[ad_1]

Short films in bitcoins have risen sharply in recent weeks to reach a monthly high, an indicator that could suggest a decline in investor confidence in the dominant cryptocurrency.

Short films remain an unconvincing indicator of sentiment in the cryptocurrency market, as analysts' view of the impact of short-term contracts on the price of bitcoin differs quite steadily.

Speaking to NCC, technical analyst and trading cryptocurrency "Hsaka" said the shorts did not necessarily reflect the sentiment of investors in the market.

Pressing a possibility for Bitcoin?

In most markets, investors generally associate short positions with a negative connotation, as this demonstrates investors' expectations that a particular asset or market will lose value in the short term.

However, on the Bitcoin market, the rise in short issues often gives investors the opportunity to move towards tight pressure, short contracts being pushed out of the market and forced to buy Bitcoins at a lower price, pushing the higher asset price.

As such, Hsaka stated that traders often used short films to supplement their narrative and that as an indicator, they did not describe the future trend of the market.

The merchant stated:

To be honest, I try not to over look the short or long story. Looks like I'm reading tea leaves. The interpretation can be modified to adapt one's own biases.

We have seen this happen many times before. The shorts break the ATH, everyone starts talking about huge pressure causing a huge BTC pump. The pump never arrives and the shorts gradually normalize.

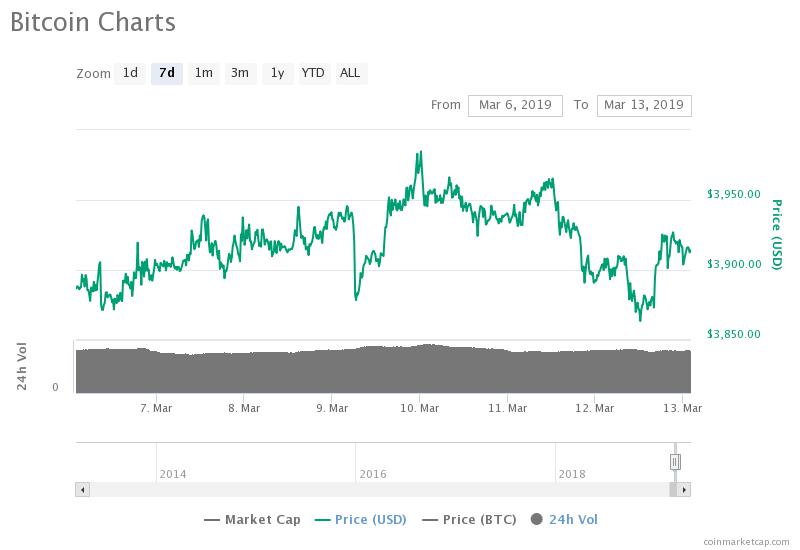

The increase in short-term contracts may have been caused by the increasing uncertainty with regard to the short-term performance of Bitcoin.

In the previous cases where BTC had experienced a long period of stability, it had recorded a sharp drop in price.

In November, for example, after months of stability in the $ 6,000 region, BTC quickly plunged to $ 3,000, eventually reaching an annual low of $ 3,122 in December.

Current landscape of Bitcoin market

Tokens and alternative crypto-currencies posted record gains in one day in recent weeks. Tokens such as IXEC RLC and Zcoin posted gains ranging from 40 to 70% against Bitcoin and the US dollar.

As the dominant cryptocurrency, Bitcoin still represents the macro landscape of the cryptocurrency market, and according to Cryptocurrency analyst Satoshi, MBA, the value of alternative cryptocurrencies could fall rapidly if BTC did not test the cryptocurrency levels. resistance of the keys higher than 4 000 USD.

$ BTC update:

That's the range I'm watching.

The only reason I think BTC is important at the moment is that I'm expecting a big dump in altcoin by the time BTC starts making bigger moves.Altcoins are safe as long as BTC remains lethargic.

I do not expect it to last, though. pic.twitter.com/ZkAPhpQzS9– DonAlt (@CryptoDonAlt) March 11, 2019

If Bitcoin manages to regain momentum and initiate significant upward movements, the analyst said the rapid movements in alternative cryptocurrency prices would continue.

"Very optimistic about alternative crypto-currencies today, many of them stand out over the months and collapse. But what I watch carefully is what Bitcoin is doing with the trend line of the year and the long-term resistance. If we go out, the real season begins. Otherwise, the alternative part of cryptocurrency ends, "says the analyst. has explained.

[ad_2]

Source link