[ad_1]

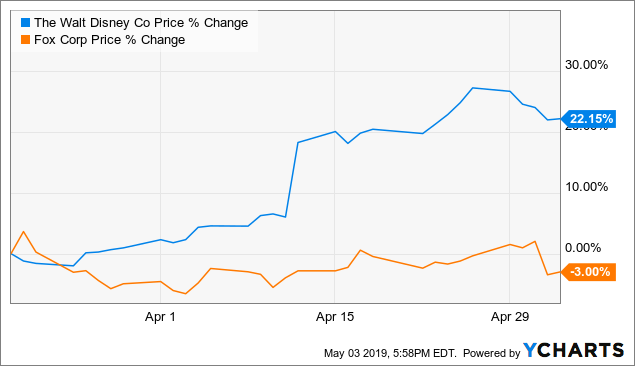

Fox Corp. (FOXA) (FOX) and The Walt Disney Company (DIS) recently signed a $ 71 billion deal, giving away much of the assets of the former Twenty-First Century Fox to Disney, thereby freeing up two companies to separate. I've advised investors to buy the post-trade troughs in both companies, which has worked well so far for Disney after Investor's Day on April 11th, where he has reached new unprecedented heights while the future of Disney is more promising than ever.

Data by YCharts

Now, Fox will release its earnings report on May 8, 2019 and its Investor Day will follow on May 9, 2019. Fox could be online for a nice rise in the price of the stock and unveil its future plans then that many investors are waiting to see what the company says before participating in the future history of the company.

