[ad_1]

The 5G, the next generation of mobile radio technology, is expected to be launched in 2019. offers a major opportunity for Qualcomm's chip business (QCOM) – and not just because it could give a boost to smartphone Qualcomm, whose $ 44 billion deal to buy NXP Semiconductors (NXPI) is still delayed by Chinese regulators before July 25, has long been the world's largest supplier of 3G / 3G phone modems 4G and some complementary chips. However, it has never been a major supplier of RF front end components such as power amplifiers and filters, or modules in which they are often placed. And this market, whose main players are Skyworks (SWKS), Qorvo (QRVO) and Broadcom (AVGO), continues to grow as 4G radios become more advanced and support more and more frequency bands.

Qualcomm, aided by a joint venture filter, he launched last year with the Japanese TDK, made some RF progress. In January, the company announced that it has won RFFE design contracts with Samsung, Alphabet / Google (GOOGL), Sony (SNE), HTC and LG. And a few weeks later, the company announced memoranda of understanding with Chinese OEMs Lenovo, Xiaomi, Oppo and vivo, whereby companies "express their interest" in collectively buying Qualcomm RFFE products from the less $ 2 billion over three years.

Alphabet is a participation in the member club Action Cracks PLUS by Jim Cramer . Do you want to be notified before Jim Cramer buys or sells GOOGL? Learn more now

