[ad_1]

At the time when the province of Alberta, traditionally right-wing political, was electing a NDP (left-wing) government, many investors seemed to consider that there was a political risk when it was titles like Suncor (SU). In the end, the interests beat the ideology and the new provincial government of Alberta has done nothing drastic to curb the growth of oil sands production. The election of the Trudeau government and its Liberals at the federal level, which is not particularly favorable to the Canadian oil sands industry, at least in terms of rhetoric, including a very good speech on reducing greenhouse gas emissions. However, it is rather rhetorical, and most fears of drastic measures that could really affect the Canadian economy and some of its key industries have proven to be skewed by decades of history about it.

An Attractive Investment

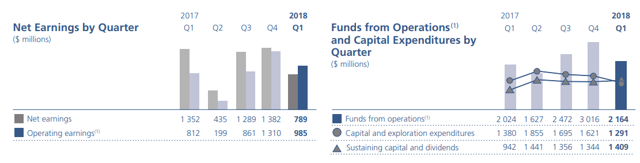

I will come back to Canada's more recent policy decisions and their impact on the oil sands industry and, therefore, on Suncor, but before that, I want to share my own reasons for owning this stock longer term. I bought this title in a few steps late 2015 and early 2016 as part of a significant strategy of taking a stand on oil producers in the expectation of a rebound in oil prices . One of the main aspects that I was looking for then was the profitability outlook. In the last quarter, Suncor reported net income of C $ 789 million, on gross revenue of C $ 3.6 billion.

Source: Suncor

As we can see, Suncor has established a strong profitability record despite the fact that the production of unconventional oil sands resources, which are estimated by some to be more expensive to produce than those of the United States, is highly dependent on the availability of oil reserves,

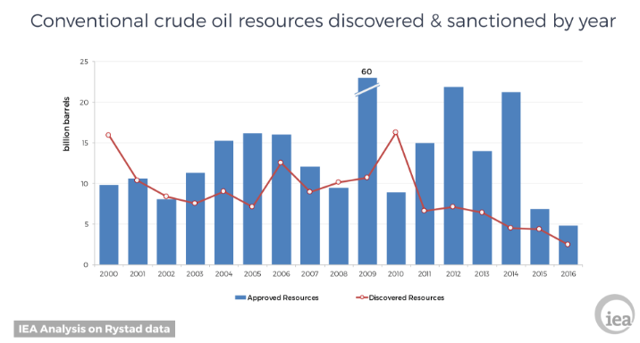

which makes Suncor particularly attractive to me. At current production levels, it is based on 31 years of production measured by P2 reserves. In this respect, it occupies a position far superior to that of most shale producers in the United States, as well as most of the world's major oil companies. This is extremely important when considering the future value of this business, looking in the context of the global oil industry overall. Conventional resource discoveries have been very anemic since the turn of the century, with the last seven years being particularly bad.

Source: IEA

Over the past fifteen years, average annual discoveries have been only 9 billion barrels, compared to a conventional oil production of 39 million barrels. about 26 billion barrels. In other words, production has exceeded discoveries by a factor of almost 3 to 1. Over the past seven years, average discoveries per year have declined to about 5 billion barrels a year. 2017 is not on the chart, but early estimates suggest that it was another disastrous year in this regard. We currently only find about 10 to 20% of the conventional oil volumes we produce. The oil industry has been compensating for decades by increasing the recovery rates of existing fields, but at some point this trend will no longer be sufficient to meet global liquid fuel needs, as the opportunity is limited by the amount of oil in place. The ultimate recovery rates of conventional fields are increasing, but they can not exceed 100%. In fact, we will probably never reach these recovery rates. I think this makes the reserves that Suncor has accumulated all the more valuable, given that it still has reserves of dozens of years, as well as opportunities for expansion. Given that oil producers are struggling to put all their oil reserves on the market before being stuck, it is understandable that many investors are skeptical about the value of Suncor's reserves. and its potential to add to them. But I think we will end up returning to common sense, fact-based

