[ad_1]

Photographer: Sarinya Pinngam / EyeEm / Getty Images

Photographer: Sarinya Pinngam / EyeEm / Getty Images

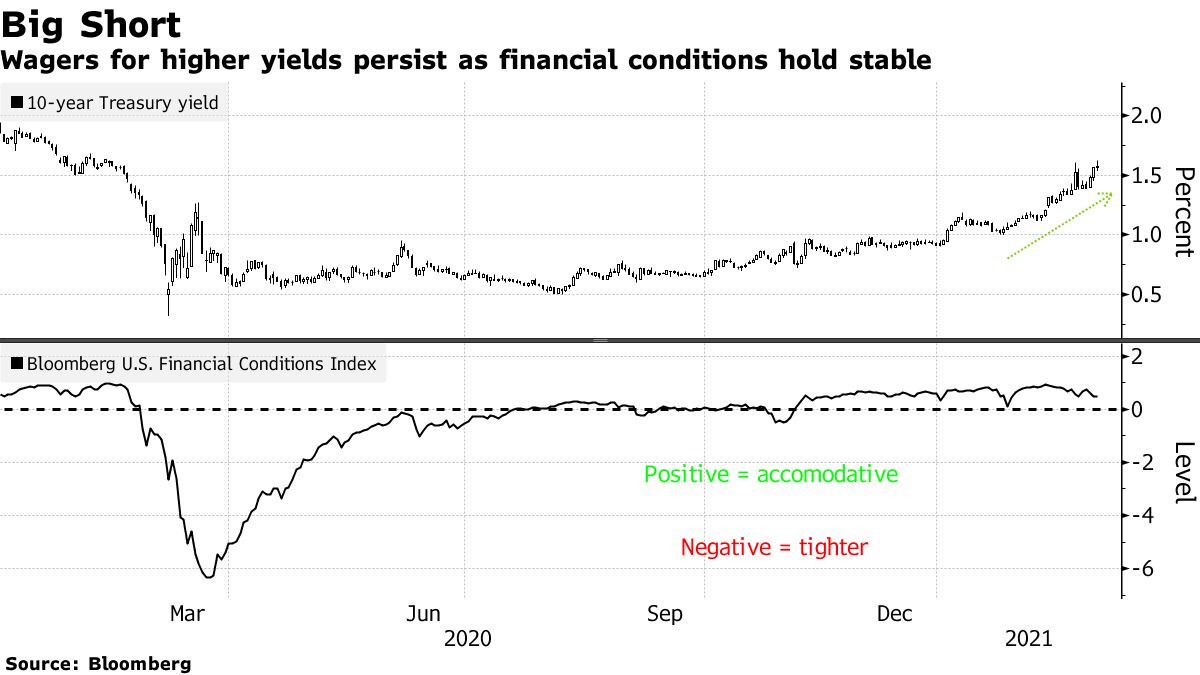

It is not only in stocks itself that the plight of short sellers is a key theme. Short bets are increasingly popular in the $ 21 trillion treasury bill market, with crucial implications for all asset classes.

The 10-year benchmark yield hit 1.62% on Friday – the highest since February 2020 – before immersion purchases from foreign investors have emerged. Stronger-than-expected job creation and appearance of Federal Reserve Chairman Jerome Powell lack of concern, for now, about rising costs of long-term borrowing has encouraged traders. In a telltale sign of the way they lean, demand to borrowing 10-year notes on the repo market is so important that rates have turned negative, possibly as part of a move to short the maturity.

The trio of upcoming fiscal stimulus, super-easy monetary policy, and an accelerated vaccination campaign are helping to shed light on a post-pandemic reality. The bearish bond scenario naturally carries risks. More importantly, yields could rise to the point of scaring stocks and tightening financial conditions in general – a key indicator on which the Fed focuses to guide its policy. Even so, Wall Street analysts don’t seem raise the end-of-year yield forecasts fairly quickly.

“There is now a lot of tinder set on this fire for higher returns,” said Margaret Kerins, global head of fixed income strategy at BMO Capital Markets. “The question is, how the higher yields are too high and really put pressure on risky assets and push Powell to act” to try to reduce them.

Stock prices have already shown signs of vulnerability to rising yields, especially technology-intensive stocks. Another area at risk is the housing market – a positive point for the economy – with mortgage rates jump.

Soaring yields and growing confidence in the economic recovery prompted a large number of analysts to recalibrate 10-year rate expectations last week. For example, TD Securities and Societe Generale raised their year-end guidance to 2% from 1.45% and 1.50%, respectively.

Asset managers, for their part, returned to the shortest net short on 10-year notes since 2016, according to the latest data from the Commodity Futures Trading Commission.

Auction pressure

In the coming days, however, BMO is eyeing 1.75% as the key next step, a level last seen in January 2020, weeks before the pandemic plunged markets into a chaotic frenzy.

A new dose of long-term supply next week may make short positions even more attractive, especially after Record weak demand for last month’s 7-year auctions served as the trigger to push 10-year yields above 1.6%. The Treasury will sell a total of $ 62 billion in 10- and 30-year debt.

As inflation and growth expectations take flight, traders are signaling that they expect the Fed may need to react faster than expected. Eurodollar futures now reflect a quarter point rise in the first quarter of 2023, but they are starting to suggest it could happen at the end of 2022. Fed officials plan to hold rates close to zero until at least the end of 2023.

So, as the market leans toward higher returns, the interplay between bonds and stocks is bound to be a major focus going forward.

“There is certainly this momentum, but the question is to what extent risky assets adapt to the new paradigm,” said Subadra Rajappa, head of US rate strategy at Societe Generale. “We’ll be watching over the next week, when the dust settles after payroll data, how Treasuries react and how risky assets react to rising yields.”

What to watch

- The economic calendar

- March 8: Wholesale sales / stocks

- March 9: NFIB Small Business Optimism

- March 10: MBA mortgage applications; IPC; average weekly earnings; monthly budget statement

- March 11: jobless claims; Consumer comfort Langer; JOLTS jobs: evolution of household net worth

- March 12: PPI; University of Michigan sentiment

- Fed calendar empty ahead of March 17 policy decision

- The auction calendar:

- March 8: invoices for 13, 26 weeks

- March 9: 42-day cash management invoices; 3 year notes

- March 10: 10-year notes

- March 11: invoices from 4 to 8 weeks; 30-year bonds

– With the help of Edward Bolingbroke and Alex Harris

[ad_2]

Source link