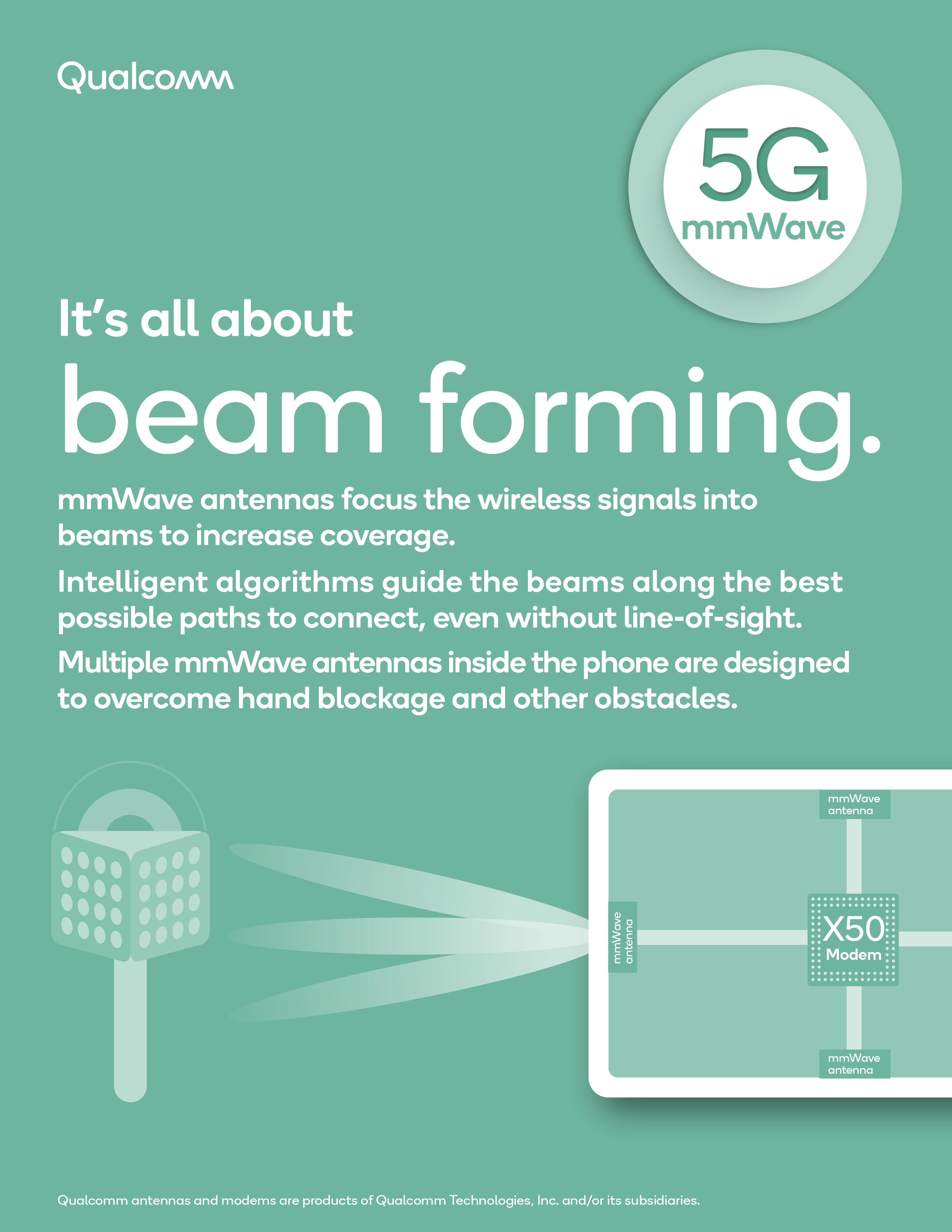

And the arrival of 5G phones – the first are expected next year, with shipments up the following years – could very well serve as a point of departure. Inflection for Qualcomm's RF efforts. This is partly due to the technical demands of 5G radios, which aim to provide gigabit peak download speeds and support (in addition to traditional mobile frequency bands) high frequency millimeter wavebands (mmWave ) that have always been viewed as unsuited to mobile networks because of range and interference problems.

However, this also depends on the fact that Qualcomm expects 5G radios to strongly rely on the modem of a device to dynamically adjust the operation of the front-end RF. Qualcomm argues that this gives the company, which can offer end-to-end solutions covering everything between the modem of a phone and its antennas, a competitive advantage over traditional RF readers. [19659010] The new RF modules of the company

On Monday morning, Qualcomm unveiled the QPM56xx and the QTM052, a pair of 5G antenna module offerings that began to be sampled for customers and , with Qualcomm & # 39; s Pre The QPM56xx supports traditional sub-6GHz frequency bands, while the QTM052, arguably the most interesting product, supports three mmWave bands north of 25GHz.