The Canadian government is looking to continue to facilitate the expansion of the oil sands industry

. to have been an unexpected development for those who do it. The Prime Minister of Canada said this year that the expansion of Kinder Morgan's (NYSE: KMI) pipeline capacity, which brings oil from Alberta to the west coast, is a major project. Faced with the BC government's ongoing obstruction of the project, the Canadian government stepped in to nationalize the pipeline to save the expansion project. In other words, far from sabotaging the oil sands industry, the current Canadian federal government is seeking to facilitate the expansion of productive capacity. This position comes despite Canada's current commitment to Paris on emissions targets and other environmental policies and goals. If Canada wants to achieve these goals, it will not be done by reducing the oil sands industry. This will be done by replacing coal with gas or increasing the capacity of renewable energies. In reality, it will probably not meet the promise of Paris, because such measures will not be enough.

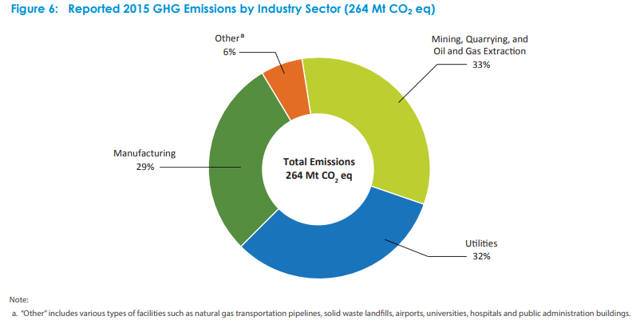

As for other policies such as carbon taxes, Alberta already has such a tax in place and does not intervene. with the continued growth of the industry. The Alberta government has also imposed a "hard cap" on the oil sands, which would allow it to grow 60% from current levels. This level should be reached by 2030. Personally, I think that at the moment when such a level will be reached, the government will simply move the absolute ceiling to account for any new potential growth in the economy. ;industry. All of this may seem hard to believe, given the Canadian political climate and comparatively progressive culture, but it is still what tends to happen in the face of difficult choices, such as sacrificing economic development in favor of environmental. For those of us who tend to be guided by history to some extent, it is worth revisiting Canada's position on Kyoto, where they participated in its negotiations, continued to pretend that they can keep the binding emissions agreement below 1990 levels, until the last moment when there was no aversion to admit the fact not to do it. I do not expect to see any other results this time either. The Paris commitment will not be achieved by switching from more coal-fired power plants to gas and installing more wind power. The two main drivers of emissions growth will be Canada's immigrant-led population growth, which adds to the need for housing, services and infrastructure equivalent to a new Greater Toronto Area every ten and a half years. , as well as the continued growth of the oil sands industry. In either case, it is very unlikely that there will be a change in policy direction, no matter who will be or will be in power in the future.

Although the true value of Suncor's oil reserves has been questioned The fear that Canada will become increasingly hostile to the oil and mining industries, which are responsible for a very large share of industrial emissions total in Canada, is in fact very little worrying.

Source: Environment and Climate Change Canada

Despite high gasoline prices, Canadian domestic demand for gasoline and other petroleum products continues to increase due to the growth of the population. Keeping net oil exports at current levels or even expanding, which is very important to maintaining Canada's trade balance, requires that oil sands production continue to increase. It is also important with respect to maintaining employment, as the supply of labor continues to increase at a steady pace. Suncor has proven that she was able to produce these reserves with a decent profit in the historical oil price range over the last decade, and she has more years of reserves than most of her peers . Given the growing trend of the Government of Canada not wanting to harm the oil sands industry through its policies, I think it's still going to be a good long-term investment. Perhaps once the other major fears that EVs with viable oil reserves remain stuck in the near future are dissipated, the market could begin to pay close attention to the value of these reserves.

Disclosure: I am / we are long SU.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link