[ad_1]

Photographer: Chris Ratcliffe / Bloomberg

Photographer: Chris Ratcliffe / Bloomberg

Want to know every morning what’s hot in Asian markets in your inbox? Register here.

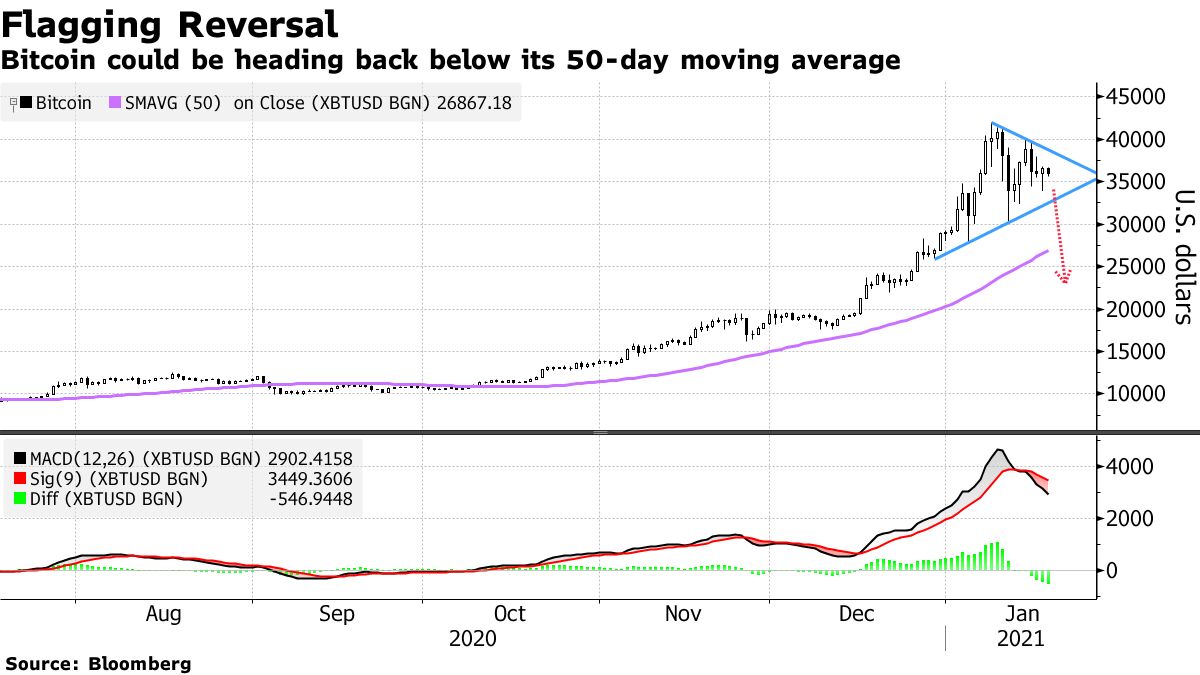

Bitcoin pulled back from the $ 40,000 level again on Monday, a drop that could point to more losses based on the latest analysis from strategists at JPMorgan Chase & Co.

The cryptocurrency could be affected by an exodus of trend-following investors unless it can soon “burst” above $ 40,000, a team including Nikolaos Panigirtzoglou said. The demand model for Bitcoin futures and the $ 22.9 billion Grayscale Bitcoin Trust will help determine the perspectives, they added.

“The flow in the Grayscale Bitcoin Trust would likely have to maintain its $ 100 million per day pace over the next few days and weeks for such a breakout to occur,” the strategists wrote in a note on Friday.

Traders looking for clues on investor appetite for risk were taken aback by Bitcoin’s astonishing rally and the turbulent 12% drop from a record high of nearly $ 42,000 on January 8. the pandemic – and the fear that some of these gains may turn out to be unsustainable.

JPMorgan strategists said Bitcoin was in a similar position end of November, except with $ 20,000 as a test. Flows of institutional investment in the Grayscale Trust have helped the world’s largest cryptocurrency extend its rally, they wrote.

Traders following the trend “could propagate last week’s correction” and “momentum signals will naturally deteriorate by the end of March” if the price of Bitcoin does not exceed $ 40,000, have they declared.

Bitcoin fell about 4% to $ 35,100 at 1:14 p.m. in Tokyo on Monday. Ether, another popular digital coin, fell 5% to $ 1,200.

What resulted in the near-quadrupling of the price of Bitcoin throughout the year remains unclear. Commentators cited day traders, high net worth buyers, hedge funds, corporations and even signs of interest from long term investors like insurers.

Bitcoin supporters say it is maturing as a hedge against dollar weakness and the possibility of faster inflation in a recovering global economy. Others say its defining characteristic remains speculative booms followed by busts.

– With the help of Mark Cranfield

(Updates with the latest price movements from the first paragraph.)

[ad_2]

Source link