[ad_1]

According to JPMorgan Chase & Co., cryptocurrency enthusiasts who rely on Bitcoin to rebound above the $ 40,000 level face a challenge due to weak demand for the largest digital asset tracking fund.

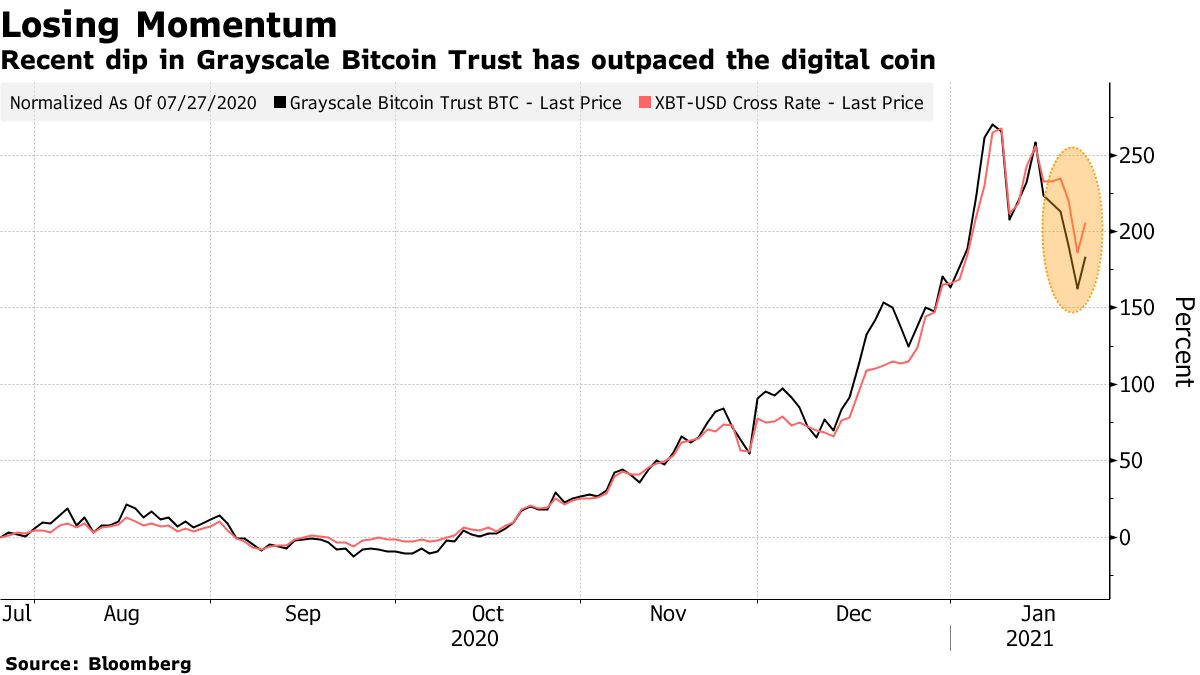

The pace of flows in the $ 20 billion Grayscale Bitcoin Trust “appears to have peaked” based on four-week moving averages, JPMorgan strategists led by Nikolaos Panigirtzoglou said in a note on Friday. The fund slipped 22% in the last two weeks through January 22, surpassing a 17% drop in Bitcoin during the same period.

Lily: Biggest Crypto Fund’s 40% Premium Evaporates During Merger

“At the moment, the institutional flow impetus behind the Grayscale Bitcoin Trust is not strong enough for Bitcoin to exceed $ 40,000,” the strategists said. They added that “the risk is that dynamic traders will continue to unwind Bitcoin futures positions.

Bitcoin’s searing rally lost momentum after the largest cryptocurrency peaked near $ 42,000 on January 8. bubble, similar to the 2017 mania that preceded a rapid collapse.

“The short-term equilibrium of risks is always skewed downwards,” JPMorgan strategists said.

In a separate analysis, Adam James with OKEx Insights found at least a few long-term Bitcoin holders – the so-called “whales” – and miners likely sold to institutional investors during the 2020 rally, as age Average of coins traded increased from in October and has remained high since.

“Old school Bitcoiners sold some of their old bags to new institutional buyers with new, extremely large bags to fill,” James wrote. OKEx Insights is affiliated with the OKEx crypto exchange.

Bitcoin rose about 2% to $ 32,700 at 11:43 a.m. in Tokyo on Monday. The digital coin is still showing a gain of around 260% over the past year, despite losing around $ 10,000 from this month’s all-time high.

[ad_2]

Source link