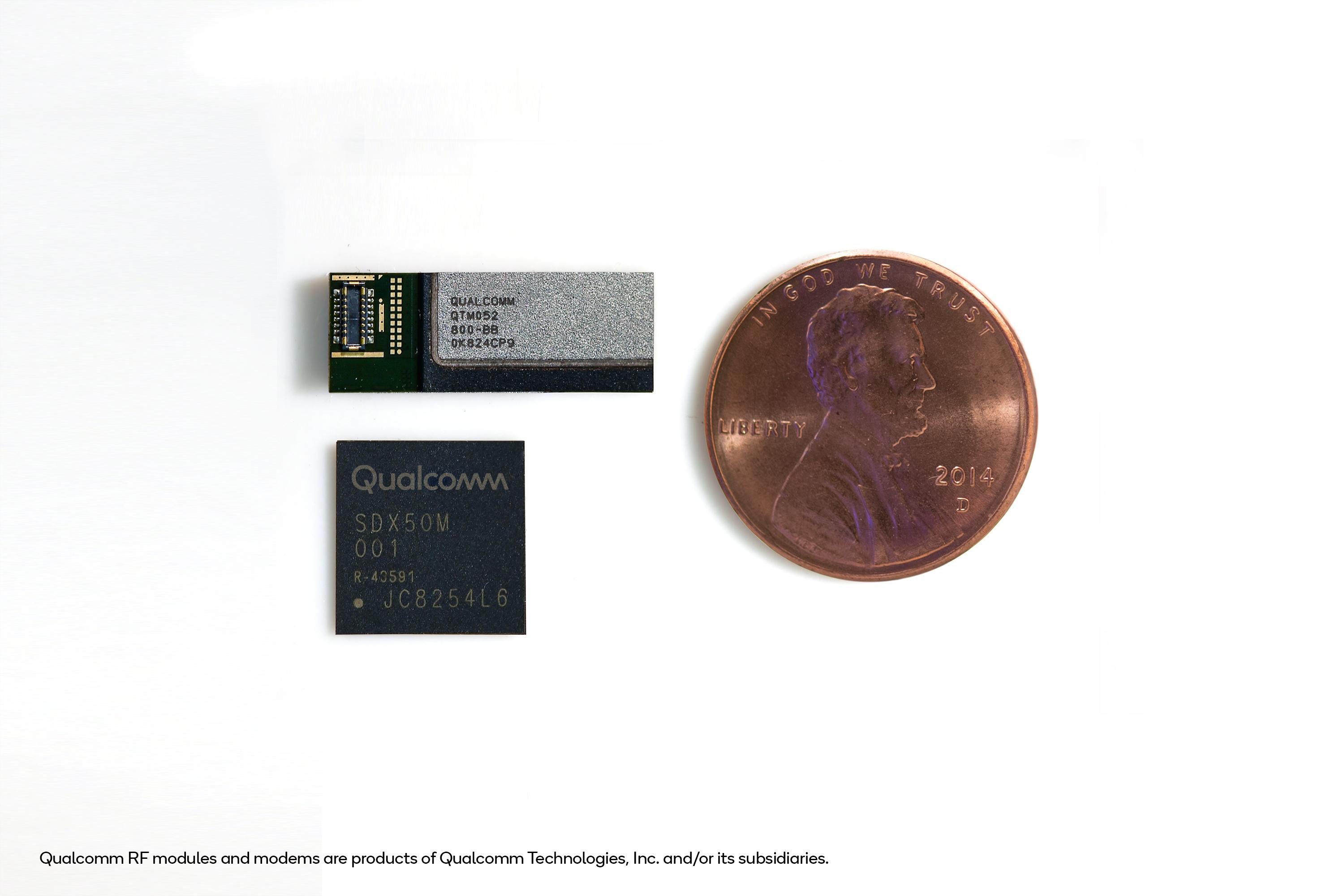

Qualcomm QTM052 antenna module and Snapdragon X50 modem. Source: Qualcomm

As shown in a press photo, the QTM052 is quite small; In terms of surface area, it is easily smaller than a penny, even though it contains RFFE components, a transceiver, an integrated power management IC and a network. ; antennas. At a meeting with TheStreetat at the company's headquarters in San Diego, Sherif Hanna, Qualcomm's product marketing director at 5G, said three modules would typically be placed in phones, and placed around his glbades. Officially, Qualcomm says that up to four modules can be integrated into a phone.

In any case, Qualcomm seems to have a long way ahead of its modern Intel rival (INTC) with regards to 5G miniaturization. An Intel 5G solution for laptops that was demoed in February required a separate crutch to house its radio circuits.

For now, Qualcomm refuses to share which phone manufacturers are planning to use the QTM052. However, Hanna suggests that the product sees strong design activity among many OEMs that Qualcomm announced in February would use the Snapdragon X50 in launch devices in 2019. This list includes the likes of LG, Sony, Xiaomi and ZTE. [19659002] In addition, Qualcomm says that at the moment, there is not much competition in RF space mmWave 5G. The company suggests that there is more competition from traditional RF readers in the sub-6GHz space, but adds that its end-to-end approach also serves as a point of sale here.

Qualcomm on 5G Battery Life and Networks

Unsurprisingly, Qualcomm expects the first 5G phones to come on the market to be top-of-the-range devices, with cheaper hardware available all over the world. line. And while new mobile radio technologies generally have a battery life in their early years on the market, Qualcomm insists that the 5G will not be as bad as the first 4G phones compared to 3G devices . Its goal is to reach the parity of battery life between 4G and 5G.

Although the range of the mmWave radio signal is only a few hundred meters, Qualcomm is optimistic about the potential of mmWave networks to provide extended coverage in urban areas, in part due to the ability of the signals to bounce. Last fall, the company released a white paper that (citing simulations) argued that mmWave radios could provide more than 50% coverage in many large cities simply by sharing the same cell sites as the stations. Basic 4G. the tapes should be more widely used to deploy 5G. However, Qualcomm argues that there is still room to use mmWave radios in the suburbs, where Verizon (VZ) and others have shown interest in using 5G to offer fixed broadband services

The Big Picture

Do not be a win-all-all game. And with 5G to provide a boost to the dollar value of RF content entering the average phone, Qualcomm and RFFE holders such as Skyworks and Broadcom are expected to benefit.

However, Qualcomm's ability to offer a modem-antenna connection 5G solutions give it a unique selling point and seem to position the company well to take a share. Along with its growing automotive and IoT businesses, Qualcomm RF's growth is expected to help offset some of the pressures experienced by its franchise operations. highly profitable patent licenses.

Source link