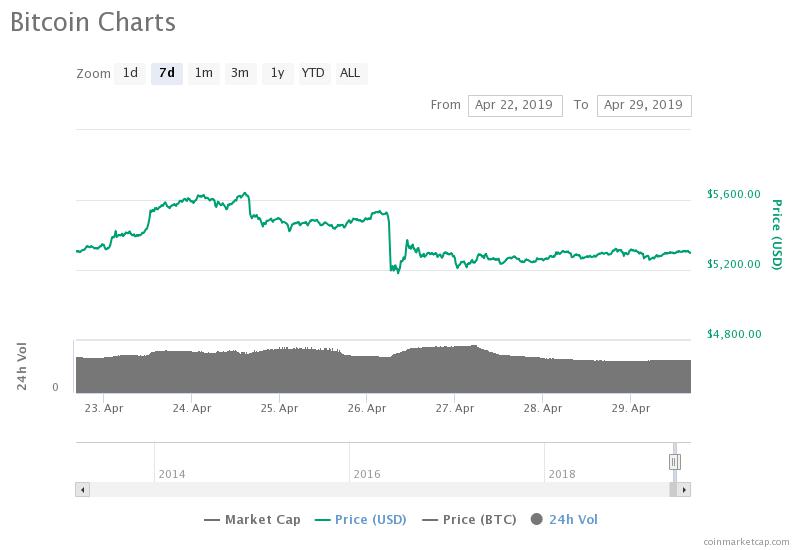

The price of bitcoin fell slightly last week (source: coinmarketcap.com)

The RSI is generally used by traders to evaluate the trend momentum of an asset or a market. A bearish divergence occurs when the price of an asset, in this case bitcoin, rises while the RSI drops, suggesting a lack of momentum.

Although the bearish divergence of the RSI does not necessarily indicate that the price of bitcoin would fall quickly in the short term, this shows that the asset should be strong enough to avoid a reversal of the trend.

Can Bitcoin overcome short-term vulnerability?

The decline in Bitcoin's momentum was not triggered by technical factors. On the contrary, the Tether scandal (USDT) and New York's attorney general's office suing iFinex, the company that oversees Tether and Bitfinex, caused a 7% drop in the price of bitcoin.

The New York Attorney General's Office alleged that Bitfinex mismanaged Tether's $ 850 million cash reserve in an attempt to "hide" the loss of the company.

According to the official document, Bitfinex reportedly sent $ 850 million to Crypto Capital, a Panama-based "bank" that was working with stock exchanges such as the defunct QuadrigaCX. Bitfinex has failed to recover the $ 850 million.

"Our investigation revealed that trading platform operators 'Bitfinex', who also control the virtual currency 'Tether', pledged to conceal the apparent loss of 850 million dollars of funds from clients and businesses combined. Said Attorney General Letitia James.

The Tether controversy had a negative impact on the short-term trend of bitcoin and forced the dominant cryptocurrency to undergo a reversal of the RSI trend.

"2D study of the bear division in RSI: in the last 5 years, there have been only 5 divergence RSI bearish on the 2D chart. Today will mark the 6th. The average draw after confirming these previous divs before a significant rebound / reversal was -44.25%, "a trader it is noted.

According to data provided by OnChainFX, the actual daily cash volume of bitcoins has increased from approximately $ 500 million to $ 246 million over the last three days, falling below the average daily volume of assets at the beginning of the year. March.

Bitcoin could deviate from the downward divergence of the RSI if market volume continues and the price of bitcoin engages a vigorous attempt to escape the $ 5,000 to $ 6,000 range, which skeptics see as a important range for breaking BTC.

Another beautiful card. If bitcoin can not bounce back to at least 5k-6k soon, it's a very bad sign for cyberbulls. And if the yellow line breaks down at some point, even the HODLers need GTFO. $ BTC $ XBT pic.twitter.com/FqqyzE1mhb

– Dow (@mark_dow) December 27, 2018

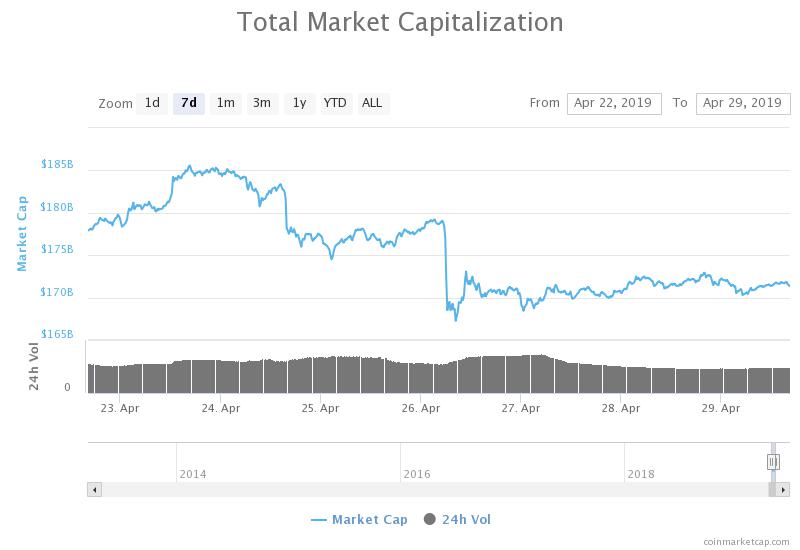

Over the last seven days, due to the Tether incident, the valuation of the cryptocurrency market dropped by about $ 14 billion, prompting many traders to be wary of the short-term trend of this asset.

The valuation of the cryptography market has decreased by $ 13 billion in the last 7 days (source: coinmarketcap.com)

Some powerful cryptocurrencies

Outside of its strategic partnership with Jaguar Land Rover, the price of IOTA has increased by 16% against the US dollar.

As part of this partnership, Jaguar Land Rover will use crypto-currencies to encourage users in the future, as the automotive market turns to autonomous automotive technology.

"In the future, an autonomous car could go to a charging station, recharge and pay, while its owner could choose to participate in the sharing economy – earn rewards by sharing useful data , such as warning vehicles in traffic jams, "Jaguar Land Russell Vickers, Rover software architect, said.

[ad_2]

Source link