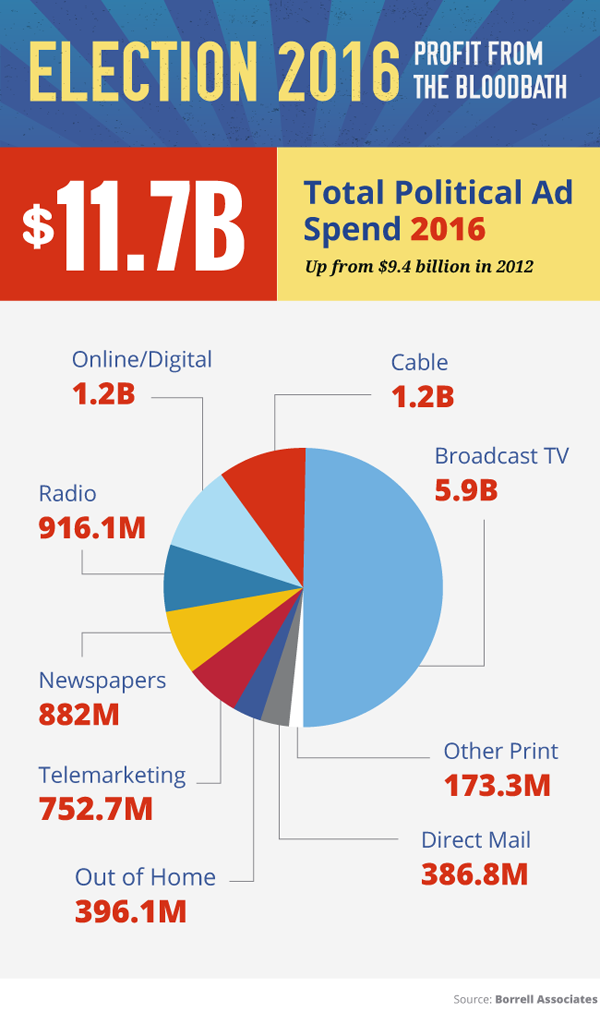

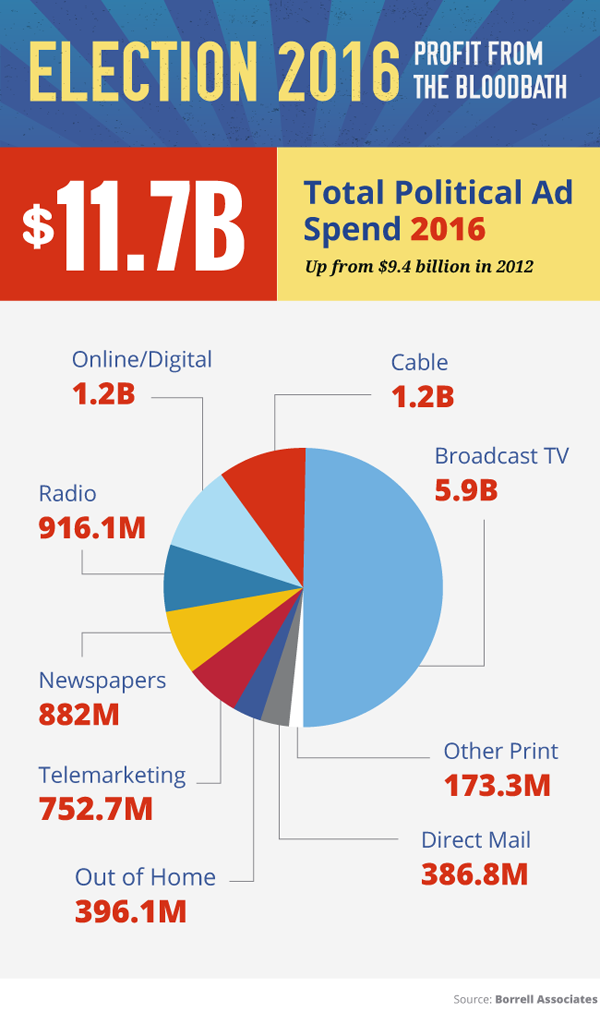

Fox is well positioned to take advantage of the advertising associated with the US presidential election cycle, which is held every four years, and will be completed by the end of 2020. Potential candidates are already advertising their candidacy and are attending. Town Halls meetings. April is the first cable network for the 34th consecutive month of audience per day and prime time. Fox seeks to attract advertising dollars from all political backgrounds, as its main audience is usually a conservative base, but it also organizes events at City Hall for many Democratic and Liberal candidates, including Bernie Sanders, Kirsten Gillibrand, Pete Buttigieg.

Borrell Associates slide

The next policy cycle could be a lucrative time for Fox as it could start moving to a digital broadcast and broadcast model in the coming years, announcing that its new FOX Media Center will be built in the research park from the University of Arizona State to Tempe. , Arizona. Once operational in 2021, the Media Center will be the technology and streaming hub for Fox.

Fox could be a potential cash cow, if she wishes, as she will control long-standing profitable assets with little or no debt after the deal with Disney. This gives Fox some interesting options for the future because it can declare a potentially interesting dividend to shareholders if it wishes with its free cash flow. It could also institute a more conservative dividend and open up to mergers and acquisitions activities, including a possible merger or acquisition of News Corporation (NWSA) (NWS), from which Twenty-First Century Fox is to be found. is separated in the summer of 2013. With a market With a cap of just over $ 7 billion, News Corp could be an interesting acquisition for Fox to attempt again to create a scale or a diversity on his platform, while Fox currently stands around a market capitalization of $ 23 billion.

As Fox resumes in a whole new form, the company may not yet have the appropriate merger and acquisition premium for a company that is open to a change in its structure for the benefit of its shareholders. The Murdoch, who run Fox and own many of his shares, have been open to splits and acquisitions in the past. An agreement in the future could therefore make sense again if the price is right. With Fox News being one of the few major cable news agencies in the US, this may be a potential mergers and acquisitions target for burgeoning streaming companies looking to expand their content. offer in the future.

We think Apple Inc. (AAPL), which will launch its Apple TV + this fall with the launch of its News + service. Amazon.com Inc. (AMZN) could see this as a potential asset to create additional value for its Prime customers as it expands its ecosystem around Prime. Finally, Netflix Inc. (NFLX) may decide to try to create value outside the creation of original content with a news agency purchase in order to increase its value proposition against the myriad of streaming services and offer put online next year. All of these players, as well as other players in the space, could eventually make a bid for Fox, because its market capitalization of 23 billion USD would be potentially much more feasible than the massive 71 billion USD game. from Disney for most of the assets of the former Twenty-First Century Fox.

The agreements between Disney and the former Twenty-First Century Fox are over, both companies heading to new directions for their future growth and prosperity. Disney's Investor Day was an undeniable success, as it convinced investors to opt for its Disney + Streaming service, while Disney shares reached unprecedented heights. Fox's chance to impress investors after the conclusion of the Disney deal will soon be upon us with its next earnings report and the nearby Investor Day. Fox has potential catalysts that include the cycle of the US presidential election as well as potential merger and acquisition activities, as it will seek to make the best use of its cash flow once the Disney deal has freed from any short-term debt problem. I continue to be a long time both Fox and Disney with oversized positions and a $ 45 year-end price goal for Fox. Good luck to everyone.

Disclosure: I am / we have long been FOX, DIS, AAPL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link