[ad_1]

Investment thesis

Park Lawn Corporation (OTC: PRRWF) (OTC: PLWCF) (TSX: PLC) should be able to take advantage of the aging population in Canada and the United States. The company should be able to expand its business through complementary acquisitions, with the funeral industry in North America being extremely fragmented. Despite the decline in its share price, its shares are still trading at a premium for its peers. We would prefer to wait for a new withdrawal because we want an increased margin of safety.

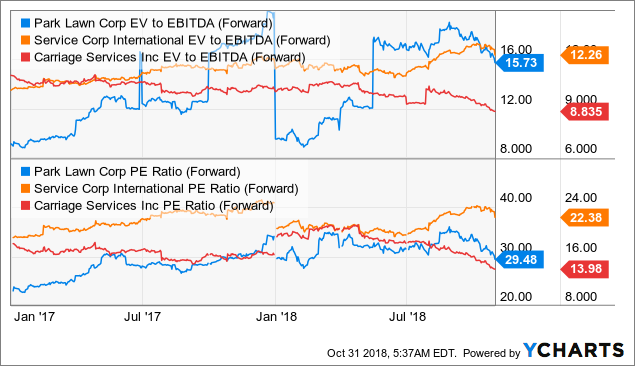

Source: YCharts

Recent developments

On October 9, Park Lawn announced an agreement to acquire Wells Funeral Homes and Cremation Services in North Carolina for an undisclosed amount. For investors, this is just one of the many acquisitions that the company has announced / finalized since the new management took office in 2016. In fact, the company now has 149 sites, including cemeteries, crematoria, funeral homes, chapels, etc. the end of Q2 2018. For information, Park Lawn had only 6 cemetery and 3 crematoriums in 2013.

Why we love Park Lawn Corporation

The demographic trend will act as its tailwind

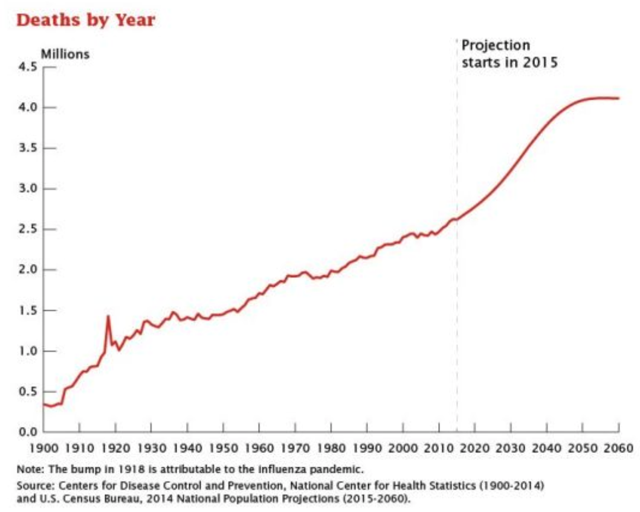

Park Lawn is expected to benefit from a favorable demographic trend in North America. In the United States, as the baby boom cohort ages, the number and percentage of people who die will increase dramatically. According to the US Census Bureau, the number of deaths in the country is expected to reach more than 3.6 million in 2037. That's about a million more than in 2015 (see chart below).

Source: US Census Bureau

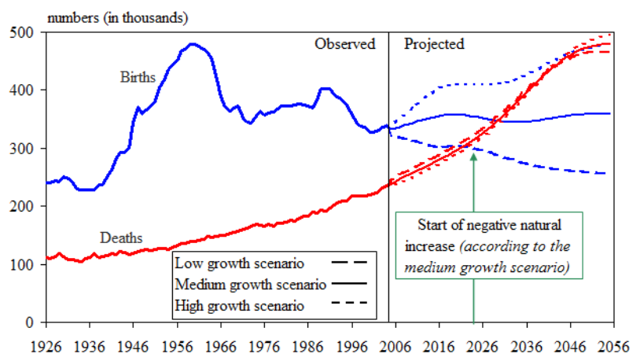

The situation is similar in Canada. According to Statistics Canada forecasts (see graph below), the number of deaths is expected to increase between 2020 and 2040 before stabilizing in the 2050s.

Source: Statistics Canada

Fragmented industry

The death services sector in North America is extremely fragmented. It is estimated that about 85% of the market is available for consolidation. This represents a huge growth opportunity for Park Lawn. In fact, management has repeatedly expressed its intention to expand its business through complementary acquisitions. This is exactly what the company has done in recent years. The company also benefited from the expansion of its operating margin through synergies and efficiencies resulting from its acquisitions. As shown in the graph below, Park Lawn's operating margin has been steadily increasing since the resumption of current management in 2016.

Source: YCharts

EBITDA target of C $ 100 million by 2022

Park Lawn aims to increase its EBITDA to C $ 100 million by 2022. This result will be achieved through a combination of acquisitions (approximately C $ 35 million), organic growth, synergies (from 7 to Can $ 8 million) and investment projects (Can $ 10 million). ~ 12 million Canadian dollars). Although its objective depends on many factors such as the availability of acquisition opportunities, it will increase its current EBITDA by approximately 15% per annum compared to its current EBITDA of C $ 45 million (pro rata). forma).

Risks and Challenges

Park Lawn's business is almost resilient to the recession, but it is not totally immune to the recession. Although the mortality rate does not increase or decrease significantly (if at all) during an economic recession, the families of the deceased may choose less expensive services (for example, cremation instead of burial). ) in times of economic recession. This could have a negative impact on his income.

Management has indicated that a significant portion of its future growth will depend on acquisitions (primarily indirect acquisitions). Although they have expressed the need to maintain their net debt / EBITDA ratio at less than 2x (currently around 1.6x), we can not exclude the possibility of a significant increase in debt to finance larger acquisitions. This can lead to a deterioration of the balance sheet. Investors need to monitor Park Lawn's balance sheet, especially because we are now in a rising interest rate situation.

Premium evaluation

The price of Park Lawn shares has increased by almost 100% over the last 3 years. The company is currently trading at an EV / EBITDA term of 15.73x. This is significantly higher than its competitors. As shown in the first graph below, its VE / EBITDA ratio is about 3.5 times higher than Service Corp. (SCI) and nearly 7 times higher than Carriage Services (CSV). Similarly, its price / earnings ratio of 29.48x is much higher than that of Service Corp. at 22.38x and Carriage Services at 13.98x.

Source: YCharts

Park Lawn currently pays a monthly dividend of CAD 0.038 per share (CAD 0.46 per year). This equates to a dividend yield of about 2%. The company has been paying dividends every month since 2011.

Investor to take away

Park Lawn is well positioned to expand its business in a fragmented area of death care services. The society should also benefit from a favorable demographic wind due to the aging of the population on both sides of the border. However, his share price seems to be trading at a premium. Even if we like its growth prospects, we prefer a higher margin of safety and expect a withdrawal.

Note: This is not financial advice and all financial investments carry risks. Investors are expected to seek advice from financial industry professionals before investing.

Thanks for the reading. If you like my article, please scroll to the top of the article and click on "to follow"to receive future updates.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link